Switching Transaction

1. What is Switching?

Switching is basically a Sell and a Buy transaction request. Switching facility allows you to switch from (sell) and switch in to (buy) any of the EPF approved funds that allow switching of units.

2. Can you select more than one funds to switch out?

Yes, you may select more than one funds from EPF i-Akaun Investment’s dashboard or directly login to Principal’s dashboard to start your switching request.

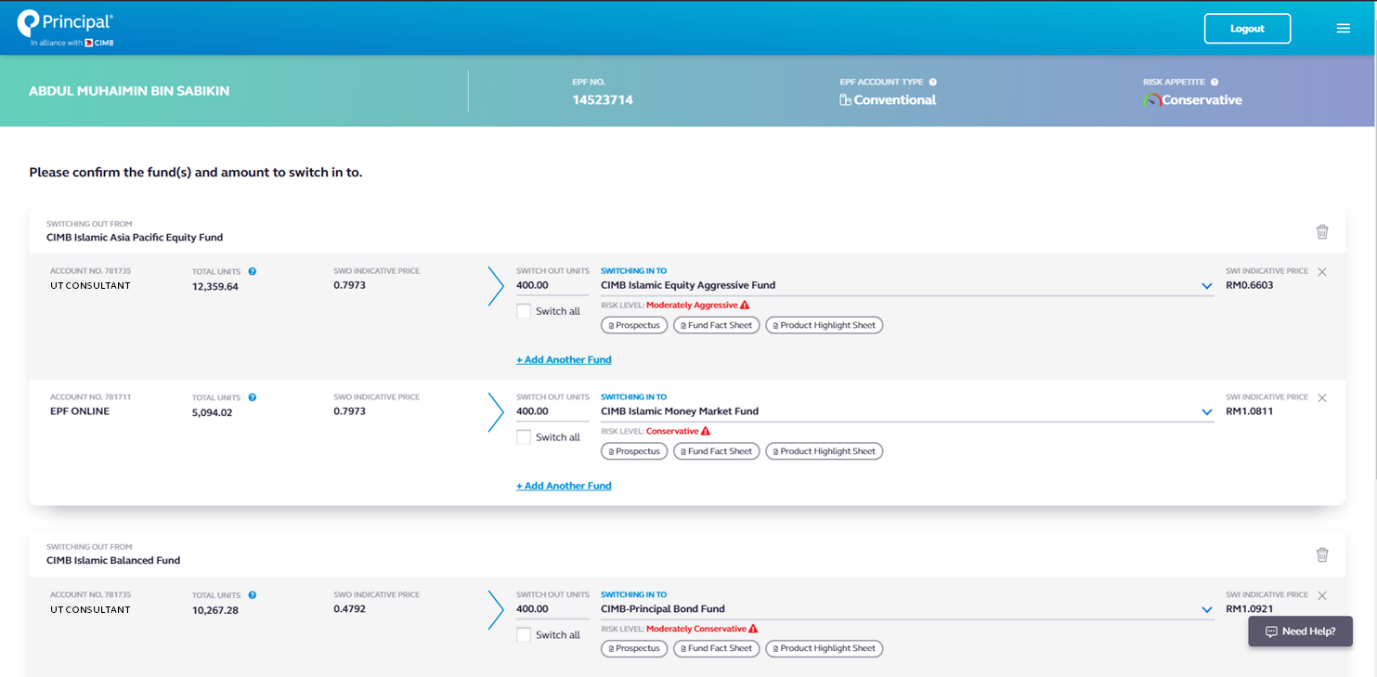

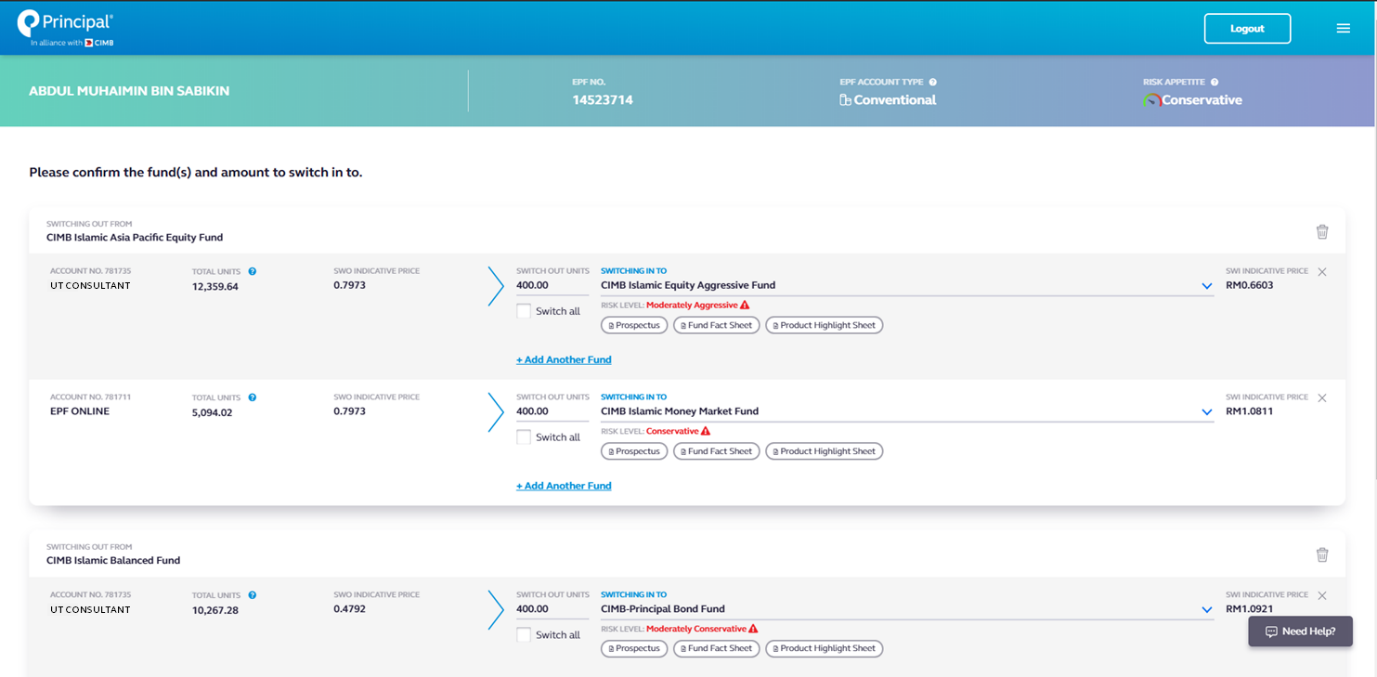

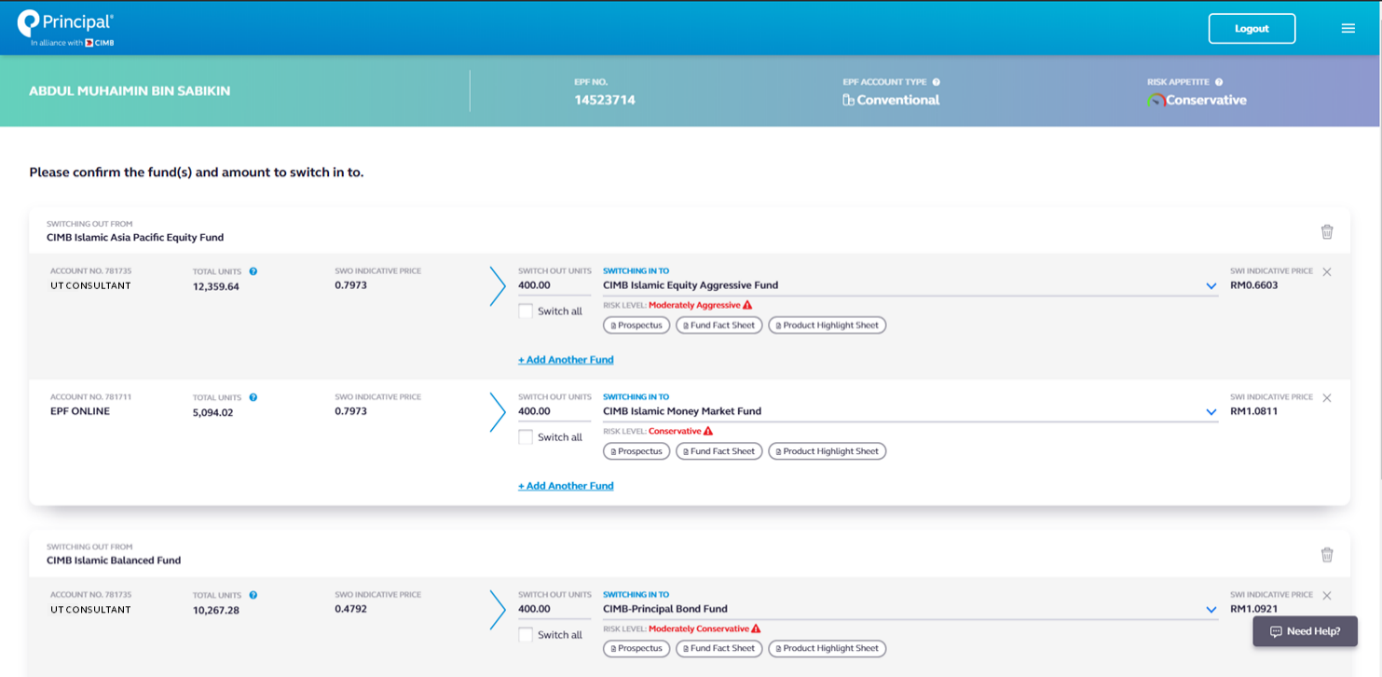

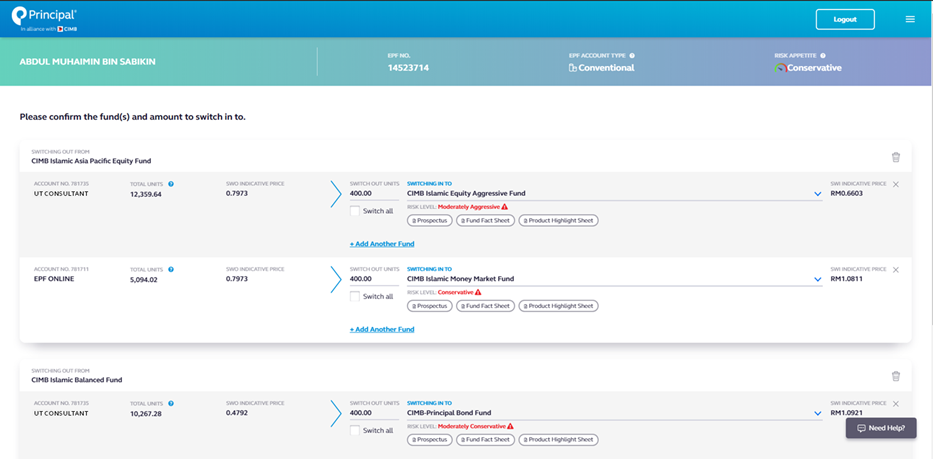

3. Can you switch into more than one funds?

Yes, you may click on “+Add Another Fund” and select a fund from the drop-down tab and allocate it to the “Switching In To” section.

4. Do you have to indicate number of units for switching?

