Principal e-Cash Fund empowers all eligible Malaysian to invest

Principal e-Cash Fund, the underlying fund for GO+ is now Shariah-compliant.

Start enjoying the benefits by simply cashing in from your eWallet balance or through bank transfer on your Touch 'n GO eWallet app.

Sit back and let us do the work for you.

Start making more cents today!

Enjoy the benefits of Principal e-Cash Fund through GO+.

Two simple ways to cash in to Principal e-Cash Fund.

Option 1: Cash In via GO+ dashboard screen.

Step 1

Tap GO+ icon on the homepage.

Step 2

Select Cash In.

Step 3

Select eWallet Balance or DuitNow Transfer and follow the instructions.

Option 2: Cash In via eWallet home screen.

Step 1

Tap the reload balance icon.

Step 2

Select GO+ balance.

Step 3

Enter cash in amount and follow the instructions.

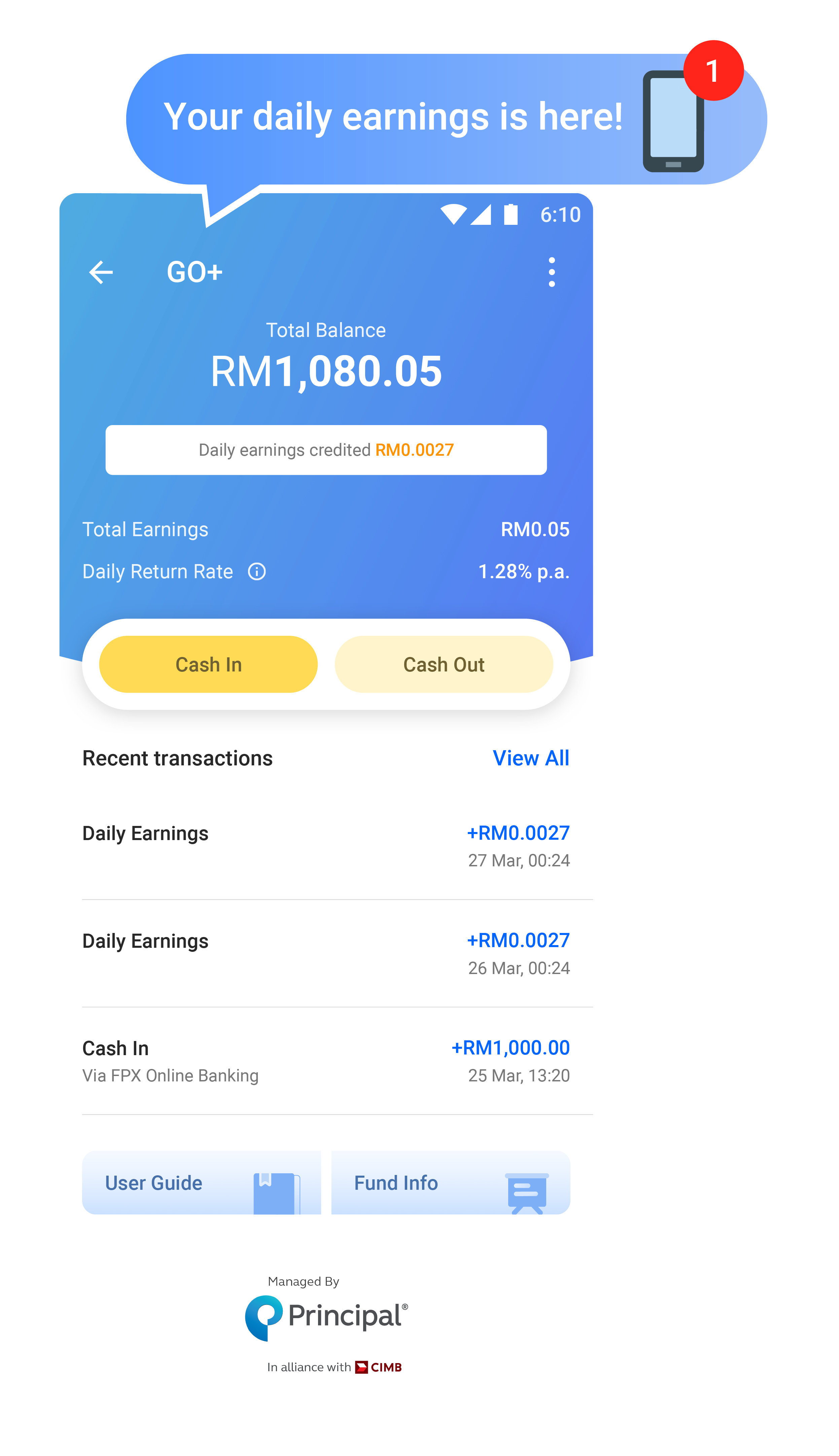

How to view your Principal e-Cash Fund earnings on GO+?

You can view your earnings on the GO+ dashboard

About Principal e-Cash Fund.

Learn more about Principal e-Cash Fund, the underlying Shariah-compliant fund for GO+.

Everything you need to know about Principal e-Cash Fund!

Knowledge Centre

At Principal, our purpose is to foster a world where financial security is accessible to all. Here’s your opportunity to explore our variety of financial topics that matter to you.

Investment 101

Investment terminologies are sometimes hard to fully understand. Here’s the most common term that are related to investment strategies.

Media Room

Stay up to date with the latest news releases.

Got a burning question? Connect with us today!

For Principal e-Cash Fund related enquiries call Principal Customer Care Centre at +(603) 7723 7262 or chat with us via  (WhatsApp).

(WhatsApp).

The operating hours are Monday to Sunday, 7.00am to 10.00pm (including public holidays).

You may email your queries to mygoplus@principal.com

For Touch 'n Go eWallet and GO+ related enquiries you may call Touch n' Go eWallet Careline at +(603) 50223888.

The operating hours are Monday to Sunday, 7.00am to 10.00pm (including public holidays).

You may submit your queries to https://tngd.my/careline-webform