MARKET COMMENTARY

January 2026

Global Outlook

In December 2025, global equities, measured in local currency, continued to generate positive gains, led by South Korea (7.3%), Taiwan (4.8%), and Malaysia (4.7%), while Hong Kong SAR lagged. The global bond market, as represented by the Bloomberg Global Aggregate Index, gained 0.3%.

Asia Pacific ex-Japan equities are expected to do well in 2026, supported by easy monetary conditions, higher earnings growth (+16% in 2026 vs +10% in 2025), attractive valuations, further improvement in governance and shareholder returns, and healthier fiscal balance sheets.

With trade tensions abating, this helps China, Korea and Taiwan regain their footing in the global tech race. The emergence of globally competitive tech firms in AI, internet-platform tech, smart manufacturing, and robotics is key for the economy to grow and drive productivity improvements. Within Asia, we prefer equities to bonds on a 12-month view. Asia’s EPS is seeing upward revisions and fund flows have been positive.

Global Outlook of the two capital markets: Fixed Income & Equities

Region: Developed economies

Fixed income

- Our view: Positive.

- The Fed executed its third policy rate cut of 25 basis points (to 3.5%–3.75%) at its December meeting. Based on the minutes from that session, there is a division regarding the pace and timing of further cuts due to economic uncertainties.2

- The BoJ raised rates to a 30-year high of 0.75%, signalling further hikes and spiking bond yields. The ECB held rates steady as inflation neared its 2% target, while the BoE cut its rate by 25 bps to 3.75% due to easing inflation and economic strain.2

Equity

- Our view: Positive.

- In Dec 2025, composite PMI data showed that private sector activity in the US, Eurozone, and Japan remained expansionary (above 50.0), but momentum cooled across all three regions. The US hit an eight-month low of 52.7 amid slowing new orders and rising co st pressures. The Eurozone composite fell to a three-month low of 51.5, driven by slowing service growth and ongoing manufacturing contraction. Japan saw activity ease to a seven-month low of 51.1, though this was supported by stabilizing factory output and robust job creation.2

Region: Regional (Asia-Pacific ex-Japan)

Fixed income

- Our view: Positive.

- Asian bonds performed positively overall, driven by declining U.S. Treasury yields and a softer U.S. dollar, which improved foreign investor sentiment. All Asian dollar bond markets saw gains for the month.3

- We expect investment-grade Asian bonds to provide a gross yield of 4.00% to 4.50% in 2026. This will likely allow Asian central banks more flexibility to ease monetary policies.3

Equity

- Our view: Positive.

- In Dec 2025, composite PMI data across key Asian economies indicated continued expansion, albeit with diverging trends. China showed a recovery as its official PMI rose to a six-month high of 50.7, driven by a rebound in manufacturing and domestic demand.

- Across the ASEAN region, business activity remained resilient, closing out the year with its strongest quarterly performance in four years despite slight year-end moderation.1

Region: China

Fixed income

- Our view: Neutral.

- In Nov 2025, China's new yuan loans increased to CNY 390 bn, still below market expectations and indicating weak household credit demand, while Total Social Financing reached CNY 2.49 tn, exceeding forecasts due to government bond issuance.

- As of Sept 2025, the non-performing loan ratio for China's commercial banks remained stable at approximately 1.5%, though the balance of NPLs rose and risks from property and retail lending persist.4

Equity

- Our view: Neutral.

- China's December PMI beat expectations, finishing the year above 50. Despite tariffs, net exports remained strong, with the 11-month trade surplus exceeding US$1 trillion. However, domestic consumption stayed weak and deflationary pressures lingered. At year-end, the government announced consumer durable trade-in subsidies and relaxed property restrictions in Beijing, signaling continued targeted economic support.4

Region: Domestic (Malaysia)

Fixed income

- Our view. Positive.

- Malaysian bonds saw renewed net foreign inflows in late 2025, reversing earlier outflows, supported by stable fundamentals and a firmer ringgit, which is increasingly viewed as a high-quality carry currency and, together with Malaysia’s strong credit profile, is likely to sustain foreign demand into 2026.5

Equity

- Our view: Positive.

- Malaysia's Dec 2025 manufacturing PMI held at 50.1, indicating expansion for a second month. The key highlight was a 7-year high in employment growth. This suggests strong 4Q25 GDP growth, following 3Q25's robust 5.2% expansion. The OPR is expected to remain unchanged after the July cut, as inflation ticked up slightly to 1.4% in Nov.5

Investment Implication:6

- While the recent geopolitical tensions between the U.S. and Venezuela have caused some concern, the financial market impact is expected to remain largely contained, as Venezuelan assets represent an insignificant weight in the emerging market equity and bond indices. We expect the focus of investors to remain on fundamentals.

