Memperkenalkan penyelesaian dekumulasi Principal PRS.

Persaraan yang selesa memerlukan perancangan jangka panjang untuk kestabilan dan jaminan kewangan. Sebagai sebahagian daripada tawaran PRS Principal, penyelesaian dekumulasi PRS adalah penyelesaian persaraan yang disertakan dengan Pelan Pengeluaran Tetap (RWP) yang membolehkan anda mengurus aliran tunai selepas persaraan anda berdasarkan matlamat dan keperluan anda. Lebih baik lagi, penyelesaian dekumulasi PRS terus melabur baki yang ada untuk potensi pulangan, supaya anda boleh melangkah lebih jauh dalam fasa baharu kehidupan anda.

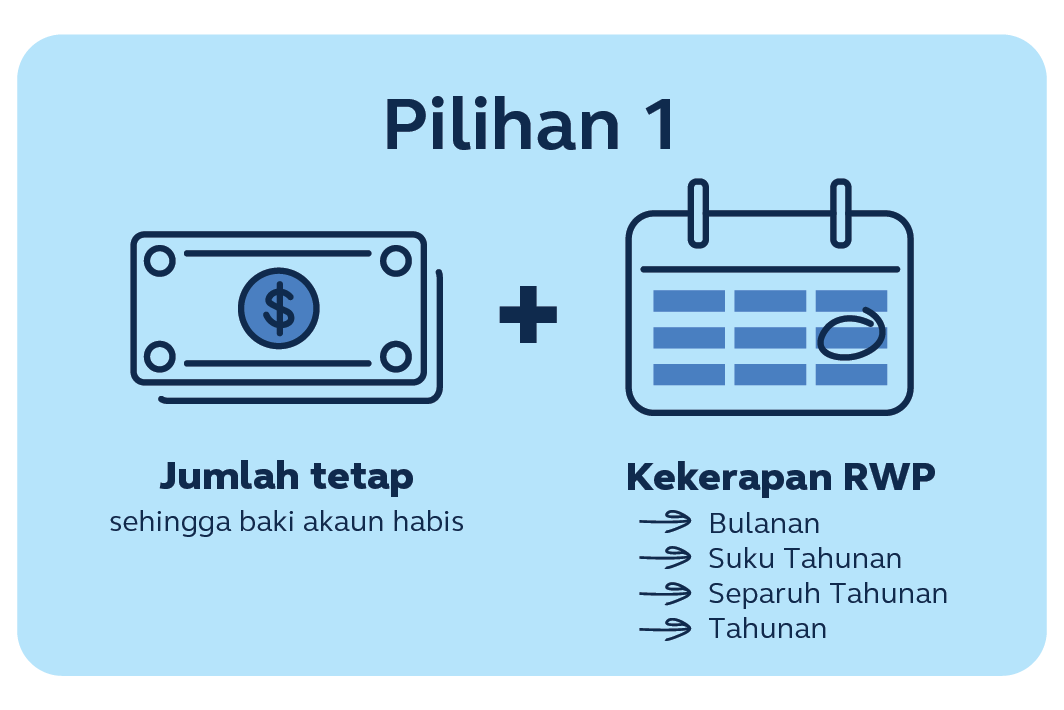

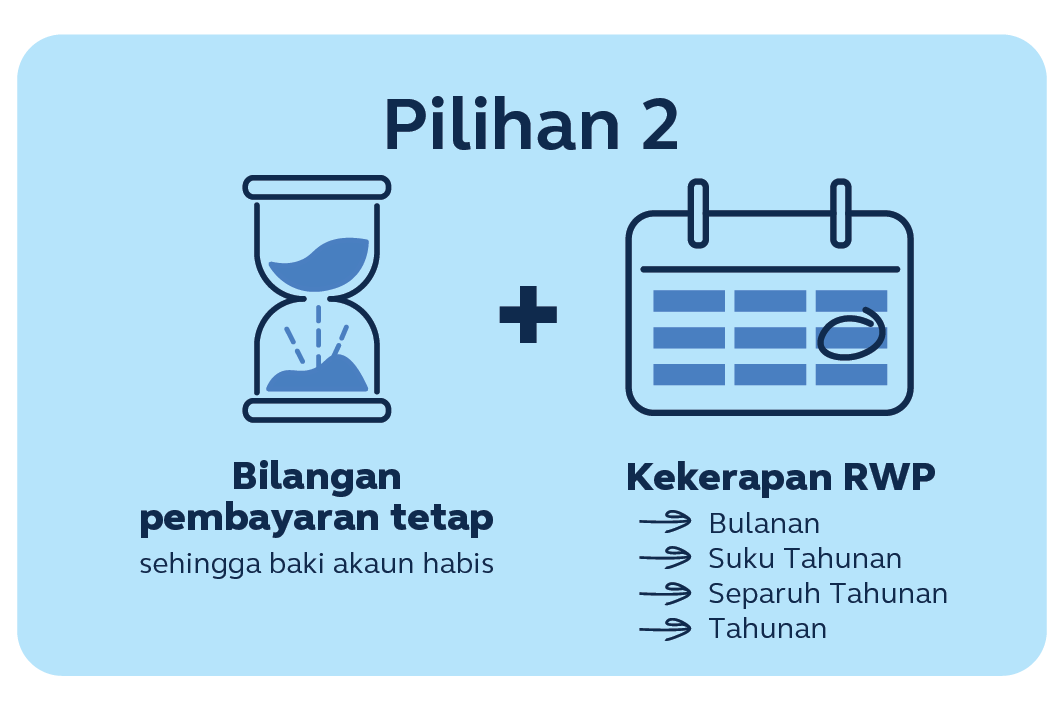

Anda boleh memperibadikan jadual pengeluaran anda dengan RWP. Terdapat 2 pilihan yang tersedia untuk pilihan anda:

Mengapa melabur dengan Principal?

Dana Principal RetireEasy Income and Principal Islamic RetireEasy Income berfungsi untuk memanfaatkan anda:

![]()

- Pilihan dana Konvensional atau Islamik dengan pendedahan global. Anda boleh memilih sama ada Principal RetireEasy Income atau Principal Islamic RetireEasy Income.

![]()

- Pelan Pengeluaran Tetap (RWP)* membolehkan anda membuat pengeluaran berulang khusus pada jumlah dan kadar pilihan anda. Anda akan menerima pemindahan automatik hasil RWP ke dalam akaun bank anda mengikut jadual, untuk kemudahan anda.

![]()

