In an ideal world, investors buy low and sell high.

In the real world, investors often do the exact opposite—buy high and sell low—especially during volatile times. We see stocks going up and down because of the coronavirus or political uncertainty, and our brains say “run.”

Tempting? Yes. You’re trying to make the right decisions for retirement and other investments your family is counting on. But in the long run, you’re generally better off staying the course rather than trying to jump out, then back into, the market.

That’s because it’s never about timing the market. It’s more about time in the market.

The power of staying invested during market volatility

During volatile times, it can seem (really) appealing to change how you invest in hopes of a better return. Let’s look at a case study of how timing the market could impact your retirement savings.

In 2008 and 2009, we experienced a period of extreme market volatility due to the explosive growth of the subprime mortgage market.

Case study: Timing the market

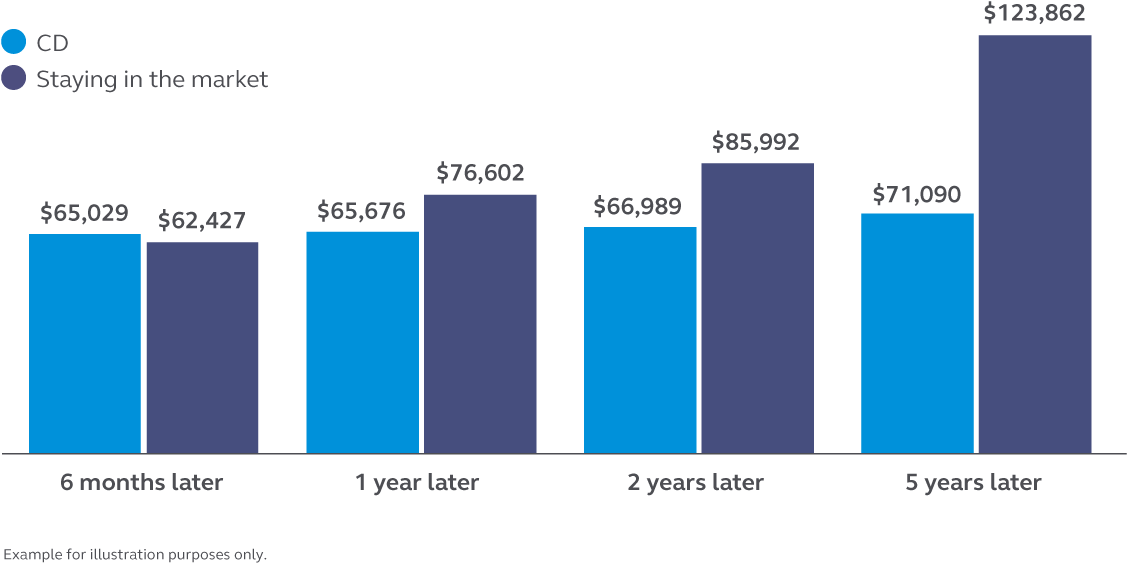

- Imagine it’s January 1, 2008, and you have RM100,000 invested in the market, and the bumpy ride drops you down to RM64,388 balance in one year.1

- So, frustrated by the declining value of your investment, you take that remaining RM64,388 out of the market. You decide to go with a more “stable” investment, putting your money into a guaranteed interest investment (a CD) with a 2% return for the next five years. During those five years, with the guaranteed interest, your balance increases to RM71,090.

- But what if, in 2009, you decided to ride out the ups and downs and kept your money invested in the market instead? By staying in the market, based on S&P Index returns at that time, you would have had RM123,862 after five years.

Putting money in a CD vs. staying in the market (2008 to 2013)2

Bottom line in this case study: You could have had $52,772 more if you’d stayed in the market instead of moving your money into a CD.

Market volatility: ideas to help you stay in control

Set a goal.

Saving for retirement generally requires you to trade near-term gains for what may be long-term benefits. Having a goal and sticking with it may help you keep perspective during ups and downs.

Think about your risk tolerance.

Make sure you have the right investment mix based on how comfortable you are with risk and how long you have until you retire or need your money to fulfil a goal.

Rebalance your investments.

Over time, the value of your investment mix (“diversification”) can change as some investments grow more than others. Rebalancing sets everything back to your original mix and may minimize the impact of market volatility.

Lean on a financial consultant.

Get help from the experts. A financial consultant can help you plan and deal with the ups and downs of the market and update or create a personalized financial plan.

Some tips for today’s markets

1. Stay the course.

The ironic thing is that volatility, the very thing that we worry the most about, is exactly what we should embrace. It may feel uncomfortable, but it can create opportunities for long-term growth. Let’s say you sell your investments …. you most likely rode the market down; at what point will you know when to get back in?

The bottom of a bear market is the point in time when you’ll feel the worst and be the least optimistic. You aren’t likely to get back in at that point, which means you may miss out on a significant portion of the recovery.

2. Review your goals, risk tolerance, and time horizon.

It’s important to make sure your portfolio diversification continues to be in line with your long-term goals. If your diversification is still lined up with your goals, then you likely don’t need to make changes and you can ride out the market volatility. If it’s not, then realigning your allocation based on your goals, risk tolerance, and how long until you’ll need the money will help you achieve long-term success.

3. Don’t panic when you check your statements. (Really.)

If you’re saving for the long-term, your focus is on 10, 20, or 30 years down the road. We live in a 24/7 news cycle, and that makes it tempting to react to everything you hear. What can feel like a big moment at the time, over the long term, may be remembered as just a blip on the radar screen.

4. Focus on what you can control.

That’s your day-to-day finances. Set up a budget. Build up your emergency fund. Pay down debt. Those are things you can do now—no matter what markets are doing—to help improve your family’s financial situation.

5. Invest, if you can.

Money to spare from a bonus, or unexpected windfall? It may be a good time to invest. (You know what they say: Buy low, sell high.)