Opening of Investment Account & Performing Initial Investment with Principal

1. Who can open an online investment account and start investing into unit trust under EPF scheme?

All EPF Members above 18 years old can open an EPF scheme investment account. You are allowed to invest 30% of the savings amount in excess of your Basic Savings amount required in Account 1. Basic Savings amount is applicable to members up to 55 years old only before release control issued by EPF.

2. How do you open a EPF scheme investment account online?

Upon selecting your investment funds in EPF i-Akaun Investment, you will be redirected to Principal’s platform:

i. Complete your personal details; and

ii. Answer the risk assessment question; and

iii. Create your login account; and

iv. Confirm your purchase request.

3. If you have existing EPF scheme investment accounts with a Principal’s unit trust consultant , can you open another EPF scheme investment account online?

Yes, you can open another online investment account as it is a self-managed investment platform. Your investment will be assigned with a new account number.

4. Can you invest (i.e. buy) the same fund(s) that you have bought with a Principal’s unit trust consultant via this online platform?

Yes, you may buy any EPF’s approved funds online even though it is the same fund you have bought from a Principal’s unit trust consultant. Your investment will be assigned with a new account number.

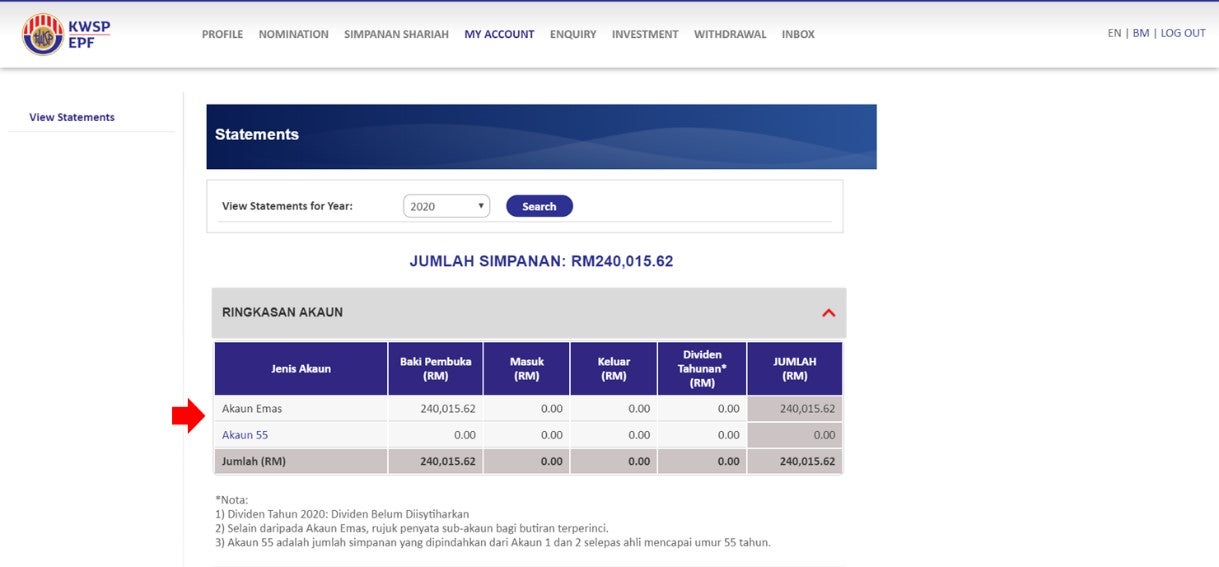

5. If your age is more than 55 years old can you invest via EPF i-Akaun?

Should you still have available amount in your EPF Akaun Emas or Akaun 55 you will be able to login to EPF i-Akaun Investment to make investment (i.e. buy) request. Once you selected your fund(s) to invest, you will be redirected to Principal’s platform for an online account creation, investment account opening and investment (i.e. buy) transaction submission.

6. If your age is above 55 years invested via EPF i-Akaun will your account be under the EPF scheme?

If you are above 55 years old your online investment (i.e. buy) is made via a withdrawal from your EPF Akaun Emas or Akaun 55, Principal will process your investment into a Cash scheme account and not a EPF scheme account.

7. Are there any charges to open an investment account?

Opening of an online investment account is free-of-charge.

8. What is Risk Assessment?

Risk assessment is to determine the most suitable investments for you after considering amongst other things your financial circumstances and risk appetite.