- Baki anda di dalam dana akan terus dilaburkan untuk memberi potensi pulangan, supaya anda boleh meningkatkan simpanan dengan baki akaun yang semakin bertambah.

![]()

- Dengan ciri penamaan pewaris, anda boleh membuat penamaan untuk tujuan pembayaran baki PRS anda sekiranya anda meninggal dunia.

*Hanya pelabur berusia 55 tahun dan ke atas layak untuk RWP.

![]()

- Anda boleh menikmati pelepasan cukai peribadi untuk sumbangan sehingga RM3,000 ** setiap tahun, bersamaan sehingga RM840 pelepasan dalam cukai tahunan.

![]()

- Pendapatan PRS akan dikecualikan daripada cukai, termasuk cukai Pendapatan Sumber Asing (FSI).

![]()

- Diuruskan oleh Principal, peneraju pelaburan global dengan lebih daripada 142 tahun kepakaran kewangan merangkumi lebih daripada US$990 bilion# aset di seluruh dunia.

**Untuk sumbangan ke dalam PRS dan anuiti tertunda yang berkuat kuasa dari tahun taksiran 2012 hingga 2025.

#Setakat Disember 2021.

Tidak pasti bagaimana untuk merancang simpanan persaraan anda? Anda boleh meninggalkan butiran anda dan wakil khidmat pelanggan kami akan menghubungi anda secepat mungkin. Pertimbangkan untuk menghubungi perunding kewangan? Kami boleh membantu anda mencari satu. Mereka boleh membantu anda menemui matlamat anda dan menasihati anda berdasarkan toleransi risiko anda.

Penyelesaian dekumulasi Principal PRS FAQ

Semua yang anda perlu ketahui tentang Penyelesaian dekumulasi Principal PRS!

What is Principal PRS decumulation solution?