Yes, you are required to indicate number of units for partial switching. To switch out all your units from a particular fund to another, you may tick on the “Switch all” box. Should the balance of units in the switch out fund is less than the minimum units holding allowed, your switching will be rejected.

5. When can you make switch out (i.e. sell) transaction request from your funds?

You can make swtich out (i.e. sell) request once your investment (i.e. buy) transactions are completed where you have units in your holding and/or accounts. You are unable to switch out (i.e. sell) any funds during the transaction and/or pending processing cycle where unit have yet to be credited into your holding and/ or account.

6. Can you switch your units from EPF scheme account(s) invested under Principal’s unit trust consultant?

Yes, you can perform such switching request online via EPF i-Akaun or directly login to Principal’s platform.

7. Can you make online submission to switch your units in your cash scheme account(s) invested via withdrawal from your EPF Akaun 55 and/ or Akaun Emas withdrawal?

In Principal’s dashboard you will be able to view your cash scheme account(s) invested via EPF Akaun 55 and Akaun Emas. However, the online switching facilities for cash scheme account are not available yet. Meantime, you may walk into any Principal’s branches neareast to you to submit any switching request.

8. Can you make online submission to switch your units in Principal’s fund(s) invested via CIMB Bank or iFast (for both EPF and Cash scheme)?

No, you can’t. You must submit your switch request to CIMB Bank or iFast directly.

