MARKET COMMENTARY

October 2025

Global Outlook

In October 2025, global equities rallied for the fifth month, led by South Korea (19.9%), Japan (16.6%), and Taiwan (9.3%), while Hong Kong SAR lagged. Bond indices fell 1.3%.

The Fed cut rates by 25 basis points in October and announced that Quantitative Tightening would end on December 1. Fed Chair Powell was more hawkish than expected, indicating that policy is not on a preset course. However, downside risks to the labour market could still lead to a rate cut in December.

Given substantial year-to-date gains in Asia, we are reducing exposure where risk-reward is less attractive. We focus on companies that boost productivity and capital efficiency, favouring select financials, defence and power industrials, tech leaders, and chosen gaming and telecom operators.

Global Outlook of the two capital markets: Fixed Income & Equities

Region: Developed economies

Fixed income

- Our view: Positive.

- The Fed cut rates by 25 basis points in October and said Quantitative Tightening will end on December 1. Chair Powell was more hawkish than expected, signalling that there is no preset policy path. However, labour market risks could prompt a December rate cut.4

- We maintain a preference in selected corporate bonds that offer attractive carry with a tactical position in government bonds in the current volatile market environment.5

Equity

- Our view: Positive.

- The Fed cut the Fed Fund rate to 4.25% during the September 2025 FOMC meeting. The Fed guided that more rate cuts are possible further ahead.4

- Slight OW US, slight UW Europe, Japan, and Cash. US benefitted from solid earnings growth and Fed cuts, but valuations are stretched. Europe is a funding source for Japan and off-benchmark exposures.

Region: Regional (Asia-Pacific ex-Japan)

Fixed income

- Our view: Positive.

- Pockets of opportunity in local currency Asian and Chinese credits as yields remained relatively attractive.6

- We expect investment-grade Asian bonds to provide a gross yield of 5.50% to 6.00% in 2025.6

Equity

- Our view: Positive.

- Owing to the strong market performance across Asia year-to-date, we are cutting exposures in areas where valuation and risk-reward have become less compelling.

- Focus on companies with market leadership, strong cash flows and/or attractive dividend yields. Remain constructive on financials, industrials, and technology leaders in internet platforms and semiconductors.3

Region: China

Fixed income

- Our view: Neutral.

- In September 2025, China's total social financing (a broad measure of credit supply) was 3.53 trillion yuan (CNY 3,530 billion), and new yuan loans reached 1.29 trillion yuan (CNY 1,290 billion).

- Non-performing loan (NPL) ratio for China's commercial banks was approximately 1.5%. The figures remained stable due to active management by financial regulators.

Equity

- Our view: Neutral.

- Latest data indicate the economy is stabilising, driven by strong industrial performance, technological advancements, and government stimulus. Key challenges include weak domestic demand, pressures in the property sector, and escalating geopolitical trade risks. 9

Region: Domestic (Malaysia)

Fixed income

- Our view. Positive.

- Following the 25bps OPR cut in July, no further rate changes are expected. Inflation rose to 1.5% in September from 1.3% in August, driven by higher prices for personal care and food.10

- To take advantage of government bonds while maintaining tactical positions in anticipation of the upcoming maturities. With widening credit spreads, we prefer the corporate segment for better total return. 3

Equity

- Our view: Positive.

- Malaysia’s manufacturing sector remained near stabilisation in October, with the PMI slightly declining to 49.5 from 49.8 in September.3

- Maintain a high asset allocation and a high portfolio beta heading into 2026. Focus on quality domestic-driven names, i.e., Construction, Utilities, and Consumer, which will benefit from cash handouts, VMY26, and a stronger MYR. Also positioned in the Technology thematic and AI value chain exposure.

Investment Implication:3

- Global: Slight Overweight US, Slight Underweight Europe, and Neutral on Japan. Underweight Cash. Increased off-benchmark exposure, including Copper ETF, Gold ETF, and selective Asian Stocks. US equities will be supported by solid earnings growth and expectations of Fed rate cuts. That said, valuation is becoming stretched and will need to be supported by continued earnings growth into next year. We maintain a Slight Overweight on the US while staying mindful of valuation risks. In Europe, political uncertainty in France has intensified after PM Lecornu’s resignation less than a month after taking office. President Macron now faces the choice of appointing a new PM or dissolving parliament to call snap elections. With parliament in deadlock and growing calls for early elections, political uncertainty and fiscal policy execution risk are likely to weigh on market sentiment. We remain Neutral on Japan, with attention turning to PM Takaichi’s cabinet formation, potential coalition negotiations, and the upcoming extraordinary Diet session to draft a supplementary budget addressing rising living costs. These developments should provide more clarity on the future policy direction.

