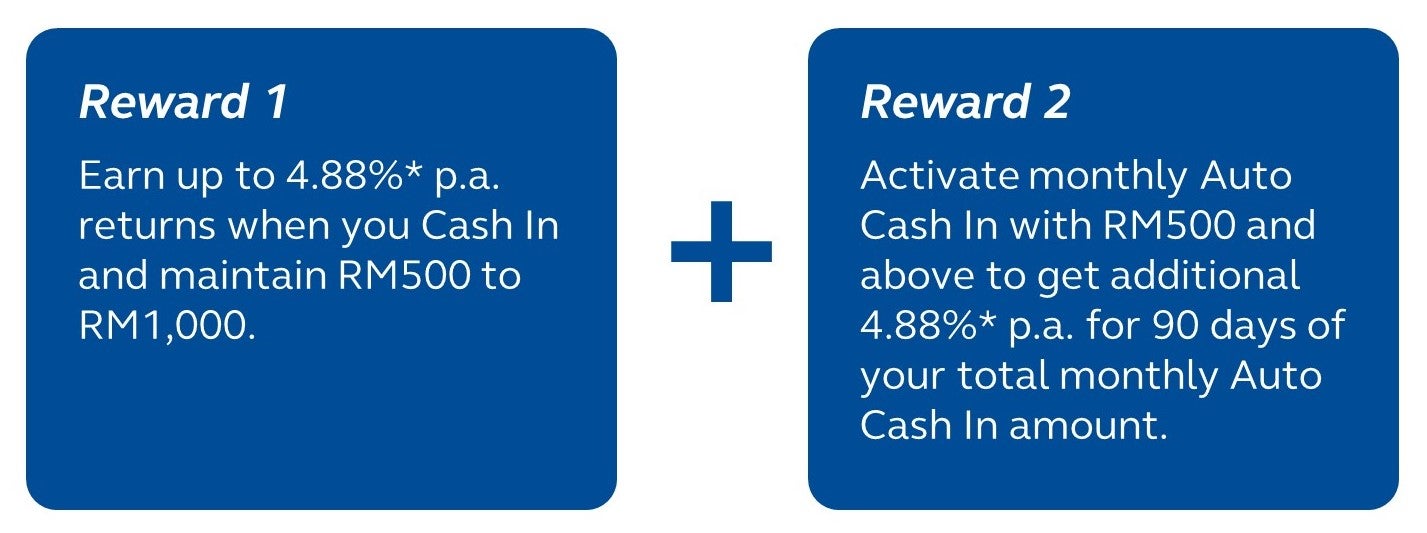

Invest and get rewarded this Raya.

Celebrate Raya with extra joy and more returns by investing in Principal Islamic Money Market Fund via GOinvest!

*The 4.88% p.a. rate comprises of a projected rate of 3.70% p.a. and a bonus rate of 1.18% p.a during the campaign period from 15 April till 31 May 2023.

Please view our campaign T&C and FAQ.

*The projected return is calculated using the expected gross return rate (per annum) from the Fund over the next 12 months, excluding any management and trustee fees.

Not an investor on GOinvest?

Follow these simple steps to begin.

#For existing GO+ investors, you may skip this step and proceed to next.

Quick step to activate Monthly Auto Cash In.

Disclaimer

You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant Prospectus, Information Memorandum and/or Disclosure Document relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. Securities Commission Malaysia does not review advertisements produced by Principal.

Frequently asked questions (FAQ)