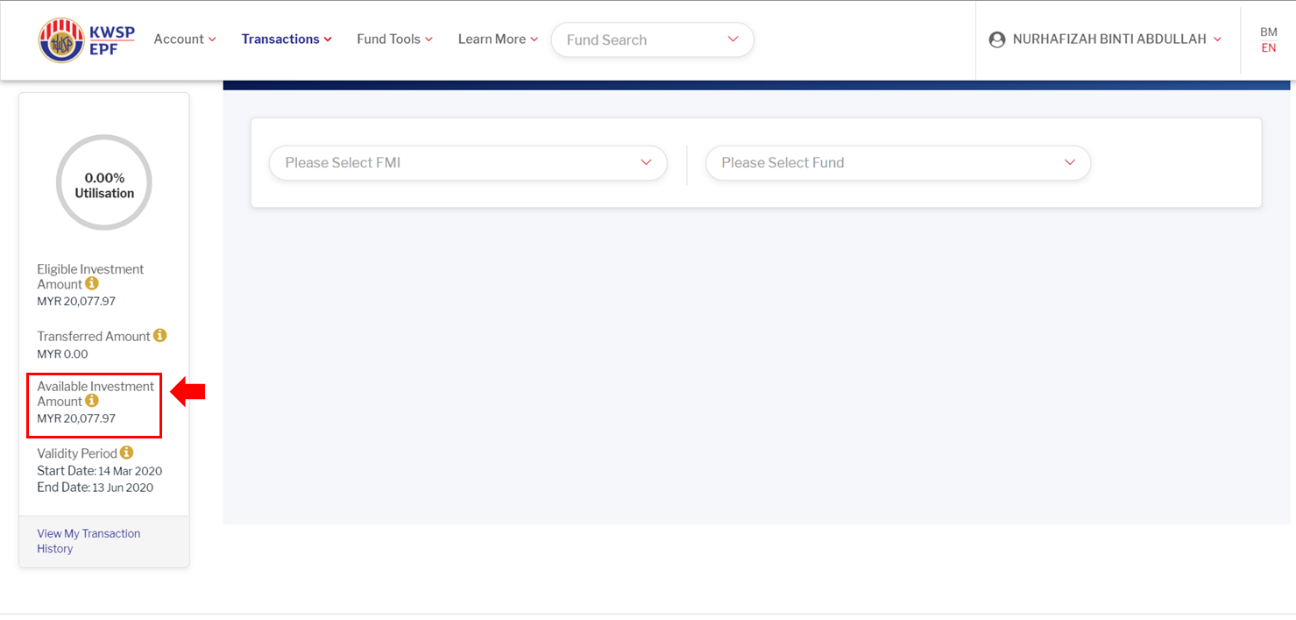

9. How frequent can you withdraw your savings from EPF Account 1 to invest?

You may apply to invest every 3 months from the last approval date of your investment. However, if you still have available investment amount from your eligible investment amount, you may make investment (i.e. buy) anytime and not bound by every 3 months withdrawal from the last approval date of your investment.

10. Can you open a joint account online for your EPF investment?

No.

