Investment pointers for May 2020

Here at Principal, we understand how your investment performance is key to knowing how your financial journey is progressing. Our investment experts have put together a summary of investment recommendations to assist you navigate the market conditions and help ensure your portfolio meets your long-term financial goals.

Our Outlook

Although we are living in an “age of uncertainty”, the market does seem to be improving despite the pandemic and there are opportunities in every market condition.

- Capital markets moved up in April 2020 with global equities rising 4 to 16%, while bonds rose over 2%. This is a rebound from the declines reported the month prior when early signs of daily new cases of COVID-19 were dropping in the US and parts of the EU.

- The US Government launched a huge fiscal stimulus, with the latest estimating nearly 3.7% of the global GDP, to help alleviate the contraction in economic activities from cessation to contain the spread of COVID-19.

- We are positive on the Asian equities on a 12-month basis as Asian economies have more policy room, relative to the rest of the world and also the fact that China has started to return to business normalcy ahead of the rest of the world.

Investment Considerations for You:

- On a short-term basis, we maintain an asset allocation at 50:50 between equities and fixed income. We are positive on Asian equities on a 12-month basis while our portfolios favour large cap and high quality defensive stocks.

- For conservative clients, we would recommend Malaysia Focus Bond Funds and Balanced Funds that are income focussed.

- For clients with higher risk tolerance, we would recommend to focus on Growth-Oriented Funds that offer exposure to growing areas in China, Asia-Pacific, Global Technology and Malaysian aggressive funds.

Additional investment perspectives to help guide you further with your investment decisions:

Region | Fixed Income | Equities | ||

| Global |

|

|

|

|

| Regional (Asia-Pacific ex-Japan) |

|

|

|

|

| China |

|

|

|

|

| Domestic (Malaysia) |

|

|

|

|

Disclaimer:![]() means neutral;

means neutral; ![]() means positive.

means positive.

Why invest with Principal Asset Management Berhad?