The Principal PRS decumulation solution - It enables you to customize your withdrawal and continue to grow your PRS for your post-retirement need. The Principal PRS decumulation solution comprises of 2 components:

- Regular Withdrawal Plan (RWP)

Let you custimise and schedule withdrawals based on your goals and cash flow needs.

- Funds

The Principal RetireEasy Income (REI) and Principal Islamic RetireEasy Income (iREI) helps you to continue grow your PRS balances, so that it an prolong the sustainability of your account balance after retirement.

How can the Principal PRS decumulation solution benefits you?

Regular Withdrawal Plan (RWP)

- Customization – You may customize and schedule the withdrawals based on your post-retirement cash flow need.

- Convenience – The withdrawal proceeds will be transferred automatically to your bank account.

- Ease of setting up – One-off application to schedule for multiple future withdrawals.

Principal RetireEasy Income or Principal Islamic RetireEasy Income (Funds)

- Dedicated funds designed to suit retiree’s need

- Help investor to continuously grow their remaining fund balance while they withdraw from the Funds to support post-retirement needs.

- Choice of conventional or Islamic funds

- Funds are unconstrained in asset allocation with global exposure

- Funds offer a controlled risk and return profile.

- Income earned by the Funds are tax exempted, including the Foreign Source Income (FSI) tax.

- Managed by Principal, a global investment and retirement leader with more than 142 years of financial expertise.

Additional benefits

- Tax benefit – You can enjoy personal tax relief of up to RM3,000 for contribution into PRS (effective from year of assessment 2012 to 2025).

- Nomination – You can make nomination for the purpose of easy disbursement of your PRS balance in the event of your demise.

What is the allocation asset of the Funds?

The Funds are unconstrained in terms of asset allocation and region exposure (i.e., no fixed allocation or weightage in underlying assets or country). The Funds are managed with strategic or long-term asset class targets and target ranges. There is a rebalancing strategy that aligns with the target weights to identify asset classes that are either overweight or underweight. The Fund may shift asset class targets in response to normal evaluative processes or changes in market forces or Fund circumstances.

For Principal RetireEasy Income:

Up to 100% of the Fund’s NAV may be invested in collective investment schemes (including exchange-traded funds (ETF) and real estate investment trusts (REITs), equities, debt securities, money market instruments and/or deposits. Notwithstanding,

- up to 40% of the Fund’s NAV may be invested in unrated debt securities; and

- up to 10% of the Fund’s NAV may be invested in unlisted securities.

For Principal Islamic RetireEasy Income:

Up to 100% of the Fund’s NAV may be invested in Islamic collective investment schemes (including Islamic exchange-traded funds (ETF) and Islamic real estate investment trusts (REITs), Shariah-compliant equities, Sukuk, Islamic money market instruments and/or Islamic deposits. Notwithstanding,

- up to 40% of the Fund’s NAV may be invested in Unrated Sukuk; and

- up to 10% of the Fund’s NAV may be invested in unlisted Shariah-compliant securities.

Currently, the Funds will seek exposure to the various asset classes by investing in CIS (including ETF and REITs) to achieve greater market exposure, diversification and for cost efficiency purposes. At any point in time in the future, the Funds may invest directly into the various asset classes it is deemed appropriate and at the Manager’s discretion.

What is Regular Withdrawal Plan (RWP)?

RWP allows Eligible Members to customize and schedule the withdrawal arrangement based on your post-retirement cash flow need. You may schedule to receive a pre-determined amount of withdrawal proceeds at your preferred frequency.

Penafian

Pelaburan melibatkan risiko dan kos. Anda harus membaca Prospektus, dan/atau Dokumen Pendedahan yang relevan termasuk apa-apa tambahan daripadanya dan Lembaran Sorotan Produk (jika ada) sebelum melabur. Anda harus memahami risiko yang terlibat, membandingkan dan mempertimbangkan yuran, caj dan kos yang terbabit, membuat penilaian risiko anda sendiri dan mendapatkan nasihat profesional, jika perlu.

Suruhanjaya Sekuriti Malaysia tidak menyemak iklan yang dikeluarkan oleh Principal. Untuk penafian penuh, sila layari bit.ly/Principal-PRS-Disclaimer