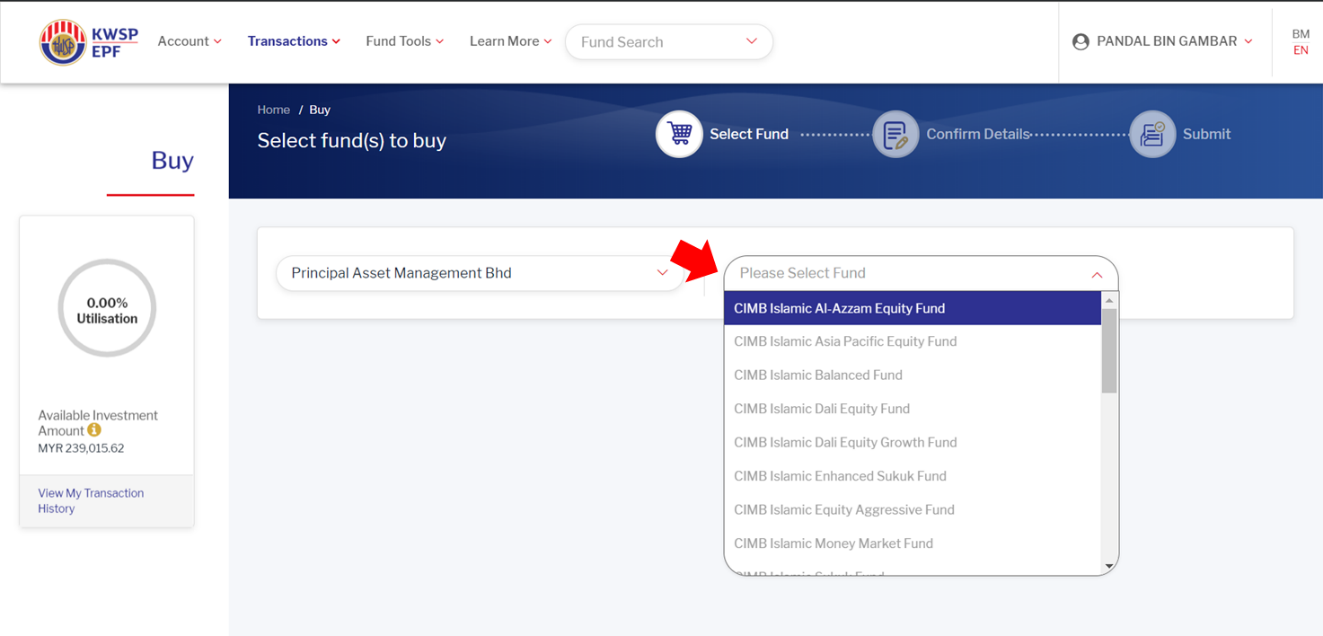

11. How do you know which of the Principal’s funds are open for this online investment?

All funds that are listed in EPF i-Akaun buy screen are EPF approved funds that are open for investment (i.e. buy) and/or to be switched into.

12. What is the amount you can start with your first-time investment via this online platform?

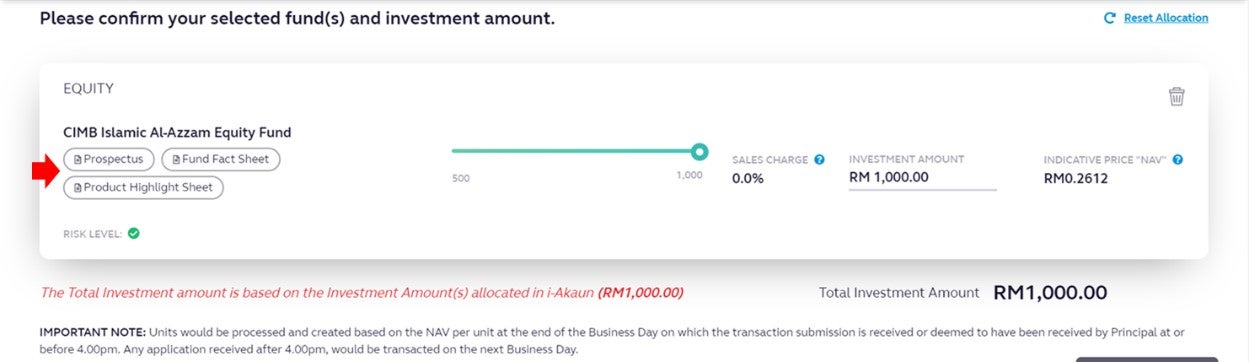

Investing in unit trust funds is generally affordable. For e.g. an initial investment for CIMB-Principal Equity Fund starts from RM500 and its subsequent additional investment is only from RM200. You may refer to our Master Prospectus to find out more on the initial and subsequent investment for other funds available. However, EPF i-Akaun required each transaction submission to have a minimum total investment amount of RM1,000 (for one fund or multiple funds investment).

13. Is there a minimum transaction amount for investment submitted via EPF i-Akaun?

Yes. EPF i-Akaun Investment required each transaction submission to have a minimum total investment amount of RM1,000 (for one fund or multiple funds investment).

14. What’s the sales charge?

Sales charge is the fee imposed when investing in unit trust. The sales charge for EPF i-Akaun is capped at 0.5%. However, from time to time, investors could enjoy special promotional sales charges.

15. What can you do if you found out that your prior selected fund(s) from EPF i-Akaun are mismatched with your risk appetite in Principal’s platform?

You have options to:

• Resume with your fund(s) purchase by clicking on “Agree & Continue” button acknowledging the mismatch alert message; or

• Remove any fund(s) from your purchase list; or

• Should you want to add new fund(s), you would need to log in to EPF i-Akaun for new fund(s) selection.