Award-winning investment house

Award-winning investment house

Diverse and innovative investment solutions spanning all risk categories

Diverse and innovative investment solutions spanning all risk categories

Local expertise with global capabilities

Local expertise with global capabilities

Universal and Islamic solutions

Universal and Islamic solutions

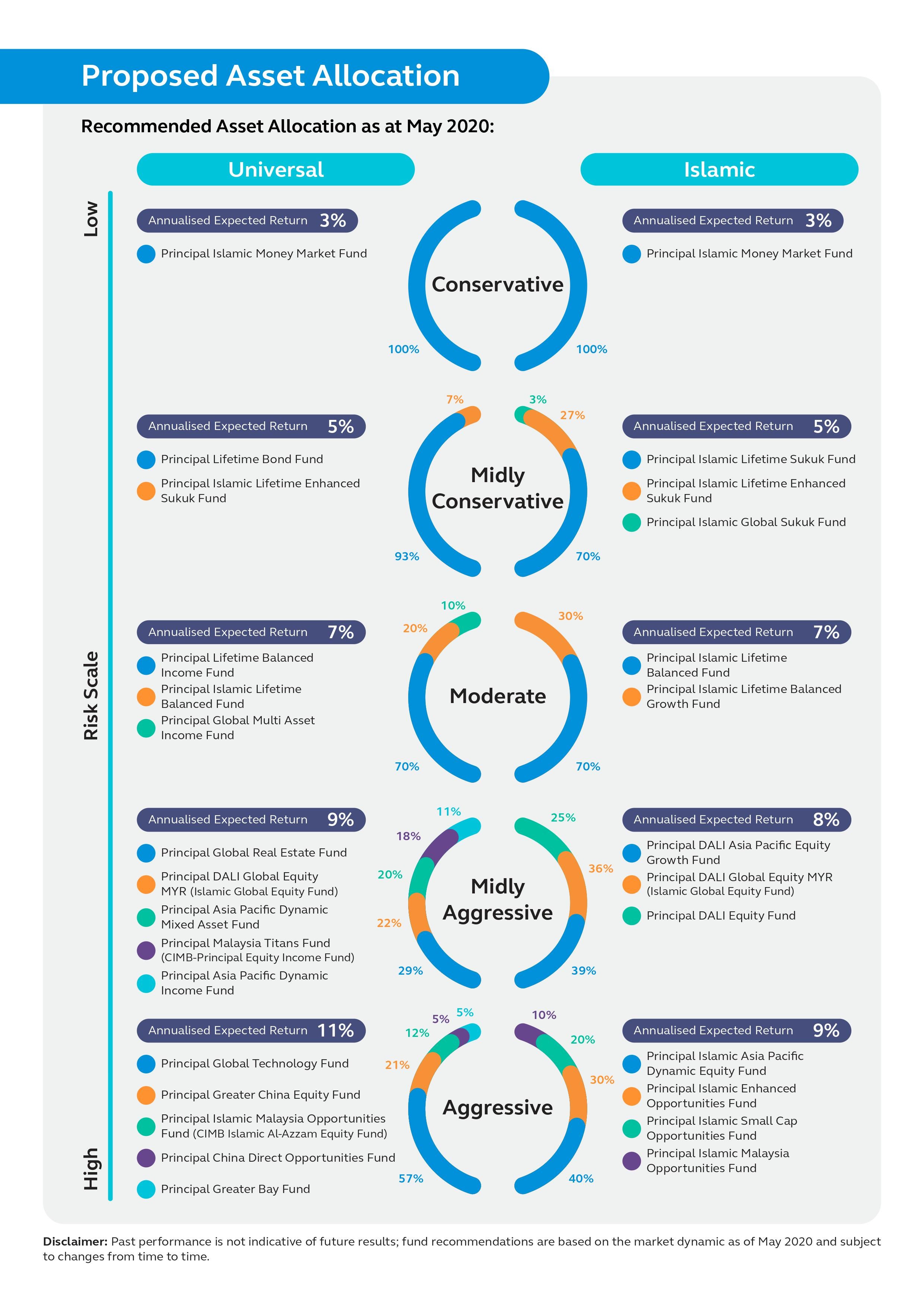

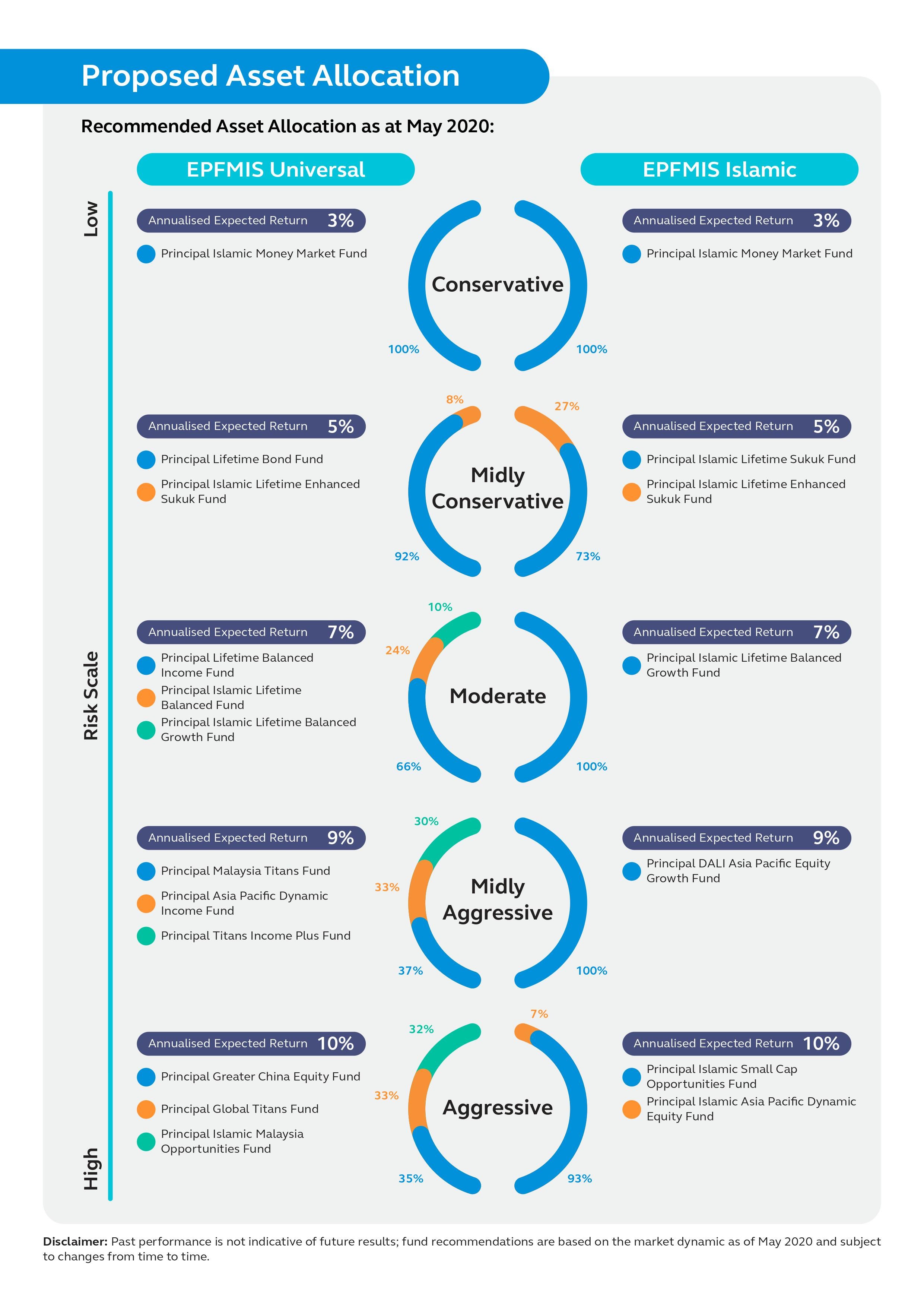

We believe that every investor is unique and the investment decisions you make should help reach your long-term financial goals. We've created a series of investment portfolio allocations to help you visualise your future investment portfolio. Below are our recommendations:

- Universal solutions (conservative to aggressive)

- Islamic solutions (conservative to aggressive)

- EPF-MIS universal solutions (conservative to aggressive)

- EPF-MIS Islamic solutions (conservative to aggressive)

Click here to download PDF version.