MARKET COMMENTARY

July 2025

Global Outlook

In June 2025, global equity markets rallied for the second month. The largest gainers were Korea, Japan and the S&P 500 at 13.9%, 6.6% and 5.0% respectively. Thailand, Indonesia, and Europe dropped 5.2%, 3.5%, and 1.3%, respectively. Bond indices rose, ranging from 1.4% to 1.9%.1

The Fed maintained the Fed Fund rate at 4.50% during the June 2025 FOMC meeting. The Fed guided that the uncertainties from the proposed tariffs do not provide leeway for rate adjustments. The ECB cut the interest rate by another 0.25% to 2.25% in April 2025 based on weak economic fundamentals and better-behaved inflation.

We have a slight preference for Equity over Cash in Asia. While we expect uncertainties over trade policy to persist, we believe that both the US and China have incentives to reach a compromise. This would address a significant concern for investors. Moreover, if the USD weakness persists, it could encourage foreign capital flows to invest in Asian equities. We prefer being appropriately diversified. We are invested in companies with more visible growth in technology, financials (stock exchanges, banks), industrials and internet platforms.

Global Outlook of the two capital markets: Fixed Income & Equities

Region: Developed economies

Fixed income

- Our view: Positive.

- The Fed maintained the Fed Fund rate at 4.50% during the June 2025 FOMC meeting. The Fed guided that the uncertainties from the proposed tariffs do not provide leeway for rate adjustments.4

- With limited rate moves priced in, there may be potential for a bull steepening as the Fed prepares to cut rates. Looking to improve yield curve positioning by shifting towards the front end, while staying cautious on the long end amid supply and fiscal risks. Prefer corporate bonds for their attractive credit spreads, which offer additional carryover from government bonds.5

Equity

- Our view: Positive.

- The Fed maintained the Fed Fund rate at 4.50% during the June 2025 FOMC meeting. The Fed guided that the uncertainties from the proposed tariffs do not provide leeway for rate adjustments.4

- Marginal Overweight for the US, while Neutral on the EU and Japan. Reduce off-benchmark exposure while keeping Gold and Treasury ETF as a hedge against tariff and recession risks.

Region: Regional (Asia-Pacific ex-Japan)

Fixed income

- Our view: Positive.

- Pockets of opportunity in local currency Asian and Chinese credits, as yields remained relatively attractive.6

- We expect investment-grade Asian bonds to provide a gross yield of 5.50% to 6.00% in 2025.6

Equity

- Our view: Positive.

- We are cautiously optimistic about Asian equities as the US & China are incentivised to reach a compromise on the tariffs.

- Invested in dividend yielders across telecoms, real estate and financials. Focus on companies with visible growth in technology, consumer tech (EVs), industrials and internet platforms.3

Region: China

Fixed income

- Our view: Neutral.

- Net credit bond supply in May 2025 decreased to RMB327bn from RMB434bn previously. This came from redemptions for LGFVs, non-LGFVs and SoEs. PoE saw redemption, too.8

- The default rate for May 2025 remained at 0.10% as per April 2025.

Equity

- Our view: Neutral.

- Prefer domestic-oriented companies with growth and strong cashflow. Like selected names in technology, domestic consumption, cyclical, infrastructure and defence, communications and financials

- The manufacturing PMI for June 2025 increased to 49.7 from 49.5 previously. The Services PMI rose to 50.5 from 50.3 over the same period.9

Region: Domestic (Malaysia)

Fixed income

- Our view. Positive.

- BNM cut the OPR to 2.75% during the July 2025 MPC meeting. The reduction in the OPR is a pre-emptive measure aimed at preserving Malaysia’s steady growth path amid moderate inflation prospects.10

- Following the recent rally, as market prices anticipate a rate cut, we aim to take profit on the shorter-end government bonds. We will continue to hold a tactical position in government bonds, as local markets are expected to remain supported with lower supply. Prefer corporates for the yield pick-up and the carry it offers. With the local PDS pipeline expected to be heavy, we will take profit on tighter names and to switch into new issuances.3

Equity

- Our view: Positive.

- The National Energy Transition Roadmap (NETR) and the Industrial Master Plan 2030 would revitalise domestic investment and buoy consumption3

- Adopt a barbell strategy by pairing high-dividend, big-cap, defensive stocks with selective exposure to undervalued laggards and domestic demand names. Looking for opportunities in sectors such as Construction, Property, Utilities and selective Banks.

Special topics:

Trump’s One Big Beautiful Bill (“BBB”) was passed: In the US, the One Big Beautiful Bill Act (BBB) was passed and it has upside risks to both growth and inflation. The Congressional Budget Office expects the US to run annual fiscal deficits of 5.8% of GDP over the next decade and the BBB would increase that by a further 1.25 percentage points 🡺 government spendings will exceed revenues by more than 6.0% on annual basis for the next 10 years. As a comparison, Malaysia’s projected fiscal deficit is 3.8% by end 2025. However, the tariffs help reduce the deficit impact of the BBB, while the tax cuts also blunt the negative growth impact of the tariffs.

