Managing uncertainty

Dealing with the effects of COVID-19 (coronavirus) on your investments, your retirement account, and your business

Answering your questions about market volatility

We're here to help with answers to questions such as, "Should I take my money out?" and "How long until the market recovers?"

Financial Stability

We’re in one of the most robust financial positions in our 141-year history.

Staying invested during volatility may pay off.

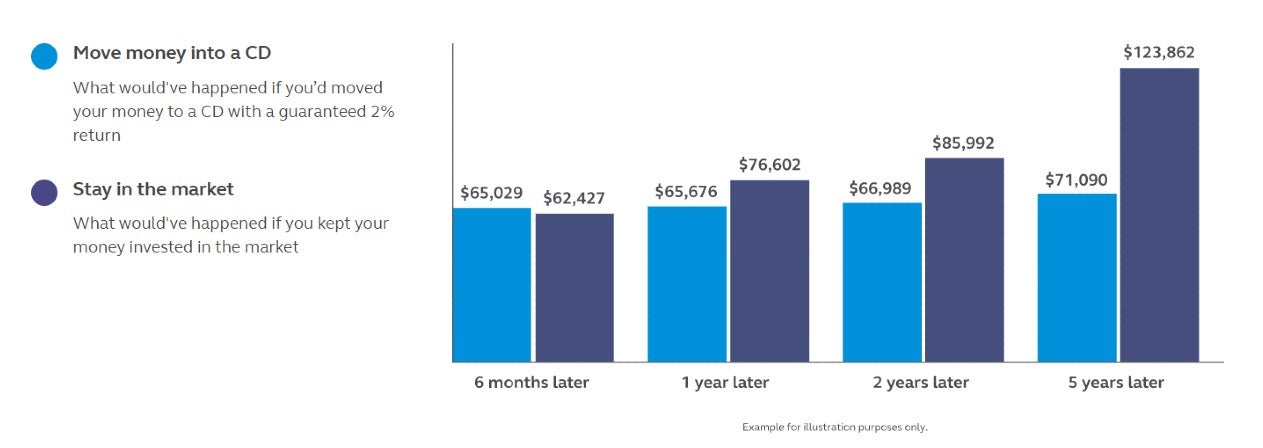

Imagine you invested $100,000 on January 1, 2008. But the markets went down. Your balance dropped to $64,388 in one year.1

The bottom line? Staying in the market could have meant 74% more after five years.2

Learn more about market volatility and staying invested.

Our latest on the market

Our thoughts on the global market conditions

One day the market’s up. Then next day, it’s down. As an investor, you should expect some volatility and bumps in the road.

Our investment perspectives

We’re here to help you invest for your long-term financial goals.

Fixed income outlook

Fixed income solutions are a great way to diversify your investment portfolio and tend to be less volatile than equity investments. Learn more about the outlook for fixed income solutions.

Explore more

The subject matter in this communication is educational only and provided with the understanding that Principal® is not rendering legal, accounting, investment advice or tax advice. You should consult with appropriate counsel or other advisors on all matters pertaining to legal, tax, investment or accounting obligations and requirements.