7 min read I Date: 16 October 2023

Overview1

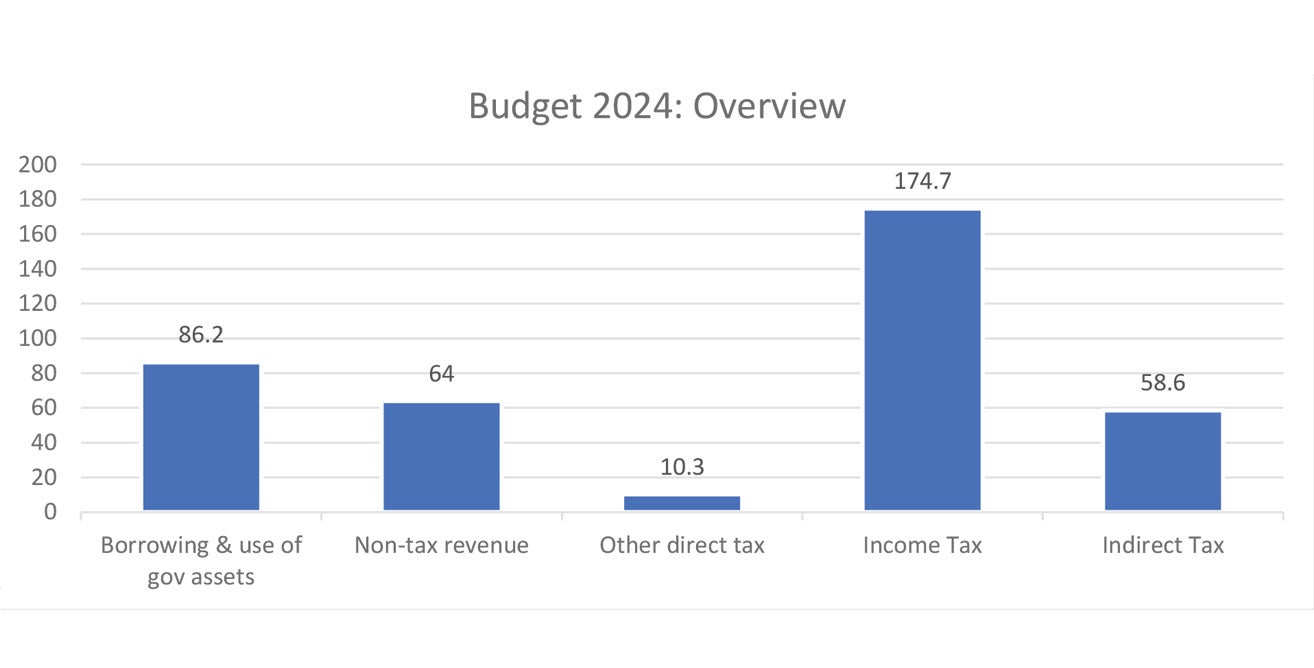

The Prime Minister and Finance Minister, YAB Dato’ Seri Anwar bin Ibrahim tabled Malaysia's largest ever budget of RM394 billion for 2024, which was 2% higher than the previous year's RM386 billion.

