4 min read I Date: 23 March 2022

( In partnership with imoney )

At the start of the year, many investors will be looking forward to what they should keep an eye on for 2022. However, considering the global turmoil of the past two years, it would be best to hear from the experts on what to expect in the coming months. Here are the top picks from the experts at Principal Asset Management on what to look out for in the investment landscape for 2022.

Economic recovery is on the horizon

While the Omicron variant of COVID-19 has thrown some reopening plans into question, there is still hope for global growth to continue. Thus far, countries have shown to be willing to open borders once again. This will pave the way for international trade to normalise and supply chains restored. According to Patrick Chang, Chief Investment Officer, Equities, ASEAN at Principal Asset Management, it’s best to keep a long-term focus while staying invested. “Our view on Omicron is that it is too early to judge its impact on the economy and if history is to repeat itself like in May 2020, this could be an opportunity for investors. In short – stay invested!” he advised and outlined other key factors that will impact the economy in the coming year.

Most of this predicted growth will take place in the first half of 2022, largely driven by the rundown of excess savings and business restocking. However, don’t expect the elevated growth levels to continue for the entire year; rates are expected to normalise in the second half of 2022. By then, accumulated savings will be mostly exhausted, quantitative easing reduced and economic reopening largely completed. During this time, inflation will also begin to moderate – or reverse – as supply chain pressure will have eased. Supply-demand mismatches will have resolved towards the end of 2022 as demand shifts back from manufactured goods towards services.

Tapering to begin in the US

Quantitative easing (where the government buys long term securities to lower the interest rate) is expected to begin slowing towards the end of 2022 (a situation generally known as tapering). The slowing of acquisitions is likely to slow down the US growth around this time. The US Federal Reserve (or the Fed) has been on a path of quantitative easing to prop up the economy since June 2020. The current instance of quantitative easing is unlike those implemented before it, since the Fed did not announce a limit on the amount of spending.

While this has helped the US economy survive the pandemic recession, it is expected to begin tapering off soon. “On the monetary policy front, we previously expected the Fed to begin raising rates in late 2022. Now, with the Fed likely to announce an accelerated pace of tapering in December or January, our base case is for the policy rate to lift-off in Q2 2022,” said Chang.

Positive outlook for ASEAN and China

Asia is gradually reopening economies, allowing supply chains to resume and manufacturing capabilities to come back online. Principal believes that the region will continue to be a leader in economic growth by early 2022. China itself recently announced a second reserve ratio (RRR) cut this year, releasing about US$188 billion of liquidity to support economic activities. The recent upheavals brought on by Chinese regulatory changes (particularly in the technology sector) are also expected to have peaked and will likely not affect investments in the coming year. Principal’s focus for ASEAN and China in 2022 will be on companies with structural growth drivers such as green policies, ecommerce, cloud computing, internet of things.

Investors shift towards impact investment

There is growing support for sustainable business practices and efforts to combat climate change. The advent of Environmental, Social, and Governance (ESG) Criteria for investors has made it more important for companies to be aware of how their plans impact the environment. More investors are expected to shift their attention towards impact investments, where their money can best be used to address challenges facing humans. As such, Principal foresees that the next wave of growth will be driven by investors actively identifying and seeking out sustainability challenges in areas ranging from climate to inequality. Principal’s forecast continues to favor sustainable investing supported by Carbon neutral pledges, the US rejoining the Paris Agreement, and substantial inflows into ESG funds and ETFs. As such, Healthtech and Greentech should be high on any investor’s watchlist.

Maximise your investments with Principal

With more than 142 years of global experience in investment and retirement solutions, you can be sure to count on Principal to help you stay ahead of the game.

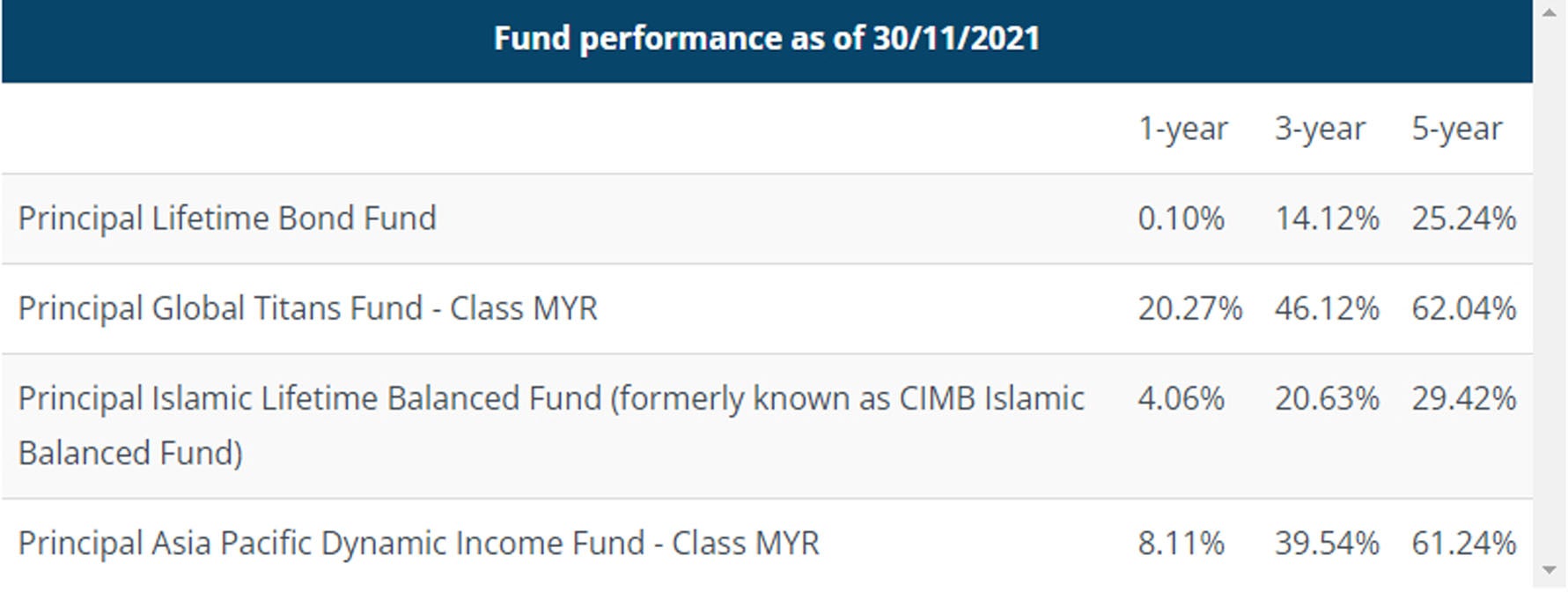

The following is a sample of the unit trust funds available through Principal:

What to do next?

Build your retirement savings by investing online with Principal. Manage all your portfolio on-the-go, anytime, anywhere.

Learn more.

If you’re new to investing, or looking for a financial consultant, we have you covered. We offer a wide range of investment solutions to help you meet your financial goals. Our team of financial experts will help you define and plan your investments to achieve your dreams. Get advice on how much time to set aside for each of your goals, and where to start working towards them.

Disclaimer

You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant Prospectus, Information Memorandum and/or Disclosure Document relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risks involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. Securities Commission Malaysia does not review advertisements produced by Principal.