Potential Impact of the Coronavirus to Capital Markets - 20 February 2020.

Is the Coronavirus impacting the health of capital markets?

We view the Coronavirus (e.g. Covid-19) as an event – not a long-term impact for capital markets. While there has been a dip in markets in the wake of the outbreak there are still strong fundamentals. During this time of market volatility, we encourage investors to hold a globally diversified portfolio with diverse asset classes to help manage risk.

Looking at the past, can help us understand today

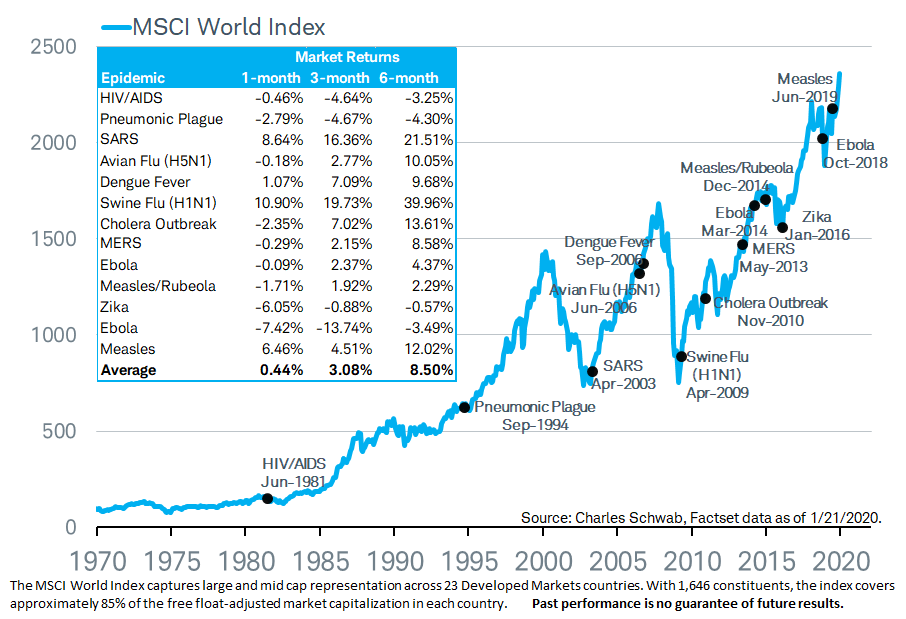

We’ve seen the impact infectious disease outbreaks can have on the markets before. Historically they tend to send markets lower, but the losses are typically temporary with no lasting impact to the economy. During the height of the SARS outbreak in 2003, global stock markets tumbled, but recovered once the outbreak was contained, the:

- S&P 500 closed out the year up 26%. Recovering from a 10% dip in March of 2003.

- Hang Seng index fell about 10% before recovering and the index ended 2003 up 35%.

- MSCI Asia-ex closed 40% higher despite the high death toll and lingering economic weakness due to the epidemic.

As of today, Covid-19– while a global health emergency is not as deadly as SARS. And, the overall response of China has been proactive and transparent, in contrast to its slower reaction during the spread of SARS. In addition, with the world far more linked than before allowing for greater mitigation and support.

It’s not just SARS, this index helps showcase the health of markets after an outbreak.

Our economic perspective

We’re in for a short-term bumpy ride. The outbreak coupled with the ongoing uncertainties already in place – such as Brexit, the US Presidential election and ongoing trade discussions all point to volatile market conditions. If history repeats itself, the turning point for market sentiment will come once the escalation of the virus decreases and when a vaccination is created. Until that occurs, sectors most hit will be consumer, transportation, restaurants, tourism, and retail. Commodities such as oil will also be affected in the near term with the concerns of slower global growth and lower demand.

Your investing strategy

As always, we advise investors to consider their long-term financial goals and risk tolerance when it comes to investing. Our investment team has recommended the following based on our asset allocation mix (as of Feb 2020):

Why these picks? Our investment team shares their views:

Malaysia

- Malaysian equity valuation is undervalued, making it attractive. It’s a great time to take advantage of the opportunity to buy low.

- We will continue to buy Malaysia on weakness and keep our barbell approach on high yield stocks. We’ll take the opportunity to accumulate selective stocks within the plantation, construction and oil and gas sectors.

- When it comes to the Covid-19 outbreak, we will look at sectors impacted by this event. We’ll tactically underweight the aviation sector, while taking opportunities to trade the glove and healthcare sectors.

Asia Pacific Region

- A market sell-off during an event like the Coronavirus usually offers great buying opportunities. Much like Malaysia – it’s a great opportunity to buy low.

- We are taking advantage by buying into structural names with good management and strong business models. We also like companies that are emerging as the key players in the fourth industrial revolution.

- Even though e-commerce may be a relatively more resilient sector with Chinese consumers choose to spend more time at home and online shopping demand may increase, stocks of these companies are likely to also be sold off indiscriminately in a knee-jerk reaction.

- We will be taking the opportunity by adding companies that are capable to lead in the growing consumption space in China.

Views as of 20 Feb 2020

Click here to read or download in PDF