Can you invest an extra RM25 a week? Even small amounts can add up over time.

An acorn is smaller than a mouse and weighs less than a key. But give that acorn just the right conditions and time and you could have an 80-foot-tall oak tree that weighs several tons. Small beginnings. The possibility of big results.

Your investments could do similar if you’re able to put away a little more money every week or every paycheck. If that’s possible for you, the results can add up.

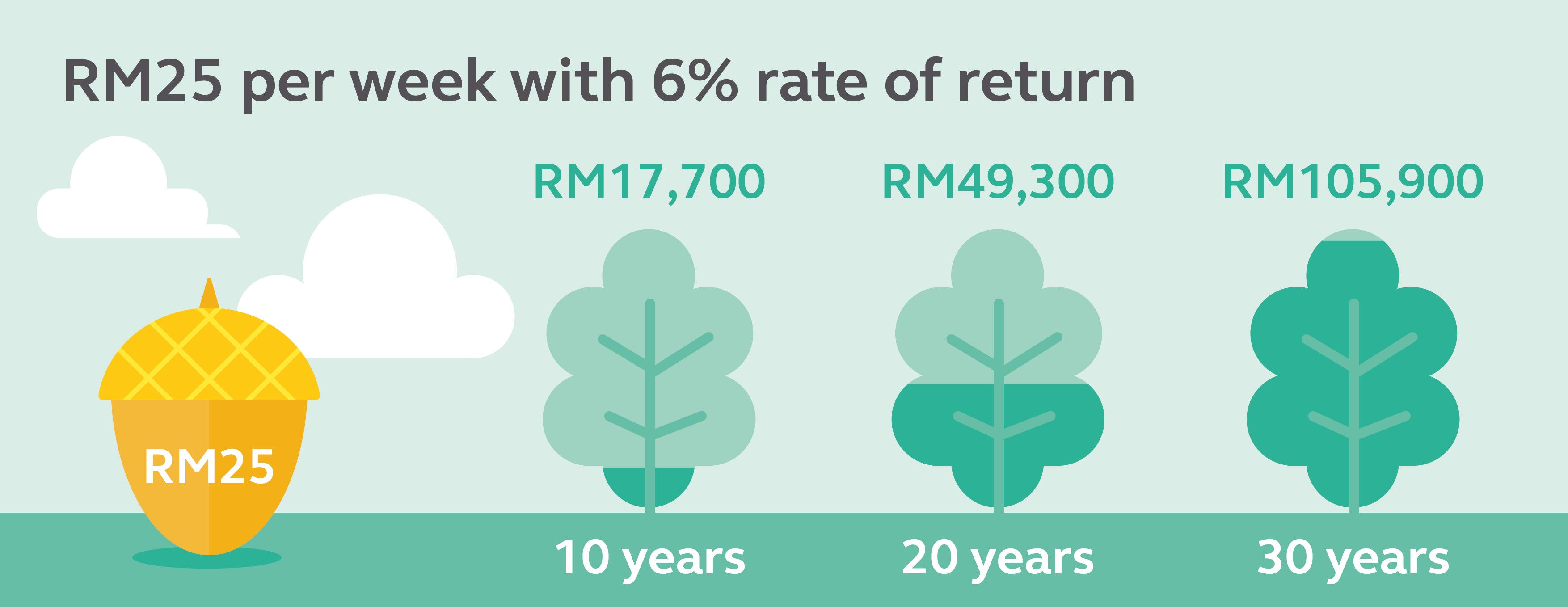

In fact, they have the potential to multiply. Putting RM 25 a week in a jar for 30 years would get you RM39,000. Invest that same weekly amount at a 6% annual rate of return, and compound earnings could help that investment grow to more than RM105,000 over those 3 decades.1

Let’s say you do your investing through a retirement account, you can find investing acorns there, too. If you had a RM70,000 annual income and bumped your pre-tax contributions up just by 1%, that’s only about RM15 off your weekly take-home pay. But every month in retirement, you could have another RM300 to spend.2

Retirement made easier, not easy

Investing an extra RM 25 a week or contributing an extra 1% toward your retirement might make getting to your financial goals easier. But it still won’t be easy. You’re always balancing current need against future goals.

It may help to think of it as taking care of your future self and family. You can stay disciplined about saving by incorporating annual savings increases. Some employers’ retirement plans allow you to increase the amount you put toward your retirement. This helps make those increases slowly over time, so that it’s easier for you to work into your budget.

What if you can’t do that much?

There’s no magic in 1% or in RM 25. Whatever additional money you can put away can help. If it’s RM10 extra a week, great! Maybe just a few ringgit per paycheck? That’s fine, too.

Remember, success doesn't require major cash.

Let time and compound earnings work for you to help achieve your goals.

1 The retirement balance (potential future value) assumes a 6% annual rate of return on their savings. The assumed rate of return in this chart is hypothetical and does not guarantee any future returns nor represent the returns of any particular investment. Estimated monthly income is based on a 4.5% annual distribution of the retirement balance at age 65 and is discounted to reflect today’s value using a 2.5% inflation assumption (potential future purchasing power in today’s value). Amounts do not reflect the impact of taxes on pre-tax distributions. Individual taxpayer circumstances may vary. For illustrative purposes only.

2 Assumes RM70,000 annual income with 3% annual wage growth, 30 years to retirement, a 6% annual rate of return, a 14% tax bracket. Estimated monthly income is based on a 4.5% annual distribution of the retirement balance at age 65 and is discounted to reflect today’s value using a 2.5% inflation assumption (potential future purchasing power in today’s value). The RM15 per-week investment relates to the first year of contributions. Wage growth would increase this amount over time. The total additional 1% contribution would amount to RM33,200 over 30 years, and, with earnings, would increase total account value by RM79,600 over that same time period.