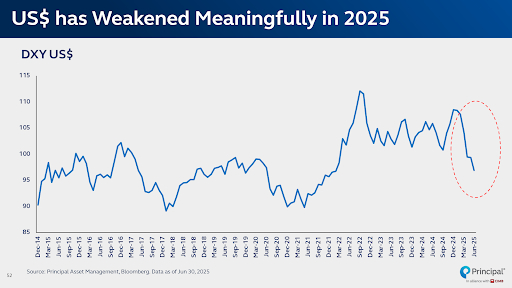

- The BBB could be the reason for the recent weakness in the USD: The US dollar recently broke down despite all the uncertainties caused by Trump and geopolitics.

- Summary: Below are a few scenarios that could be bearish for the US$:

- The AI narrative shifts as markets become sceptical of companies investing hundreds of billions while not knowing how big the profits will be, or when;

- US Treasury yields adjust higher as the prospects of deficit spending outweigh the potential benefits to economic growth;

- Markets interpret the strength of US consumers and corporations as being mainly driven by massive and rising government deficits;

- Economic growth slows and inflation rises in the second half

- For emerging markets, the weaker US dollar in the first half of 2025 offered a reprieve rarely seen since December 2020. There is more flexibility for monetary policy. And capital markets would undoubtedly benefit from portfolio flows seeking diversification.

Investment Implication:3

- Global: Slight Overweight US & Japan, Neutral Europe and Underweight Cash. US PMIs remain strong, with earnings revisions over the next 12 months being modestly positive, and both consumer demand and the labour market remain healthy. Additionally, recent tech sector earnings have been solid, reinforcing a constructive outlook for US equities. Japan will continue to be supported by structural tailwinds, including the ongoing corporate governance reforms and improving shareholder returns. The domestic economy continues to show resilience, underpinned by solid wage growth. A further moderation in rice prices would provide support for household spending and consumption. Neutral on Europe. While Germany has introduced fiscal stimulus measures, broader regional support remains limited. Many other European countries continue to face fiscal constraints, reducing the likelihood of a coordinated fiscal response. As such, a more constructive stance on Europe would require not only successful implementation of Germany’s fiscal plans but also more substantial and coordinated fiscal support across the region.

- Malaysian Equity: Malaysia has almost fully recovered from the sell-off triggered by Liberation Day tariffs in April. We advocate a barbell strategy by pairing high-dividend, big-cap, defensive stocks with selective exposure to undervalued laggards and stocks with domestic-focused demand. We believe there are still pockets of opportunities to invest primarily in sectors such as Construction, Property, Utilities and selective Banks. Key risks include a further escalation of global trade tensions which could affect business and investment conditions.

- Malaysia Fixed Income: We will stay cautious ahead of the tariff deadline on 9 July and avoid adding risk early. We expect some profit-taking activities ahead of BNM’s MPC meeting in July. We will look to lock in gains on government bonds that have priced in the 25bps cut while continuing to have some tactical positions in anticipation of a possible curve correction or repricing. Preference remains for corporate bonds, as recent widening of credit spreads offers a more attractive carry compared to government bonds. We will continue to focus on primary issuance for more attractive pricing and better allocations while rotating out of selective tighter names where upside is limited.

- Market volatility is likely to remain elevated in the weeks ahead as investors assess rapidly shifting tariff developments and consider the potential implications for growth, inflation, central bank policy, and financial markets. Nevertheless, incremental news flow could become more supportive as we approach the second half of the year, as clarity emerge with countries beginning negotiation and offering concessions.

- We reiterate the importance of to keeping sight of longer-term investing principles that can boost risk-adjusted rates of return through portfolio diversification and an emphasis on quality growth and income to navigate the volatility ahead. Our strategy has also emphasized focusing on companies that demonstrate the attributes of large-cap defensiveness, with earnings that are more domestically focused. Additionally, quality bonds have historically provided portfolio stability, especially during times of uncertainty.

- We now prefer both fixed income and equities. Key themes for 2025 include: i) the impact of policy shifts on China's recovery; ii) the U.S. economic outlook; and iii) the influence of tariffs and geopolitical risks on asset prices.

Glossary:

UW: Underweight

OW: Overweight

MoM: Month-over-Month

YoY: Year-over-Year

FOMC: Federal Open Market Committee

ECB: European Central Bank

UST: United States Treasury

PMI: Purchasing Managers Index

SoE: State-Owned Enterprise

SEZ: Special Economic Zone

BNM: Bank Negara Malaysia

MPC: Monetary Policy Committee

Disclaimer

Past performance does not guarantee future results. Performance data represents the combined income and capital return as a result of holding units in the Fund for the specified length of time, based on bid-to-bid prices. Earnings are assumed to be reinvested.

Sources :

- Bloomberg, 31 June 2025

- Federal Reserve Board, 31 June 2025

- Principal, 31 June 2025

- European Central Bank, 31 June 2025

- Federal Open Market Committee (FOMC), 31 June 2025

- JP Morgan Research, 31 June 2025

- Bloomberg, 31 June 2025

- BofA Securities, 31 June 2025

- National Bureau of Statistics of China, 31 June 2025

- Bank Negara Malaysia, 31 June 2025