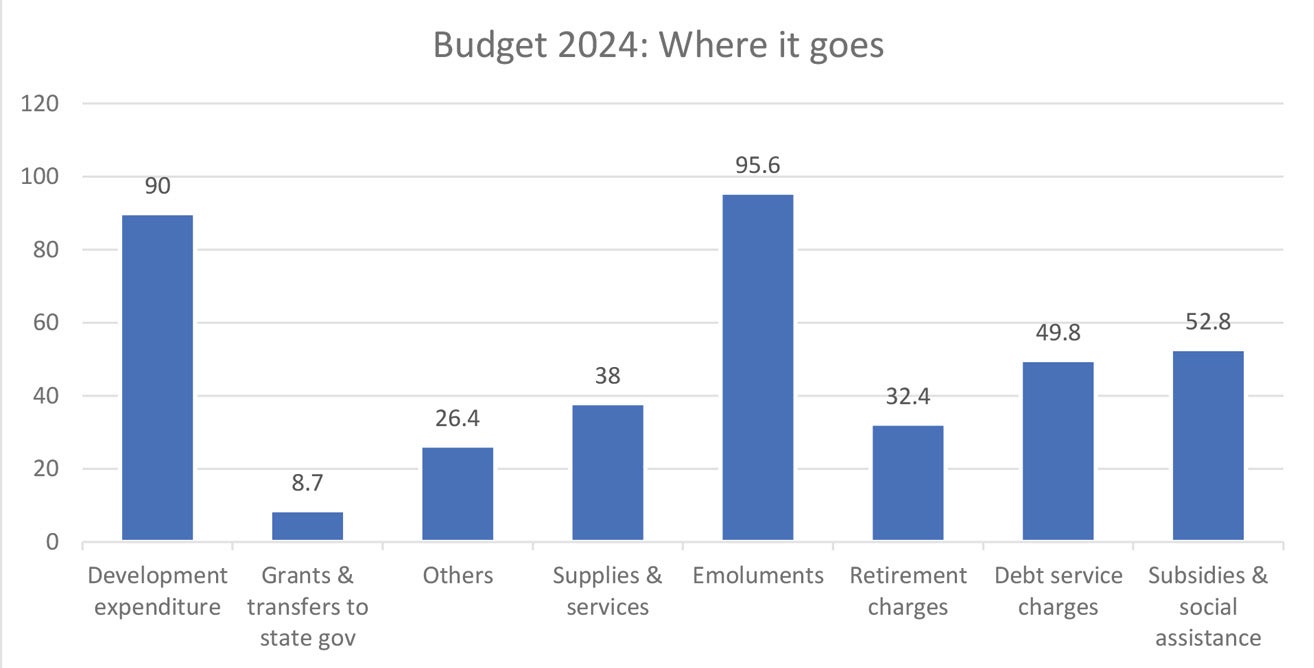

An amount of RM90 billion was allocated for development expenditure compared to RM97 billion for 2023, but the latter included a 1MDB debt repayment of US$3 billion. The larger budget will be funded by higher tax receipts, partly through the hike in Sales & Service Tax (SST) from 6% to 8% and other forms of new taxes, as the government reduces dependence on Petronas dividends from RM40 billion to RM32 billion for 2024, with lower subsidies and an increase in borrowings.2

Reducing risk & strengthening growth1

Budget 2024 demonstrates policy continuity and much needed fiscal reforms. Ambitions to restructure the economy to position Malaysia as an investment destination were also clear. It has three key pillars:

- Good governance for service agility;

- Restructuring the economy to boost growth, building on the National Energy Transition Roadmap (NETR), New Industrial Master Plan 2030 (NIMP 2030) and the 12th Malaysia Plan (12MP); and

- Raising the Rakyat's standard of living.

The government maintains its gradual fiscal consolidation path, with the fiscal deficit improving from a projected 5% in 2023 to 4.3% in 2024. It sets out a series of targets to be met within 3 to 5 years which include achieving a fiscal deficit of 3% of Gross Domestic Product (GDP) by 2026 and capping federal debt and government guarantees at 60% and 25% of GDP respectively.

Bank Negara Malaysia (BNM) projects Malaysia's GDP growth to range between 4% to 5% for 2024 versus 4% for 2023, driven by sustained domestic demand and a recovery in exports. The central bank projects inflation to range between 2.1% to 3.6% (against 2.5% to 3.0% for 2023), and for the unemployment rate to improve further to 3.4%.2

Asset class implications1

Equities:

We remain hopeful on the prospects of valuation upside as the risk premium narrows on the back of improved policy clarity and the country's fiscal condition. We remain constructive on sectors that stand to gain from the NETR, especially the Utilities, Construction and Property sectors. We have also turned more optimistic on the Financial sector, fuelled by a better earnings outlook. We also like selective Technology stocks that benefit from ongoing structural shifts.

Consumer, Tourism, Construction and Utilities sectors are seen as key beneficiaries of Budget 2024. The absence of punitive measures on the listed market such as Prosperity Tax (Cukai Makmur), capital gains tax, and higher gaming taxes are welcome news. The 8% SST on brokerage should have minimal impacts on trading volume and cost. Banks should also benefit from the absence of further loan assistance, an acceleration in development spending & investment, and higher consumption. The Property sector could benefit from relaxation of the Malaysia My Second Home (MM2H) conditions.2

Fixed Income:

We believe the government bond yield curve will see some steepening following government plans to refinance some of the outstanding short-term bills with Malaysian Government Securities (MGS) and Malaysian Government Investment Issues (MGII). The move will see total gross issuances of MGS and MGII for 2023 increasing to RM186 billion from a prior forecast gross issuance of RM175 billion. Nevertheless, we do expect the domestic fixed income market to be able to absorb the additional supply in view of the ample liquidity locally.

As for 2024, we are projecting lower MGS and MGII gross issuances of RM178 billion, comprising the fiscal deficit of RM85.4 billion and maturities of RM93 billion in 2024. The smaller issuance in 2024 will help keep bond yields supported, taking into consideration that the interest rate will be maintained at 3.00% with GDP growth to range between 4% to 5% in 2024 despite the government forecasting inflation to range between 2.1% to 3.6% for 2024 following the rationalisation in subsidies and hike in service tax.2

Recommendations1

We believe the Principal Lifetime Bond Fund and Principal Islamic Lifetime Sukuk Fund would potentially benefit from the government’s commitment to narrow its fiscal deficit to 4.3% of GDP in 2024 and 3% in the medium-term, from the estimate of 5% for 2023.2

The projected improvement in fiscal position over the medium-term would enhance the attractiveness of the domestic bond market. In addition, the improvement in market sentiments and launch of the NETR and NIMP 2030 has reinforced Malaysia’s economic growth and corporate earnings outlook.2

Our recommended equity exposure is the Principal Islamic Small Cap Opportunities Fund and the Principal Malaysia Enhanced Opportunities Fund.

