Other Useful Information

1. What is a unit trust?

Unit trust fund is a financial vehicle consists of a pool of funds collected from a group of general public investors with similar objectives. This collective investment fund is managed full time by professional fund managers. An investment portfolio typically includes equities, bonds and assets. A unit trust is a three-way relationship among the Manager, the Trustee and the Unit Holder. The Manager manages and operates the unit trust fund, the Trustee holds all the assets and the Unit Holder is the investor.

2. What are the benefits of unit trust investment?

Investors get to invest in a diversified portfolio and benefit from the expert management of fund specialists for an affordable capital outlay and minimum risk. Their unit trust investments are individually tailored to suit their specific needs and constantly monitored, saving valuable time and resources. Unit trusts are liquid because units can be bought or sold on any working day without any lock-in period.

3. What should you consider before investing in a unit trust?

You should always consider factors such as your investment objectives, risk profile, investment time horizon and your affordability at any one time.

4. Should you invest in unit trust funds that are ranked at the top of the performance tables only?

Fund with a track records of 3 to 5 years can be used to gauge the consistency of the performance of the fund. Nevertheless, it is not advisable to use a sole criterion of top ranked funds over a given period to make investment decision into any funds. It is not necessarily the case that past performance guaranteed future performance, i.e. the fund will continue to be the best in future.

5. How much do you need to start an investment in a unit trust fund?

Investing in unit trust funds is generally affordable. For example, an initial investment for CIMB-Principal Equity Fund starts from RM 500 and its subsequent additional investment is only from RM 200. You may refer to our master prospectus to find out more on the initial and subsequent investment for other funds available.

6. What is dollar cost averaging?

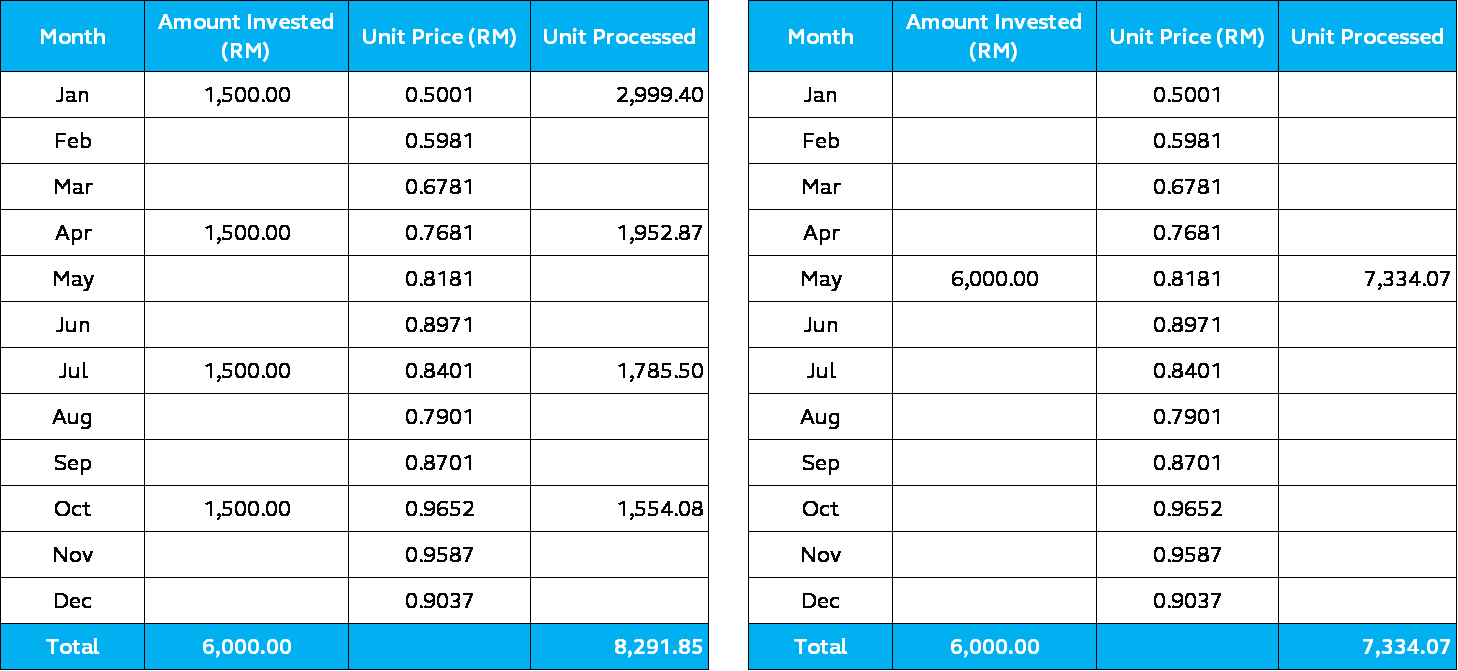

Dollar cost averaging is a systematic approach, investing a fixed amount of money in a regular interval (monthly or quarterly) regardless of the price level whether market is rising, declining or fluctuating. With this cost averaging approach investor will get more units when prices are down and fewer units when prices are up. Based on illustration below, the overall cost per unit for regular investment is likely to be lower compared to a lump sum of money is invested at one time. Essentially when investing in unit trust, it is important to adopt a discipline saving plan over a long-term period which will weather you to ride through market volatility.

7. What is “Net Asset Value”?

Net Asset Value (NAV) refers to the net value of a fund at the close of a business day, after deduction of all the expenses.

8. What is “Net Asset Value” per unit?

It is the Net Asset Value (NAV) of the fund divided by the number of units in circulation as at the close of a business day.

9. What is “Unit Pricing”?

The Manager adopts a single pricing method for any transactions (i.e. applications, withdrawals, switches and/or transfers) based on forward prices. Transactions request will be processed based on the NAV per unit at the next valuation point upon receipt of the successful transaction requests from you. If the transactions are made by 4:00 p.m. on a business day, we will process the transactions using the NAV per unit for that business day. For transactions made after 4:00 p.m., we will process the transactions using the NAV per unit on the next business day. The valuation point of the funds for a business day will also depend on whether the portfolio consists of foreign investments.

10. What is forward pricing?

Forward pricing refers to pricing determined at the close of the current business day after all investments, and the cost of all transaction activities, have been taken into account. Historical pricing which is pricing at the close of the previous business days.

11. What are the operating hours of Principal’s Customer Care Centre?

Customer Care Centre operating hours are:

• Monday to Thursday: 8.45am to 5.45pm

• Friday: 8.45am to 4.45pm

Closed on National and Selangor Public holidays

For telephone assistance, you may call our Customer Care Centre at +(603) 7723 7260

You may also email your queries to myservice@principal.com