In most countries around the globe, people are living longer. And Malaysia is no exception. Which means you’ll likely be spending more time in retirement than you did working. With longer lifespans, inflation and rising healthcare costs, Malaysians need to consider saving more for retirement than just relying on their Employee Provident Fund (“EPF”).

One way to save more for retirement is to take advantage of the Private Retirement Scheme (PRS), offered through your employer.

So, just what is PRS?

PRS is an initiative under Capital Market Master Plan 2 to accelerate the development of the private pension industry. It’s regulated by Securities Commission Malaysia and administered by the Private Pension Administrator (PPA).

It is a voluntary investment scheme to complement your EPF to boost your total retirement savings, for individuals aged 18 years and above

How does it work?

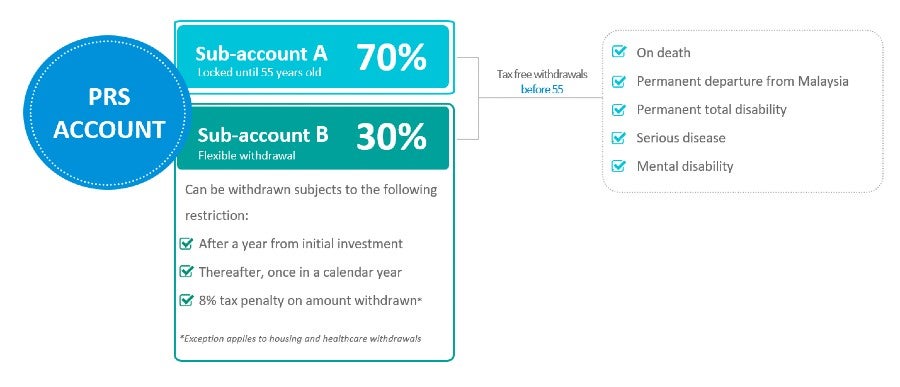

PRS has two accounts:

- Sub-account A – 70% of your contribution goes into this account and it’s locked until you’re 55

- Sub-Account B – 30% of your contribution goes into this account and offers flexible withdrawals

Please note: Under the current Movement Control Order additional withdrawal provisions have been made possible. Please contact us for details.

Benefits of PRS

When choosing to save more for retirement with PRS, you receive a variety of benefits:

Investment Strengths

- Quicker accumulation of funds at a 0% sales charge (applies even after resignation from your company)

- Strong investment performance from a leader in asset management

- Diverse options to meet your risk tolerance and goals; offer both Conventional and Islamic retirement schemes (e.g. Principal PRS and Principal Islamic PRS Plus)

- Investments are creditor protected

- Ability to customise based on your risk tolerance and personal goals

Plus, when choosing to save more for retirement with PRS through your employer-sponsored Principal plan, you receive exclusive benefits:

Convenience and Interaction

- Automated investments via payroll deduction; allows you to “set-it and forget it” with a minimum contribution of RM100 per month! Bonus: you benefit from the power of compounding on your investments and dollar-cost averaging benefits.

- Online top-ups through PPA Online.

- Guidance and support from Principal for investment insights and fund selection.