Markets started the year on a positive note but have since become volatile due to the mini-banking crisis, hawkish monetary policy, and geopolitical tensions.1 How then should investors navigate markets?

Here are the 3 signs why Fixed-Income assets are back in the spotlight and reasons you should consider including them in your asset allocation mix.

The markets experienced volatility due to shifting sentiments about economic prospects and financial instability.

Attempting to time market exits and entries can be costly for investors. However, a diversified portfolio can help investors establish adequate defensiveness in case volatility persists. In this regard, investors can concentrate on funds that provide quality income and exposure to dividend payments.

Manage liquidity as policy rates may peak earlier than anticipated.

In expectation of increased volatility, many investors have held more cash than usual. However, there are indications that rates may have reached their highest point. As a result, investors should either remain invested and diversified or become adequately invested. Additionally, they should act swiftly to secure attractive yields and avoid unnecessary deleveraging.

Buy quality bonds as yields are still attractive.

Given the promising yields and the possibility of capital gains during an economic downturn, we believe that high-quality fixed income presents attractive opportunities. Furthermore, we are fond of Malaysia's fixed-income due to its attractive yield spread. Investors who take an active approach to managing their bond portfolios have the potential to leverage these opportunities fully.

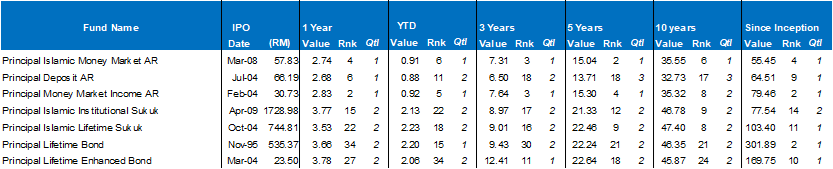

Diversification is a key component of any investment strategy, as it helps to reduce the portfolio’s overall risk. By adding fixed-income investments to their portfolios, investors can balance out the risk associated with equity investments. Explore investing in Principal’s fixed-income products, which is backed by strong track records and lower volatility.

- More than 20 years of track record.

- Outperformance over time.

- 90% of the funds are within the 1st and 2nd quartiles.

- Optimal risk-adjusted return.

Past performance is not indicative of future performance.

Source: Lipper, 31 March 2023.

What to do next?

Explore investing with Fixed Income assets via Principal online investment portal. Learn more details here: https://www.principal.com.my/en/invest-online

Source:

1 BFM, 14 April 2023

Disclaimer:

You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant Prospectus, Information Memorandum and/or Disclosure Document relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant Prospectus, Information Memorandum and/or Disclosure Document. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. Securities Commission Malaysia does not review advertisements produced by Principal.