Source:

1 Principal view as of 16 October 2023

2 Ministry of Finance (MOF) as of 16 October 2023

Figure 2: Gross Domestic Product by Sector, 2022 – 2024 (at constant 2015 prices)

|

|

SHARE (%) |

CHANGE (%) |

||

|

20231 |

2022 |

20231 |

20242 |

|

|

Services |

59.3 |

10.9 |

5.5 |

5.6 |

|

Manufacturing |

23.5 |

8.1 |

1.4 |

4.2 |

|

Agriculture |

6.3 |

0.1 |

0.6 |

1.2 |

|

Mining |

6.1 |

2.6 |

-0.8 |

2.7 |

|

Construction |

3.6 |

5.0 |

6.3 |

6.8 |

|

GDP |

100.0 |

8.7 |

~4.03 |

4.0 - 5.0 |

1 Estimate

2 Forecast

3 Approximate

Note: Total may not add up due to rounding and exclusion of import duties component

Source: Department of Statistics and Ministry of Finance, Malaysia

Figure 3: Fiscal deficit and funding profile, 2020 to 2024F (MYR ‘bil)

|

|

2020 |

2021 |

2022 |

2023E |

2024F |

|

Federal Government Revenue |

225.1 |

233.8 |

294.4 |

303.2 |

307.6 |

| Operating Expenditures

|

224.6 |

231.5 |

292.7 |

300.1 |

303.8 |

|

Current Account Balance |

0.5 |

2.2 |

1.7 |

3.1 |

3.8 |

|

Gross Development Expenditure |

51.4 |

64.3 |

71.6 |

97.0 |

90.0 |

|

Less: loan recoveries |

1.3 |

1.0 |

1.4 |

0.7 |

0.8 |

|

Net Development Expenditure |

50.1 |

63.6 |

70.2 |

96.3 |

89.2 |

|

Covid-19 Fund |

38.0 |

37.7 |

31.0 |

|

|

|

Budget Deficit |

(87.6) |

(98.7) |

(99.5) |

(93.2) |

(85.4) |

|

% of GDP |

-6.2% |

-6.4% |

-5.6% |

-5.0% |

-4.3% |

|

Total Expenditure |

314.0 |

333.5 |

395.0 |

397.1 |

|

|

Funded By: |

|

|

|

|

|

|

Net Domestic Debt Issuances |

86.9 |

98.6 |

99.7 |

93.6 |

- |

|

Net External Debt Issuances |

(0.3) |

1.7 |

(0.3) |

(0.3) |

- |

|

Other Debt / Change in Assets |

1.1 |

(1.6 |

0.1 |

(0.0) |

- |

|

Total |

87.6 |

98.7 |

99.5 |

93.2 |

- |

|

YoY Change: |

|

|

|

|

|

|

Federal Government Revenue |

(15%) |

4% |

26% |

3% |

1% |

|

Operating Expenditures |

(15%) |

3% |

26% |

3% |

1% |

|

Gross Development Expenditures |

(5%) |

25% |

11% |

36% |

(7%) |

|

Budger Deficit |

(70%) |

(13%) |

(1%) |

6% |

8% |

Note: The “E” denotes an estimate, and the “F” denotes forecast data. YoY means Year-on-Year There is no assurance that any projection, estimate or forecast will be realised.

Source: MOF, Principal compilation as of 16 October 2023

Click here to download the PDF format

What to do next?

- If you need any investment assistance, please get in touch with your financial consultant. (We can help you find one). They can assist you with your investment goals and advice you on your risk tolerance.

- Alternatively, you can also manage your portfolio on-the-go, anytime, anywhere via our online investment portal.

- If you need further assistance, please leave your details here, and we will connect with you.

Disclaimer: We have based this document on information obtained from sources we believe to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. It contains general information only on investment matters and should not be considered as a comprehensive statement on any matter and should not be relied upon as such. Expressions of opinion contained herein are those of Principal Asset Management Berhad only and are subject to change without notice. This article is not intended to be, nor should it be relied upon in any way as a forecast or guarantee of future events or investment advice regarding a particular investment or the markets in general. The data presented is for information purposes only and is not a recommendation to buy or sell any securities or adopt any investment strategy. This material is not intended to be relied upon as a forecast, research, or investment advice regarding a particular investment or the markets in general, nor is it intended to predict or depict performance of any investment. The information contained in this document does not take into account any investor's investment objectives, particular needs or financial situation. Investors should consider whether an investment fits their investment objectives, particular needs and financial situation before making any investment decision. Past performance is not reflective of its future performance. Investing involves risk and cost. Investors should understand the risks involved, compare and consider the fees, charges and costs involved, make their own risk assessment and seek professional advice, where necessary. This article has not been reviewed by the Securities Commission Malaysia. For the full disclaimer, please visit: https://www.principal.com.my/en/disclaimer-my