- Malaysian Equity: Continue to advocate a barbell strategy, given the current uncertain global environment, where near-term volatility is expected to continue, especially due to the US administration’s unpredictability. Concerns over a tariff-driven global slowdown and the constantly changing Trump administration’s trade policies could weigh on market confidence and pressure Malaysia’s growth and earnings outlook. That said, downside risks may be partially cushioned by the recent supportive domestic driven initiatives by the government. The barbell strategy is pairing high-dividend, big-cap, defensive stocks with selective exposure to growth companies with domestic-focused demand. We believe there are still pockets of opportunity to invest, especially in sectors such as Construction, Property, Utilities and selective Banks. Key risks include a further escalation of global trade tensions affecting business and investment conditions.

- Malaysia Fixed Income: With inflation contained and growth steady, we expect BNM to keep the OPR unchanged at 2.75% through the remainder of 2025. Corporate spreads are expected to widen once MGS yields stabilize due to a lag in repricing. We will take profit on existing corporate bond holdings when the opportunity arises. Stay overweight corporates for yield pick-up by redeploying into primary issuances where we see more attractive valuations considering the robust pipeline of quality corporates, prioritizing Issuers with strong balance sheets and limited trade exposure. Maintain tactical positioning in government bonds amid the recent selloff, which offers a cheaper entry point.

- Markets are entering the fourth quarter of 2025 with uncertainty. The US government has shut down after the final vote on a stopgap spending bill failed to pass the Senate. US President Donald Trump has added new tariffs on imported timber and lumber, while the Wall Street Journal reported that the administration is considering a tariff scheme to incentivize chipmakers to invest in domestic manufacturing.

- Market volatility may be expected in the coming days and weeks. But the macroeconomic effects of shutdowns have historically been minimal and quickly reversed. With the Fed now resuming rate cuts and cash returns are set to fall further, we believe it remains a good time to put cash to work. We maintain that the rational for investing in both Equity and Fixed Income remains strong, and we still foresee additional growth in the coming years. Our base case remains that rate cuts have typically been supportive for stock markets during non-recession periods, as well as further benefits for fixed income.

- Investors are advised to keep sight of longer-term investing principles that can boost risk-adjusted rates of return through portfolio diversification and a phased-in strategy. This can help to manage the risk of poor timing, reduce the influence of emotion, and provide more opportunities to benefit from market dips and rebounds. Our strategy emphasized companies that demonstrate the attributes of quality growth, with earnings more domestically focused. Additionally, quality bonds have historically offered portfolio stability, especially in times of uncertainty.

Special Topic3:

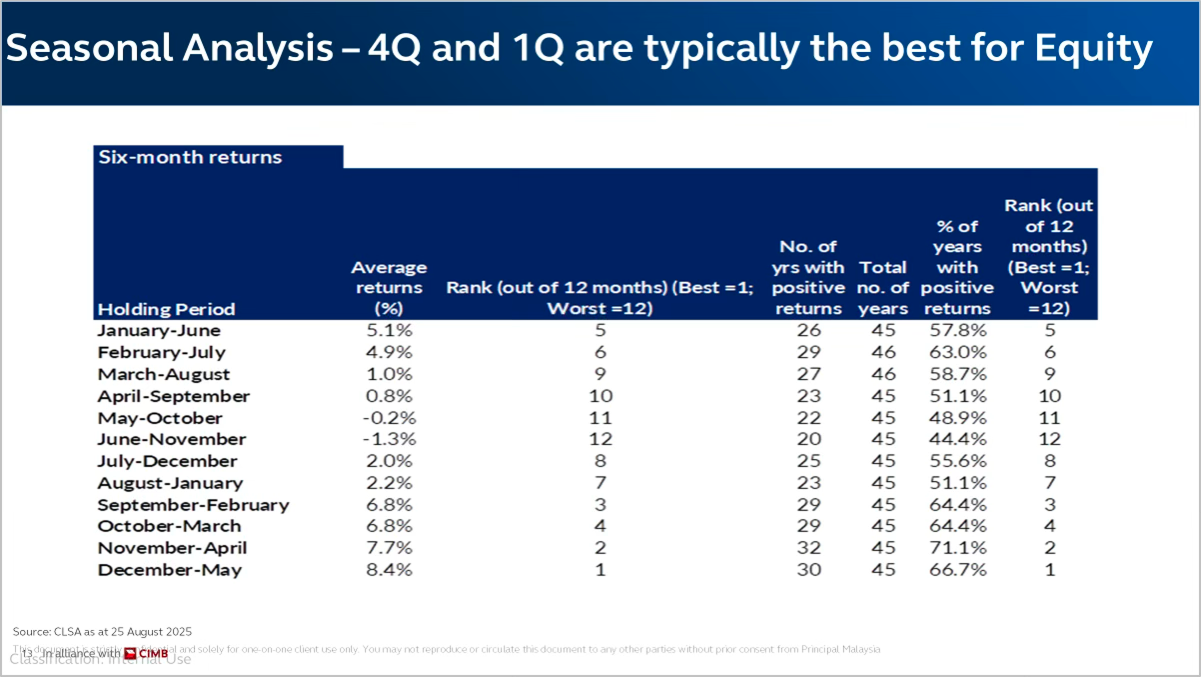

The chart above highlights a clear seasonal pattern in equity returns, with returns from the end of the calendar year through early next year generally better than those from mid-year periods.

- The data shows average returns, rankings, and frequency of positive returns for various six-month holding periods throughout the year.

- The highest average returns are observed in the periods December–May (8.4%) and November–April (7.7%), which correspond roughly to the 1st quarter of the calendar year.

- Similarly, September–February (6.8%) and October–March (6.8%) also show strong returns, highlighting the strength of the 4th quarter and early part of the year.

- These periods also have a high percentage of years with positive returns (above 60%), indicating consistent performance.

- Conversely, mid-year periods like June–November (-1.3%) and May–October (-0.2%) tend to have the lowest average returns and rank poorly, suggesting these months are typically weaker for equities.

The seasonal trend implies that investors may benefit from focusing on the equity market in the 4th quarter and 1st quarter periods to potentially maximize returns.

Glossary:

UW: Underweight

OW: Overweight

MoM: Month-over-Month

YoY: Year-over-Year

FOMC: Federal Open Market Committee

ECB: European Central Bank

UST: United States Treasury

PMI: Purchasing Managers Index

SoE: State-Owned Enterprise

SEZ: Special Economic Zone

BNM: Bank Negara Malaysia

MPC: Monetary Policy Committee

Disclaimer

We have based this document on information obtained from sources we believe to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. Expressions of opinion contained herein are those of Principal Asset Management Berhad only and are subject to change without notice. This document should not be construed as an offer or a solicitation of an offer to purchase or subscribe or sell Principal Asset Management Berhad’s investment products. The data presented is for information purposes only and is not a recommendation to buy or sell any securities or adopt any investment strategy. This material is not intended to be relied upon as a forecast, research, or investment advice regarding a particular investment or the markets in general, nor is it intended to predict or depict performance of any investment. We recommend that investors read and understand the contents of the funds’ prospectus and product highlights sheet available on the Principal website, which have been duly registered with the Securities Commission Malaysia (SC). Registration of these documents does not amount to nor indicate that the SC has recommended or endorsed the product or service. There are risks, fees and charges involved in investing in the funds. You should understand the risks involved, compare, and consider the fees, charges and costs involved, make your own risk assessment and seek professional advice, where necessary. Past performance does not guarantee future results. Performance data represents the combined income and capital return as a result of holding units in the Fund for the specified length of time, based on bid-to-bid prices. Earnings are assumed to be reinvested. This article has not been reviewed by the SC.

Sources :

- Bloomberg, 30 September 2025

- Federal Reserve Board, 30 September 2025

- Principal, 30 September 2025

- European Central Bank, 30 September 2025

- Federal Open Market Committee (FOMC), 30 September 2025

- JP Morgan Research, 30 September 2025

- Bloomberg, 30 September 2025

- BofA Securities, 30 September 2025

- National Bureau of Statistics of China, 30 September 2025

- Bank Negara Malaysia, 30 September 2025