5 min read I Date: 14 March 2023

The Employees Provident Fund (EPF) recently declared a dividend rate of 5.35% for Conventional Savings and 4.75% for Syariah Savings for the Year 2022, with a total payout amounting to RM51.14bil.1 Whilst dividend payout for the Year 2022 may be lower than 2021, it is still higher than 2020, and it still indicates positive returns in savings for contributing EPF members.

Here are the top 5 things you can do to manage your EPF savings and returns for brighter retirement days:

1. Evaluate your investment portfolio

Market movement and volatility can be contributing factors to the performance of your investment portfolio. Evaluate and re-balance your investments at least once every six months to ensure you meet your financial goals and objectives.

2. Top up your EPF savings on a voluntary basis

It is said that RM145.5bn was withdrawn from members’ accounts to aid the hardships of the COVID-19 pandemic 2, which caused a drop in median savings. In the recent re-tabling of Budget 2023, the Malaysian government has made a minor amendment to the current income tax relief that will allow Malaysians to claim tax reliefs for EPF self-contribution. This will allow EPF members to enjoy tax relief of up to RM4,000 for statutory EPF contributions.3

3. Re-investing a portion of your EPF savings into Global, Regional and Domestic funds

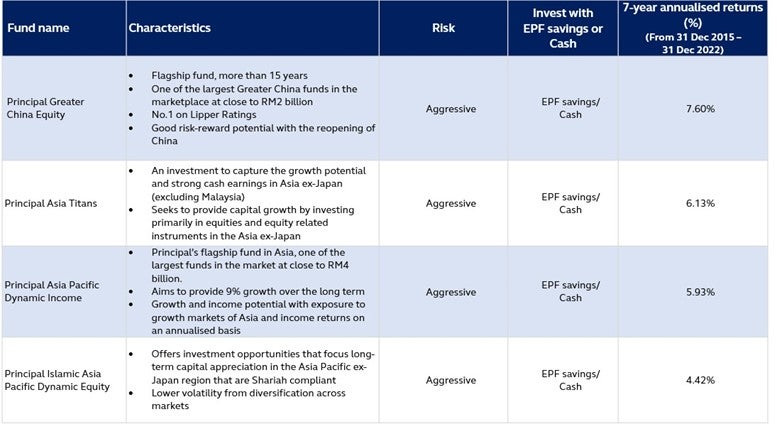

Another possibility is to re-invest a portion of your EPF savings via EPF’s I-Invest. By investing with Principal through this method, you will have diversification opportunities with over 20 EPF-approved Global, Regional and Domestic funds with various asset classes. We are positive on Asian equities underpinned by China economic recovery, and earnings growth in Asia expected to be stronger than developed markets. Our recommended strategic holdings include Asia Pacific Dynamic Mixed Asset Fund, Asia Pacific Dynamic Income Fund, Asia Titans, Islamic Asia Pacific Dynamic Equity Fund, and Greater China Equity Fund.

4. Explore alternative investment options

Understand your time horizon, risk tolerance and investment goals before choosing. For example, apart from voluntary EPF contribution and diversification of EPF savings via i-Invest, you can also look at investing in Private Retirement Scheme Fund (PRS). You can also enjoy up to a RM3,000 tax rebate on PRS contributions until 2025.

5. Review your retirement plans

Your retirement plans will determine how much you will need to save and invest. The general rule of thumb is to review and rebalance at least once every 6 months or once every quarter. Here are also 4 scenarios you can consider before rebalancing your portfolio:

o Changes in your risk profile

o Changes in situational basis i.e emergencies, market conditions

o A shift from your asset allocation strategy

o Achieving your financial goal(s)

Start your investment journey with Principal

Investing your EPF savings is a good start to diversifying your investment portfolio. It gives you greater control over where your savings are invested in, and it can also help you reach your retirement goals.

Here are our recommended funds:

*Past performance is not an indication of future performance.

Begin investing with a minimum of RM1,000, and you’ll get up to RM50 Touch ‘n Go eWallet Reload PIN as your welcome reward. Invest with 0% sales charge (for investments using EPF savings). Use offer code “Welcome2023”. Valid from now till 31 December 2023. T&C apply. Learn more: https://www.principal.com.my/offer/invest-online/new-investor

What to do next?

Start visualising your retirement days. If you need any assistance, consider contacting our financial consultants. They can help you discover your goals and advise you based on your risk tolerance.

In the meantime, here’s what you can read on how to:

- supplement your retirement savings with Private Retirement Scheme (PRS).

- diversify your EPF savings via EPF’s i-Invest.

Disclaimer:

You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant Prospectus, Information Memorandum and/or Disclosure Document relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. Securities Commission Malaysia does not review advertisements produced by Principal.

Sources:

1. The Star, 4 March 2023

2. New Straits Times, 4 March 2023

3. RinggitPlus, 24 February 2023