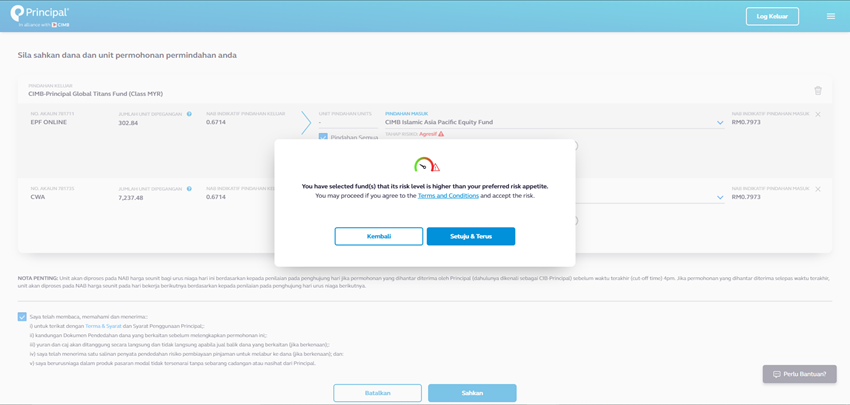

9. Can you resume with your switching submission if you received the message that your switch into fund(s) is mismatched with your risk appetite?

You have options to:

• Resume with your fund(s) switching by clicking on “Agree & Continue” button acknowledging the mismatch alert message; or

• Remove and replace the suitable fund(s) in your switching in to list.

10. When will your submitted transaction request (switch order) be processed by Principal?

Your buy order will be processed on the same business day should you have successfully submitted transaction request and received by Principal before 4pm. If you have successfully submitted transaction request and received by Principal after 4pm or on a non-business day, orders will be processed on the next business day.

11. When will the switch out fund be debited and switched in fund be credited in your holdings?

The respective funds will be debited from and credited in your holding by three business days (T+2) for local funds and four business days (T+3) for foreign funds.

12. When will you know about the price/ NAV for the fund(s) you switch into?

The ‘Indicative Price/ NAV’ that you could see in transaction screen is the 'indicative price'. This is usually the fund price/NAV of the latest trading day (i.e. price of the fund one working day ago). This indicative price is NOT the actual transaction price of the fund that you are buying or selling. Unit trusts in Malaysia are priced based on "forward pricing". This means that if you transact today before 4pm, you will get the fund’s value as of the closing price of the market today. However, you will know the price in one working day. If you transact today after 4pm, you will get the fund’s value as of the closing price of the market tomorrow. However, you will know the price in two working day.