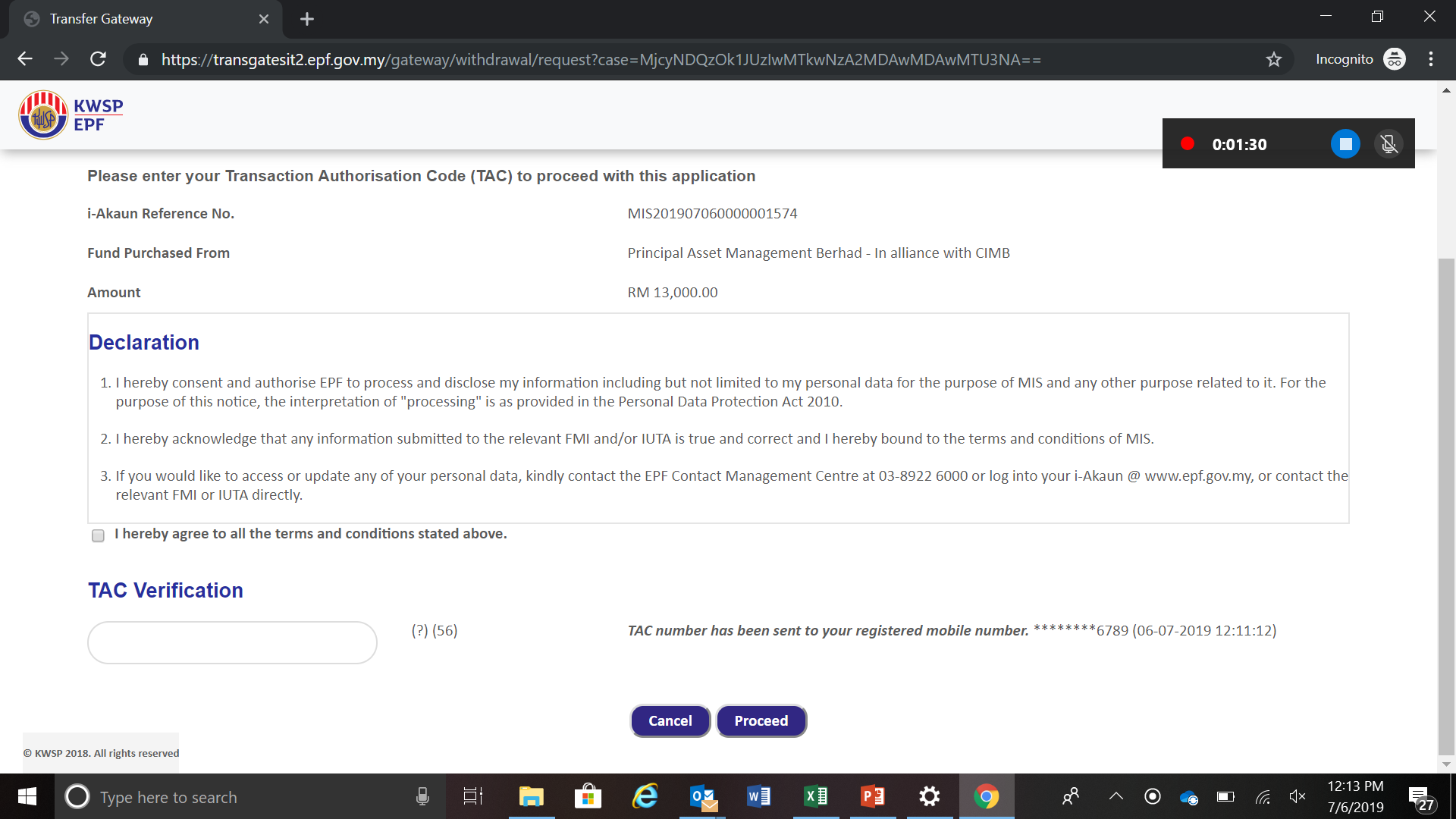

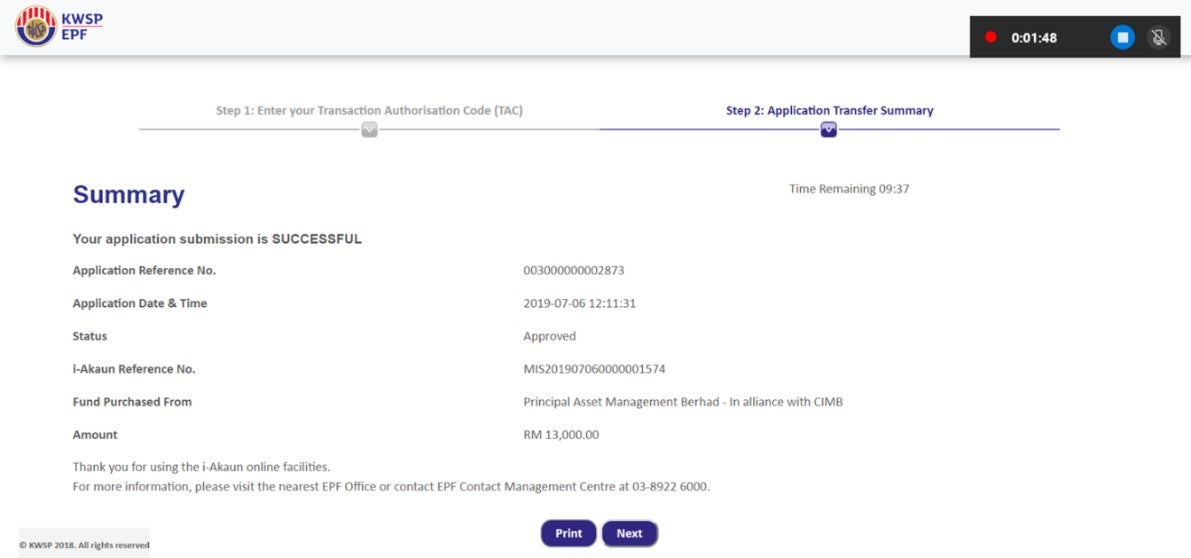

16. How do you make withdrawal from your EPF Account 1 once you confirmed your investment (i.e. buy) transaction?

Once you confirmed your investment (i.e. buy) transaction, you will be redirected to EPF i-Akaun Investment’s transfer gateway to process the withdrawal request from your EPF Account 1. A TAC from EPF will be sent to your mobile number (maintained in EPF i-Akaun record) to confirm the investment transaction request.

17. How long does it take for EPF to approve the withdrawal from your Account 1 for your investment (i.e. buy) transaction request?

Your investment (i.e. buy) transaction request will be processed immediately during the EPF i-Akaun transfer gateway online operating hours. You will either received a Successful or Rejected transaction confirmation notice.

18. When will your successfully submitted investment (i.e. buy) transaction will be processed by Principal?

Your buy order will be submitted for processing on the same business day should you have successfully submitted the investment transaction and received by Principal before 4pm. If you have successfully submitted the investment transaction and received by Principal after 4pm or on a non-business day, orders will be submitted for processing on the next business day.

19. When will your online investment account be created and; units of fund will be credited in your holdings?

Your online investment account will be created immediately and units of fund will be credited in your holding by three business days (T+2) for local funds and four business days (T+3) for foreign funds.

20. When will you know about the price/ Nett Asset Value “NAV” for the fund(s) you bought?

You could see the ‘Indicative Price/ NAV” on the transaction screen. This is usually the fund price/ NAV of the latest trading day (i.e. price of the fund one working day ago). This indicative price is NOT the actual transaction price of the fund that you are buying or selling. Most of the unit trusts in Malaysia are priced based on "forward pricing". This means that if you transact today before 4pm, you will get the fund’s value as of the closing price of the market today. However, you will know the price in one working day. If you transact today after 4pm, you will get the fund’s value as of the closing price of the market tomorrow. However, you will know the price in two working day.

21. What happens after you successfully submitted your investment (i.e. buy) transaction?

You will receive a total of two email notifications from Principal:

i. 1st email: after your online submission is successfully performed; and

ii. 2nd email: after the units have been processed into your holdings (T+2 or T+3 business days) and the Statement of Account is ready.