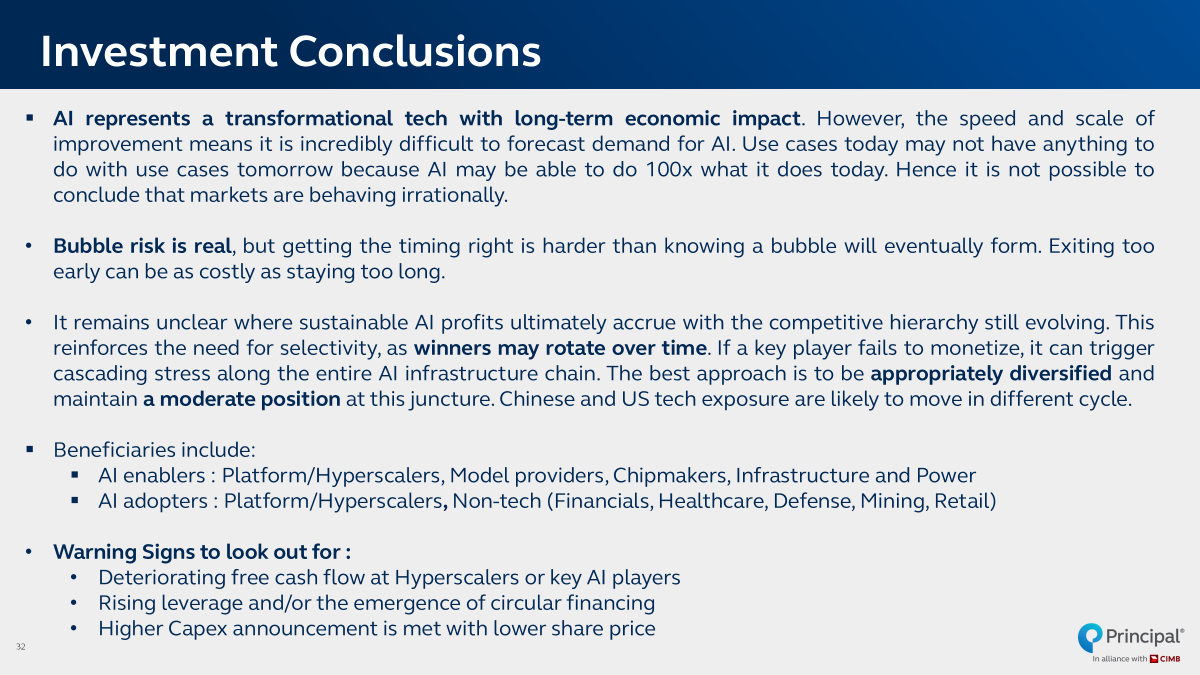

- The market in 2026 is projected to continue its positive performance, driven by optimism in abundant liquidity, stable macroeconomics, and the ongoing growth in digital transformation. Investors are advised to adhere to long principles — using diversifi cation and a phased in strategy to manage timing risk, reduce emotion, and benefit from market fluctuations. Our strategy focuses on quality growth companies with domestic earnings, supplemented by quality bonds for portfolio stability during uncertainty.

- Global Equity: We maintained a neutral allocation across regions, remained underweight cash, and held off benchmark exposures, including Asia, Gold, and Copper ETFs. US equities will be supported by solid earnings growth and expectations of Fed rate cuts. That said, valu ation is becoming stretched and will need to be supported by continued earnings growth in 2026. We have neutralized both US and European exposures, while remaining cautious on valuation risks, particularly among expensive US technology names . While we are constructive on Japan because of the positive economic impact from PM Takaichi’s fiscal stimulus, Japan ’s off benchmark opportunities (Asia, Gold and Copper ETFs).

- Asian equities should do well in 2026, supported by easy monetary conditions, earnings growth, and further improvement in governance and shareholder returns policies. The portfolio focuses on companies demonstrating market leadership, durable competitive advantages, strong free cash flow generation, and improving capital management. We remain constructive on financials, industrials, alongside technology leaders in internet platforms and semiconductors.