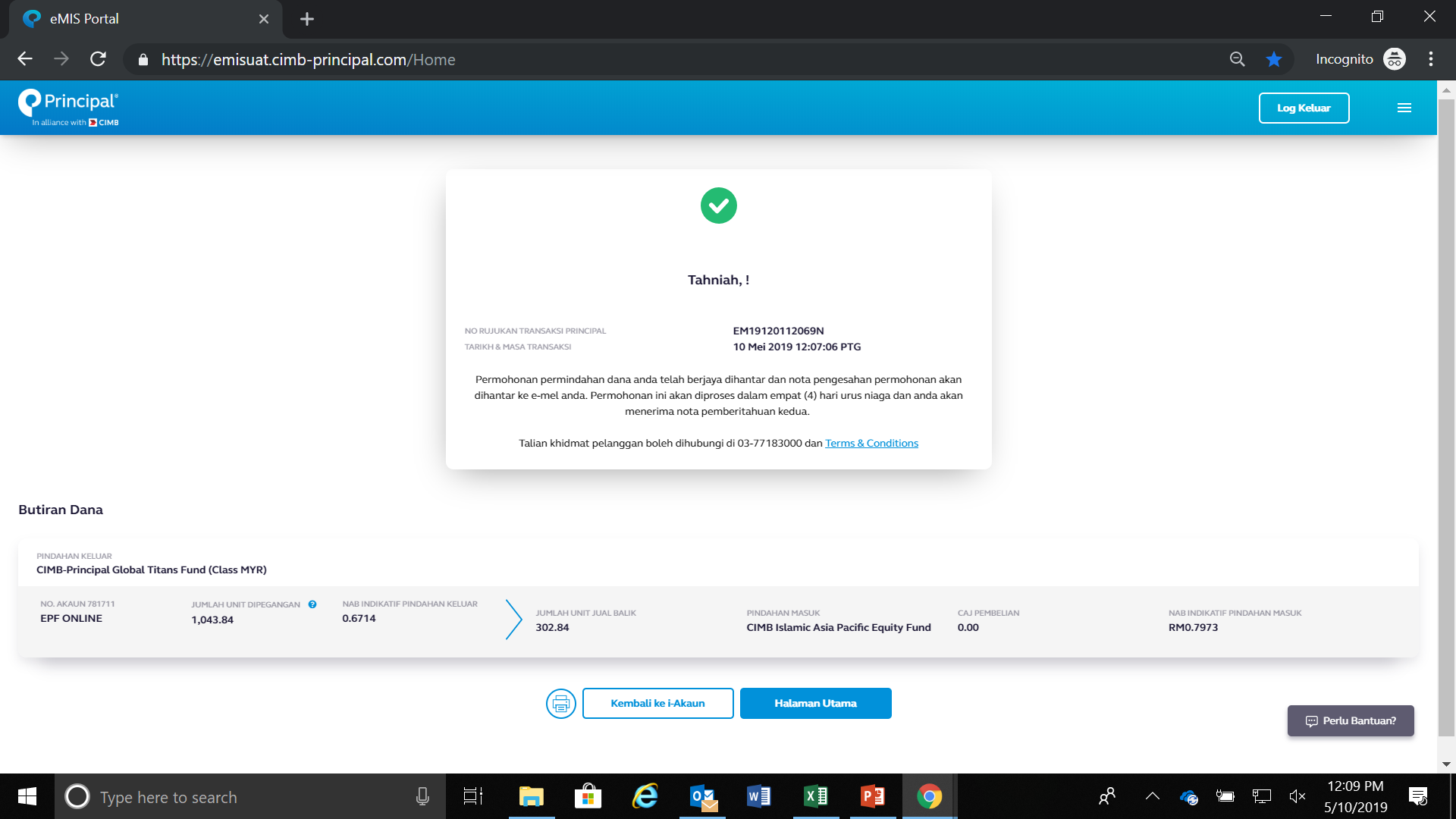

13. What happens after you have successfully submitted your switching transaction request online?

You will receive a transaction confirmation notice; followed by two (2) emails from Principal.

i. 1st email: after your online transaction is successfully submitted.

ii. 2nd email: after the units have been processed into your holdings (T+2 or T+3 business days) and the Statement of Account is ready.

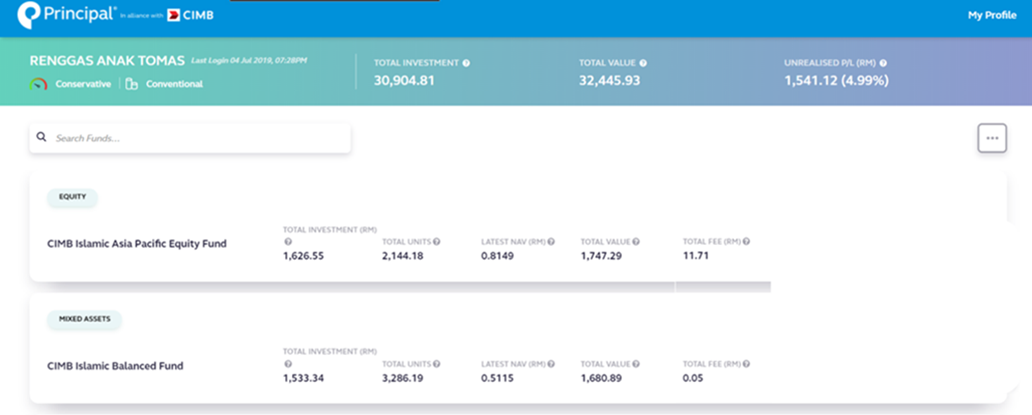

14. How can you view your investment account(s) and/or account holding?

Once your investment/ fund is debited from and credited in your holding, you will receive an email notification. Alternatively, you may also login to Principal’s dashboard to view your investment details and/ or account holdings.