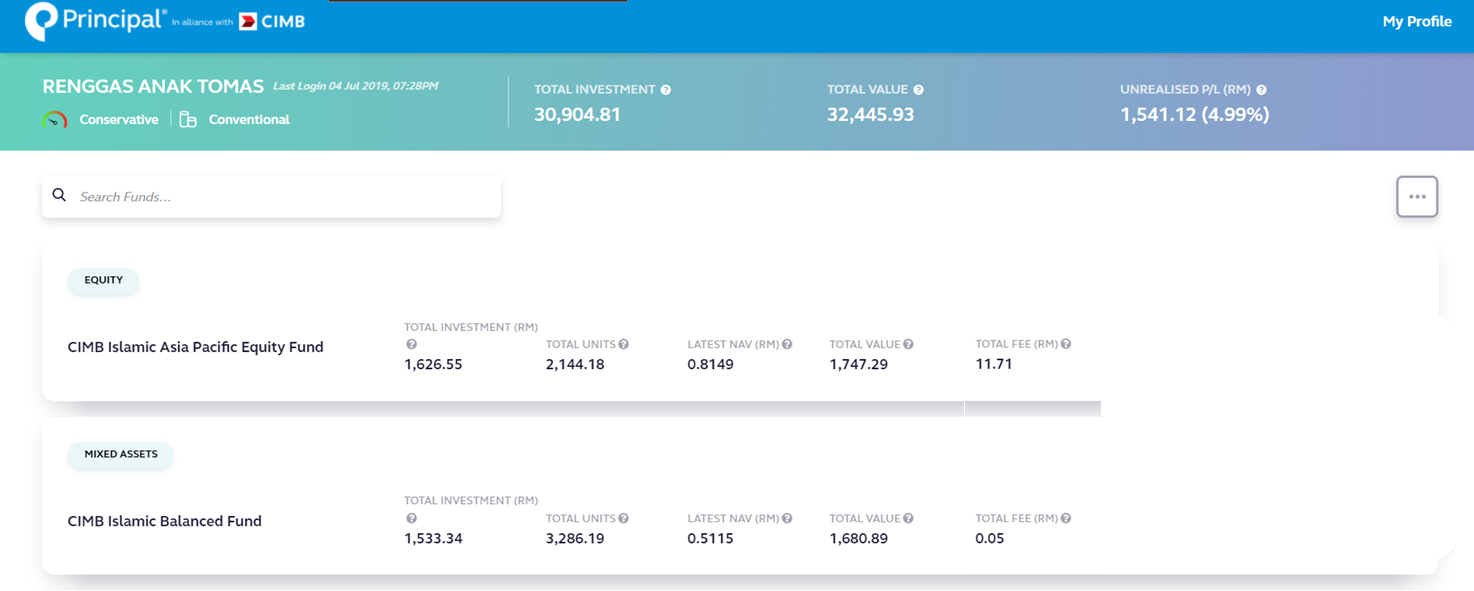

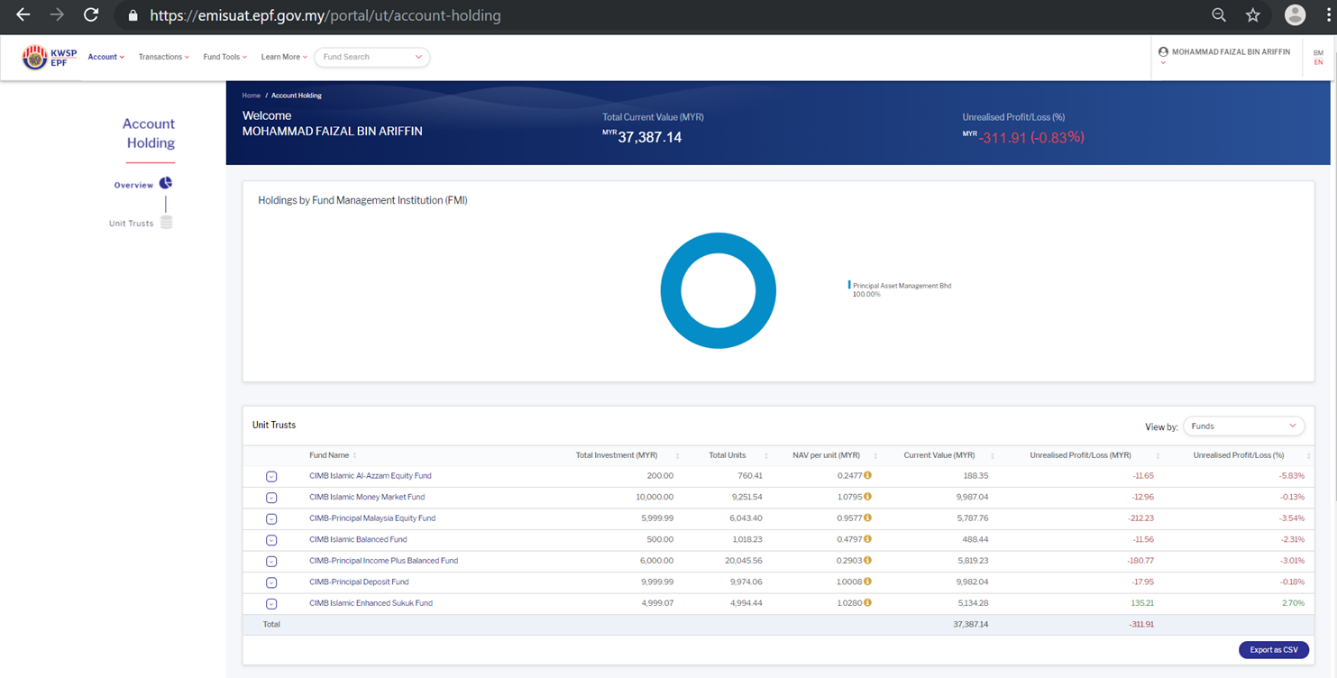

22. How can you access your investment account?

Once your investment/ units of fund are credited in your holding, you will receive an email notification. Alternatively, you may also login to Principal’s dashboard to view your account holdings, ledger details and/or transaction history on successfully submitted transactions pending processing. You will be able to view your account holding in EPF i-Akaun’s dashboard too.