- Malaysian Equity: In this early part of the year, the focus is on portfolio clean up, realizing losses, and rebalancing. The intention is to maintain a high asset allocation and portfolio beta with continued focus on quality domestic earnings exposure in sectors like Constr uction, Utilities, and Consumer — beneficiaries of cash handouts, Visit Malaysia Year 2026 (VMY26), and a strengthening Ringgit (MYR). The portfolio is also positioned in the Technology thematic and AI value chain. Key risks include unexpected downside to Malaysia's economic momentum, increased volatility from tariff uncertainty, and geopolitical events.

- Malaysia Fix Income: We expect BNM to keep the OPR unchanged in the near term, supported by a stronger ringgit and contained inflationary pressures. While a rate cut is not our base case, we do not rule out a pre-emptive easing later in the year should growth momentum soften. Asset allocation continues to favor corporate bonds, where carry remains attractive relative to government securities. We maintain a preference for high-quality, domestically oriented credits, as these issues are better insulated from potential external risks, including evolving tariff dynamics and global trade uncertainty. Primary market opportunities remain a key focus, particularly where new issues offer incremental yield pick-up over the secondary market. In the government bond space, movements are expected to be largely driven by external factors, including US rate developments and global risk sentiment. With government bond spreads to OPR already nearing five-year lows, we see limited near-term downside and remain cautious amid the prospect of increased government bond supply. As such, we will take profit on government bond rallies, while selectively participating in government securities for trading opportunities, supported by improved sentiment from a firmer ringgit. Overall, we maintain a neutral to modestly overweight duration stance, balancing carry accumulation with active trading opportunities, while remaining disciplined amid valuation constraints and supply considerations.