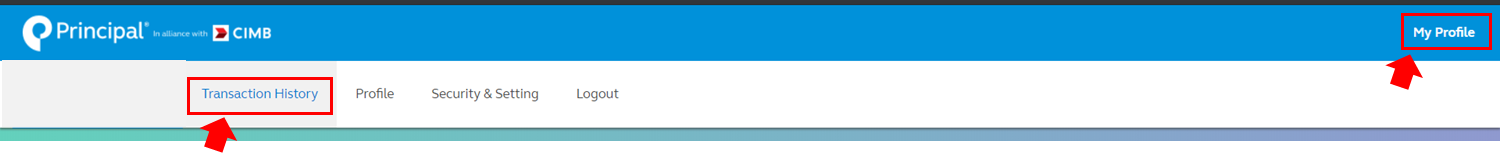

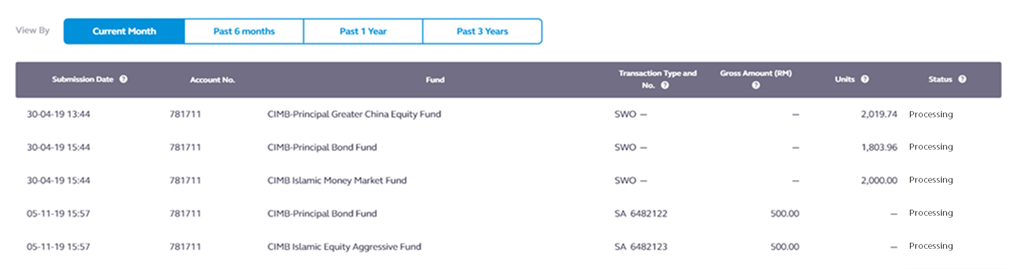

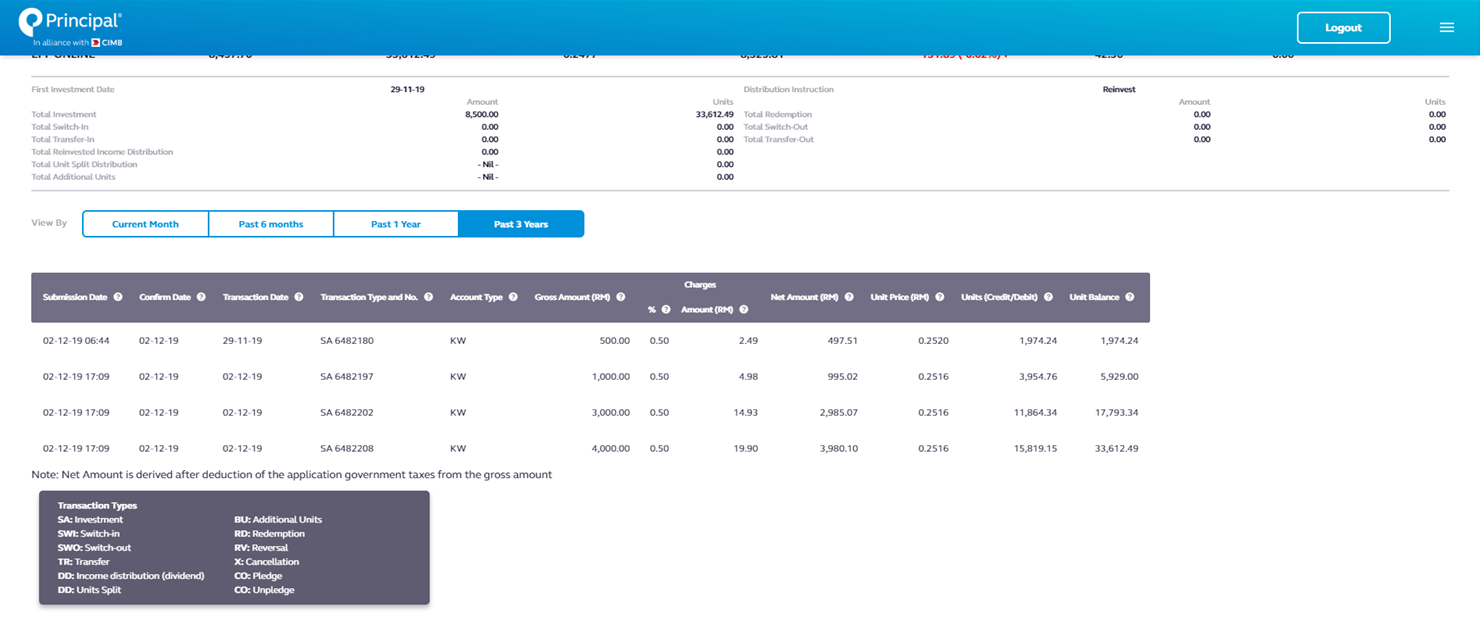

15. How can you view your switching transaction processing status?

You may refer to the Transaction History in the top right menu tab that will show the status of the all your successfully submitted transactions. The status labelled with ‘Processing’ means the transaction(s) is pending processing. Once the transaction(s) is processed and units are credited into your account holdings, the transaction(s) will be removed from the Transaction History and displayed in your fund and/ or account ledger with the complete holding details.