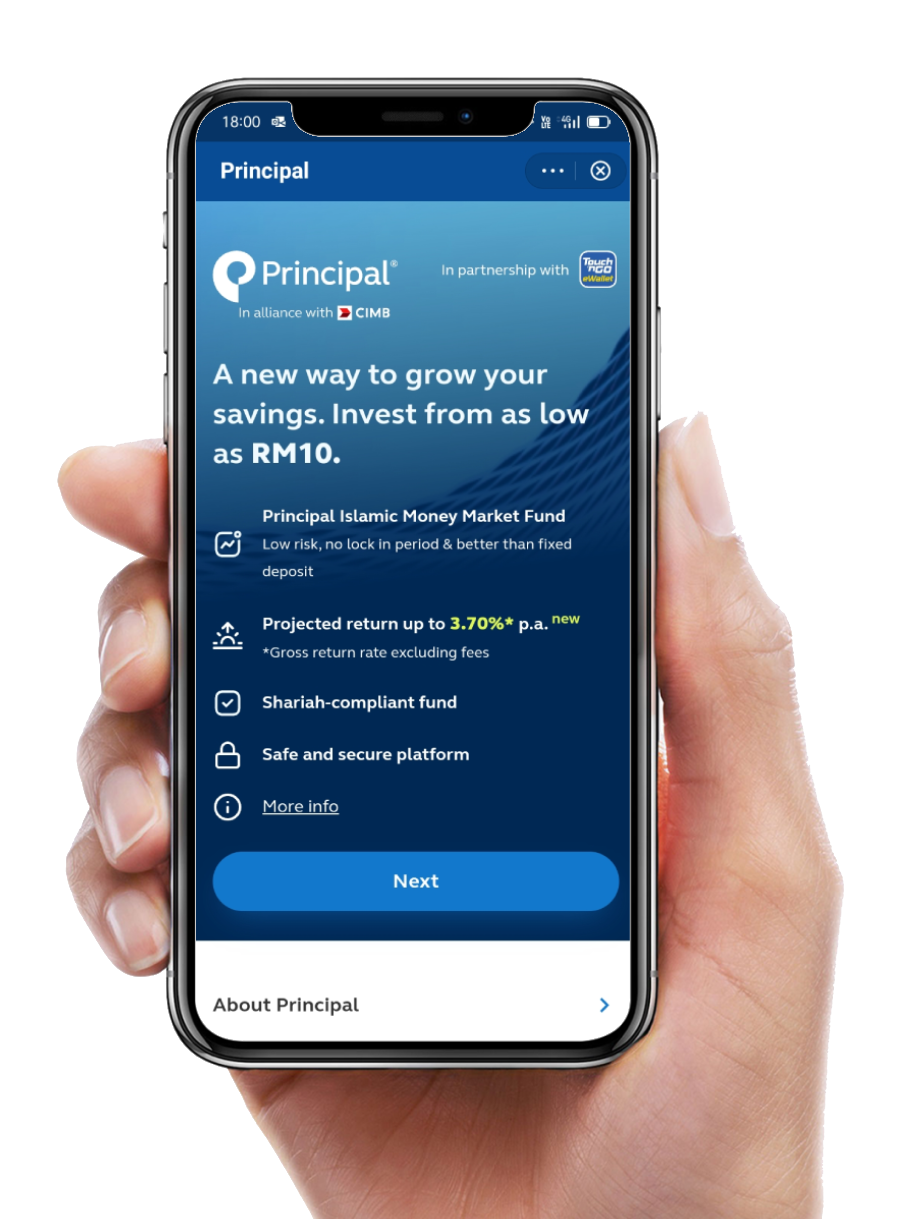

1. How is investment possible with Principal through Touch ‘n Go eWallet app?

You can now invest in Unit Trust funds* (“Fund”) with Principal Asset Management Berhad (“Principal Malaysia”) through GOinvest, a new investment platform available in the Touch ‘n Go eWallet app ("Investment Platform").

*See FAQ No. 7 for fund listing.

2. Is this a goal-based investing platform?

Yes, it is a goal-based investing where you can select and personalise your investment goal(s).

3. What is the difference between investing with Principal through GO+ and GOinvest?

| Investing in Principal e-Cash Fund through GO+ | Investing in Principal Islamic Money Market Fund through GOinvest | |

| Purpose | For daily usage Earn daily returns on your balances and use it to make payment. |

For savings An option for you to save and invest your money. |

| Returns | Daily nett returns of up to 3.41% p.a. or more. | Projected gross returns* of up to 3.7% p.a. |

| Withdrawal/Cash-Out |

|

|

| Investment horizon | Short-term | Short to mid-term |

*The projected return is calculated using the expected gross return rate (per annum) from the Fund over the next 12 months, excluding any management and trustee fees.

4. What are the benefits of investing in this Investment Platform?

- Convenient way to start investing from as low as RM10

- Principal Islamic Money Market Fund is a Shariah-compliant fund

- Earn projected returns of up to 3.7%* p.a.

- Safe and secure platform

- You may select personalised investment goals

- No capping amounts

- No lock in period

*The projected return is calculated using the expected gross return rate (per annum) from the Fund over the next 12 months, excluding any management and trustee fees.

5. Who is eligible to invest through this investment platform?

Any Malaysian, Touch ‘n Go eWallet user who is above 18 years old and has completed the account verification process is eligible to invest.