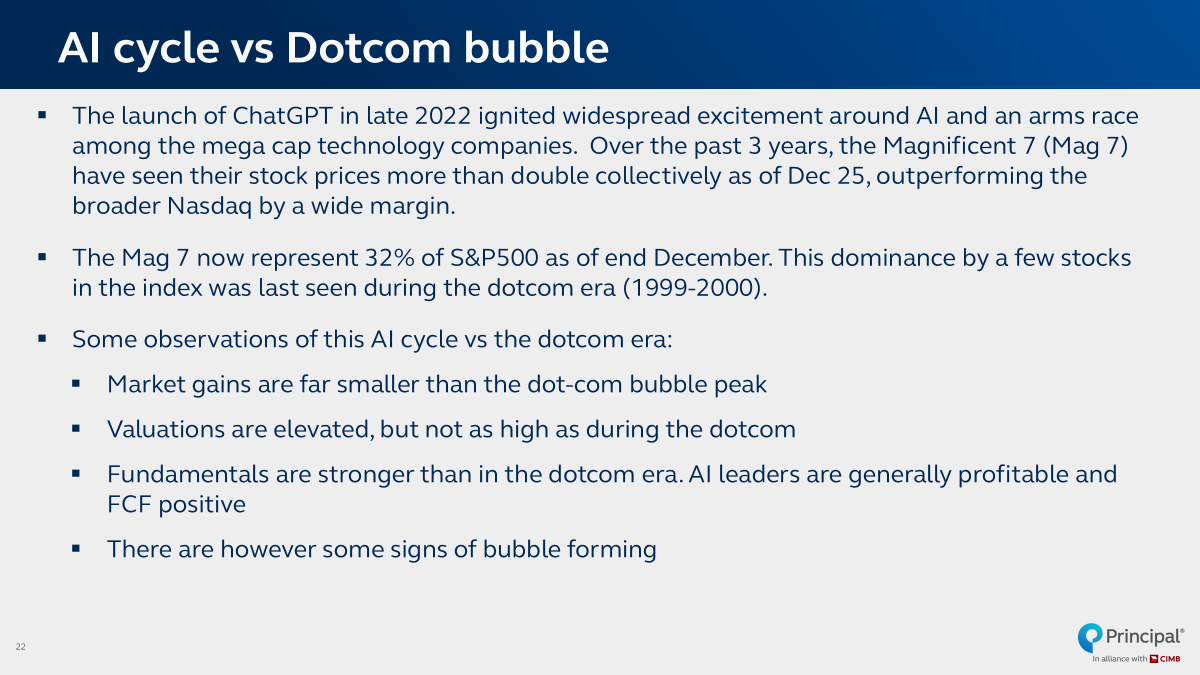

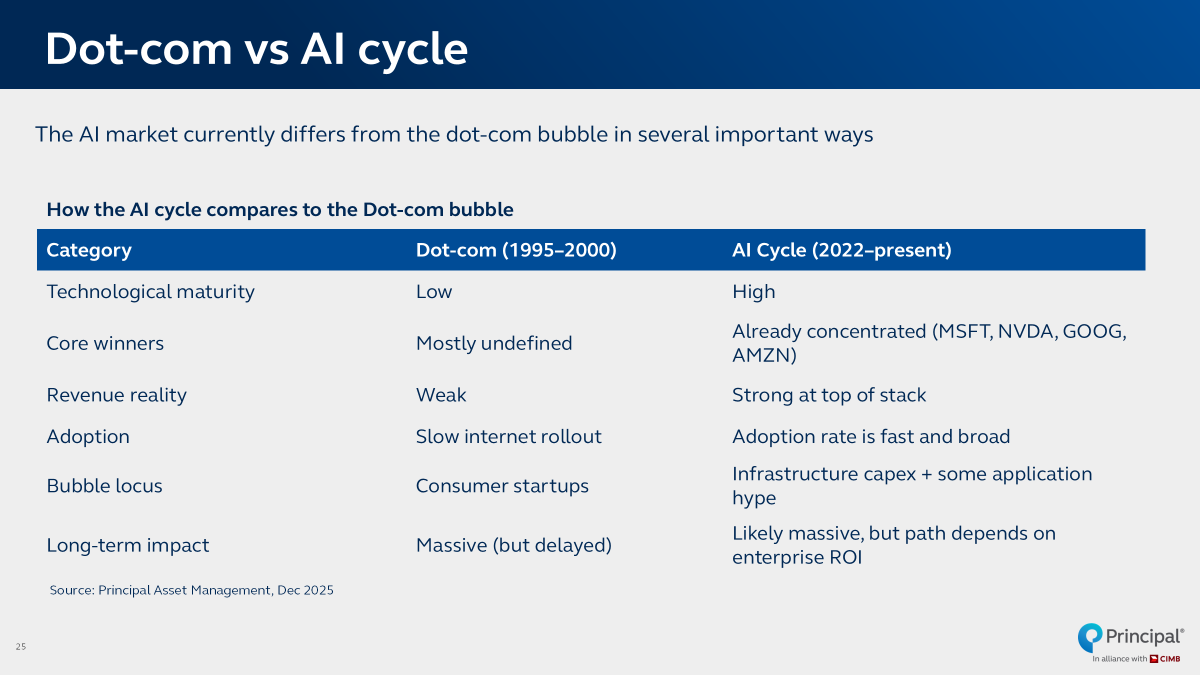

Special Topic6:

Glossary:

UW: Underweight

OW: Overweight

MoM: Month-over-Month

YoY: Year-over-Year

FOMC: Federal Open Market Committee

ECB: European Central Bank

UST: United States Treasury

PMI: Purchasing Managers Index

SoE: State-Owned Enterprise

SEZ: Special Economic Zone

BNM: Bank Negara Malaysia

MPC: Monetary Policy Committee

Disclaimer

We have based this document on information obtained from sources we believe to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. Expressions of opinion contained herein are those of Principal Asset Management Berhad only and are subject to change without notice. This document should not be construed as an offer or a solicitation of an offer to purchase or subscribe or sell Principal Asset Management Berhad’s investment products. The data presented is for information purposes only and is not a recommendation to buy or sell any securities or adopt any investment strategy. This material is not intended to be relied upon as a forecast, research, or investment advice regarding a particular investment or the markets in general, nor is it intended to predict or depict performance of any investment. We recommend that investors read and understand the contents of the funds’ prospectus and product highlights sheet available on the Principal website, which have been duly registered with the Securities Commission Malaysia (SC). Registration of these documents does not amount to nor indicate that the SC has recommended or endorsed the product or service. There are risks, fees and charges involved in investing in the funds. You should understand the risks involved, compare, and consider the fees, charges and costs involved, make your own risk assessment and seek professional advice, where necessary. Past performance does not guarantee future results. Performance data represents the combined income and capital return as a result of holding units in the Fund for the specified length of time, based on bid-to-bid prices. Earnings are assumed to be reinvested. This article has not been reviewed by the SC.

Sources :

- Bloomberg, 31 December 2025

- Federal Reserve Board, BOJ, European Central Bank, 31 December 2025

- JP Morgan Research, 31 December 2025

- National Bureau of Statistics of China, 31 December 2025

- BNM, 31 December 2025

- Principal, 31 December 2025