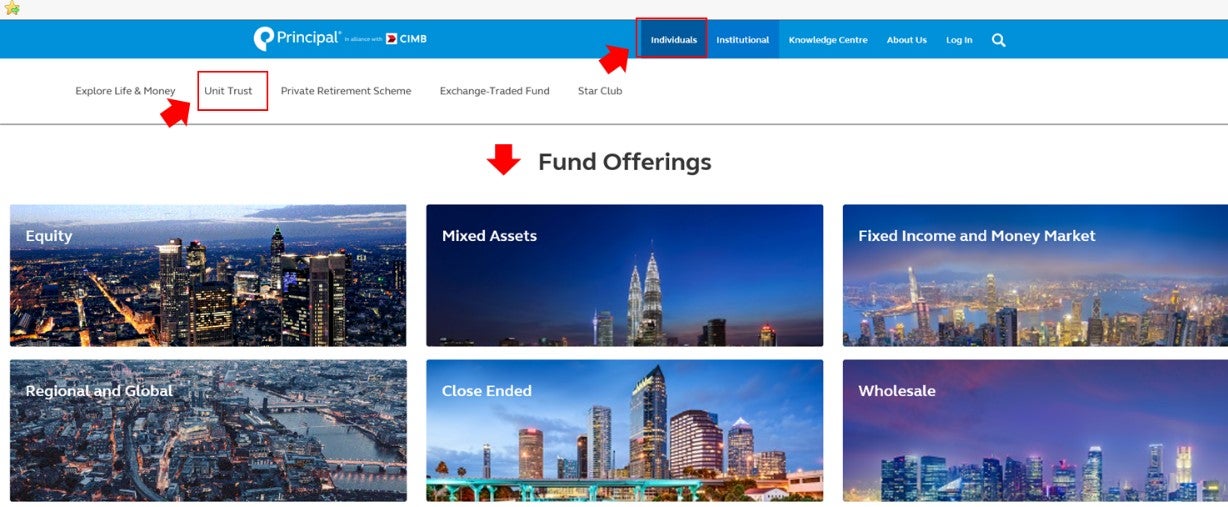

23. Where can you get the respective funds information?

You may view that information in the Principal’s corporate website at https://www.principal.com.my/, and EPF i-Akaun.

