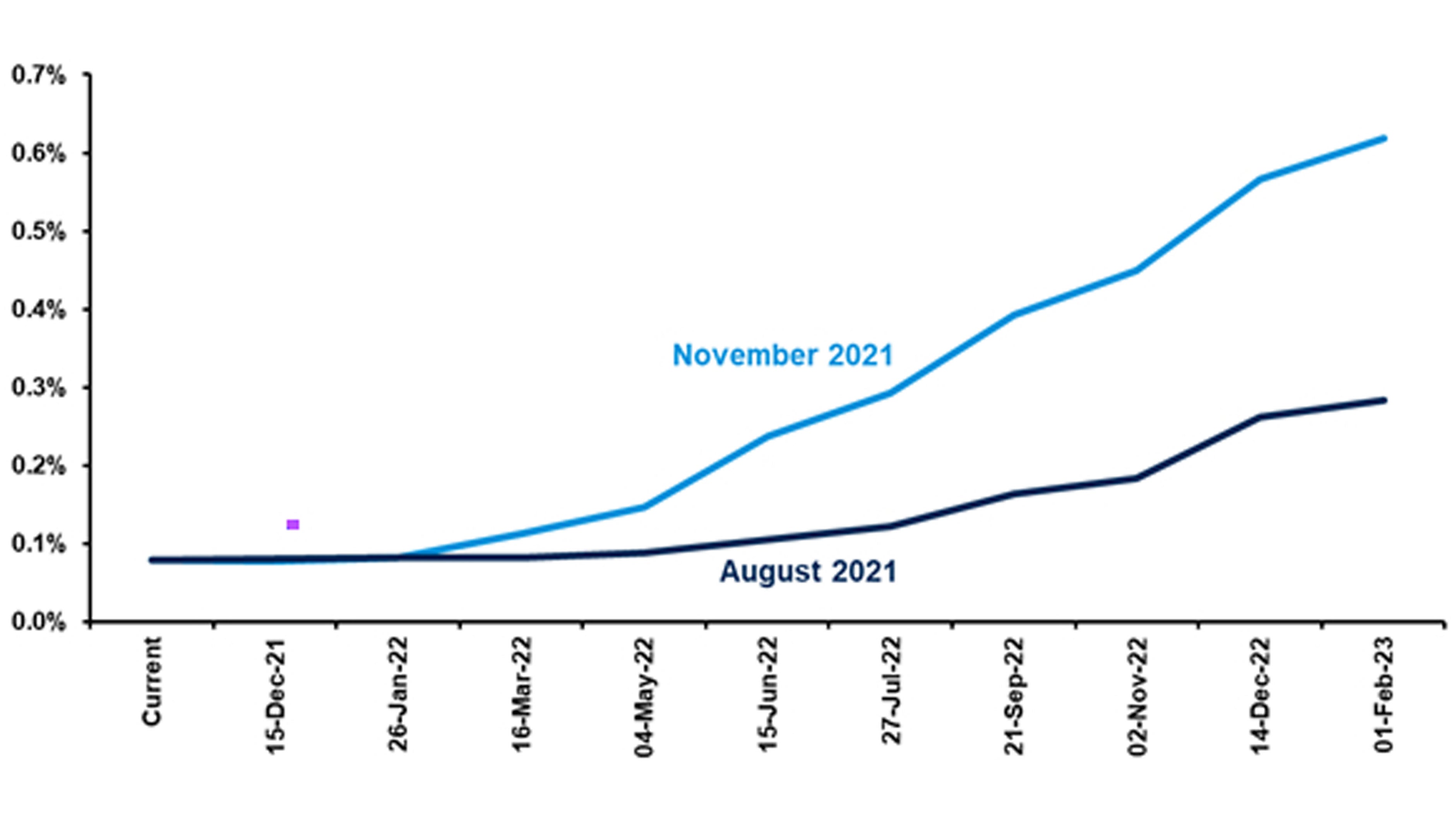

Unlike market expectations, which have priced a Fed rate hike in mid-2022, we believe the Fed will look through inflationary pressures and hold off on hiking the federal funds rate until December 2022.

Market expectations for the federal funds rate

August 2021 versus November 2021

Source: Bloomberg, Principal Global Investors. Market expectations calculated using Fed Funds Futures. Data as of November 4, 2021.

In recent weeks, hawkish pivots from the Bank of England, the Bank of Canada, and the Reserve Bank of Australia have prompted markets to probe whether central banks really can look through elevated inflationary pressures. The global repricing of policy rate hikes hasn't bypassed the United States Federal Reserve (Fed) either. Markets now anticipate a Fed rate lift-off immediately after tapering concludes in mid-2022.

With supply chain issues likely to extend well into 2022 and an apparent broadening in inflationary pressures across the economy, elevated price pressures won't be brief, and Fed patience with inflation is likely wearing thin. The biggest concern, the risk that long-run inflation expectations become unanchored, may force the Fed's hand.

Yet, the mid-2022 market view still seems too early. Unlike other central banks, the Fed wants to see the labor market heal further, requiring the mystifyingly elusive recovery in labor participation to materialize before rate hikes commence. What's more, Chair Powell has repeatedly emphasized the separation between the end of tapering and rate hikes—there should be a few months interval between the two.

On balance, our expectation is for the Fed's first rate hike to come in December 2022. This will still be later than several other major central banks, with only the European Central Bank and the Bank Of Japan likely to out-patience the Fed.

Disclosure

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Lower-rated securities are subject to additional credit and default risks.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor's investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®