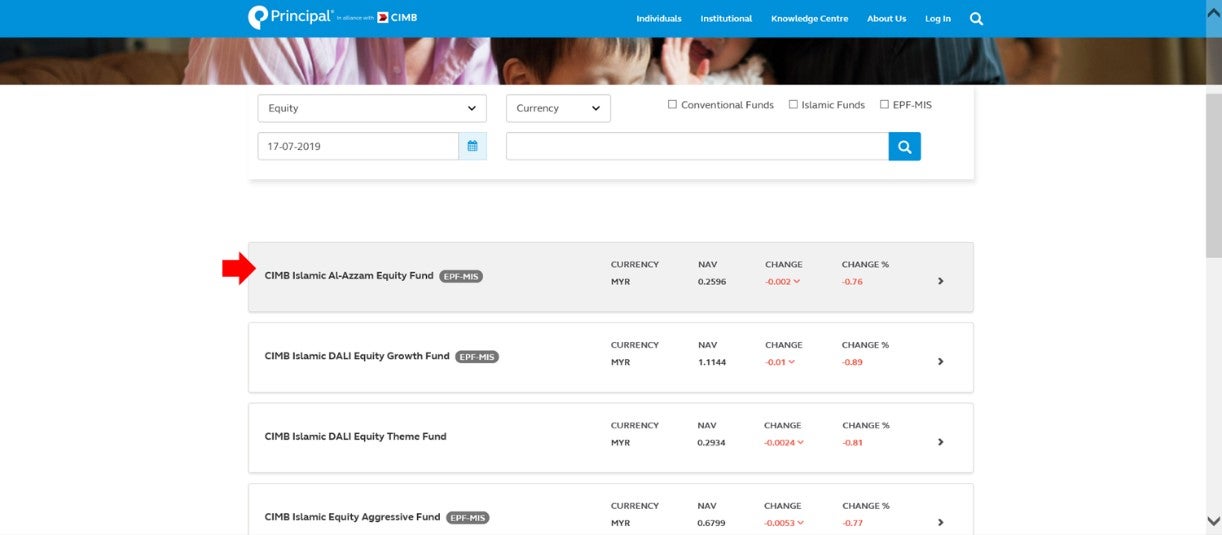

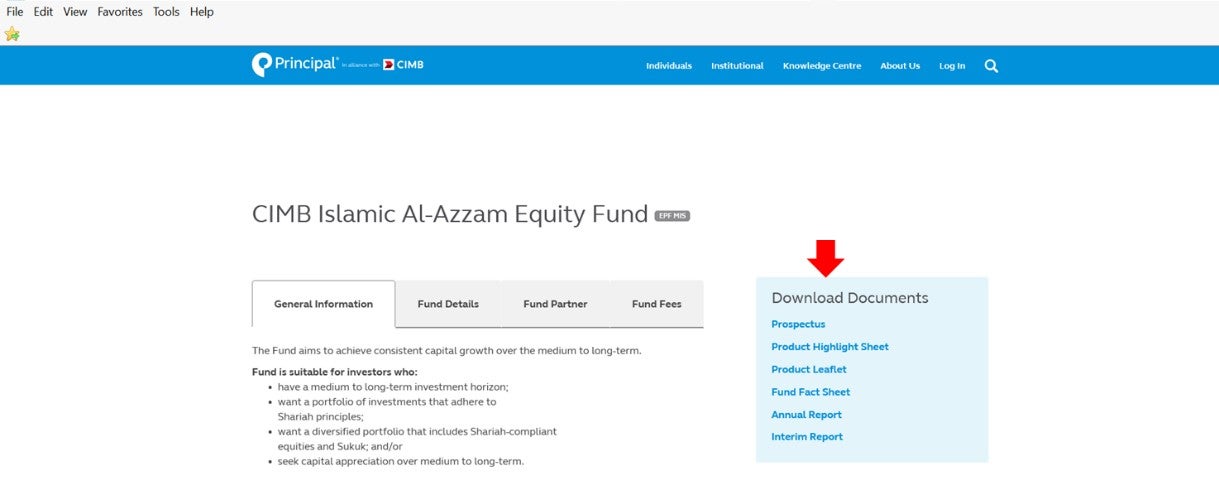

Principal’s corporate website

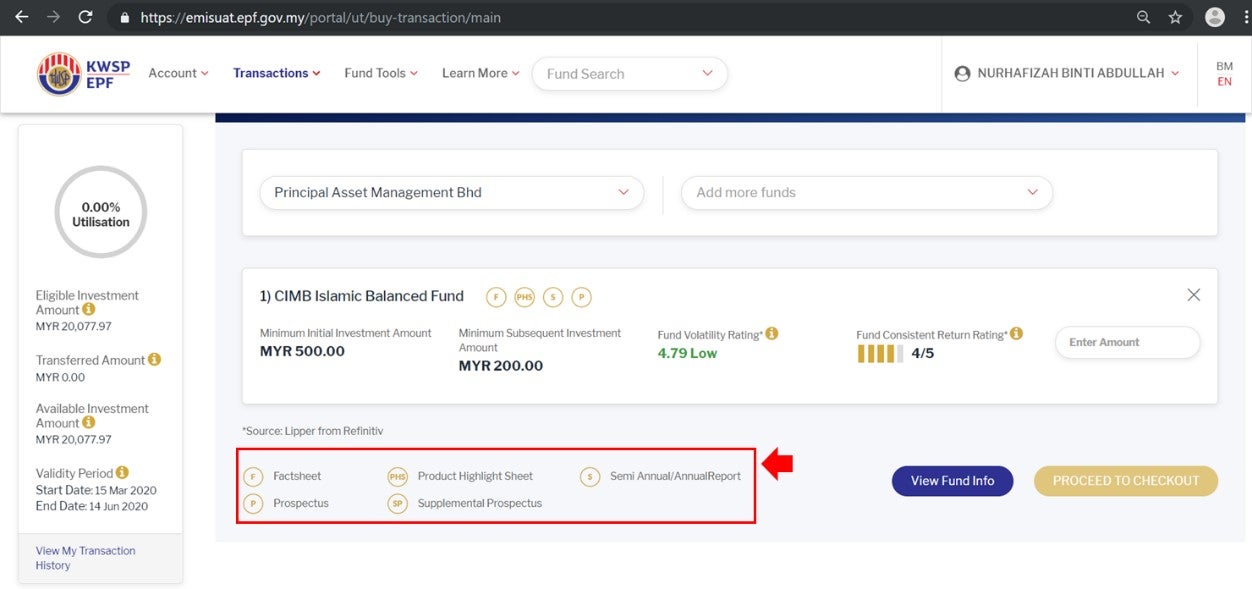

EPF i-Akaun – Transaction - Buy screen

24. Can you submit your investment (i.e. buy) requests through your Principal’s unit trust consultant and/ or through Principal’s branches should you have invested via this online platform?

Yes, you can still submit investment requests to Principal via your servicing unit trust consultant and/ or any of Principal’s branches. Those requests will be processed into the respective account(s) maintained by the unit trust consultant(s).