Strong global growth helped to push many major asset classes to new

all-time highs in 2021. Now that global growth may be plateauing, investors will need to be more discerning in the coming year.

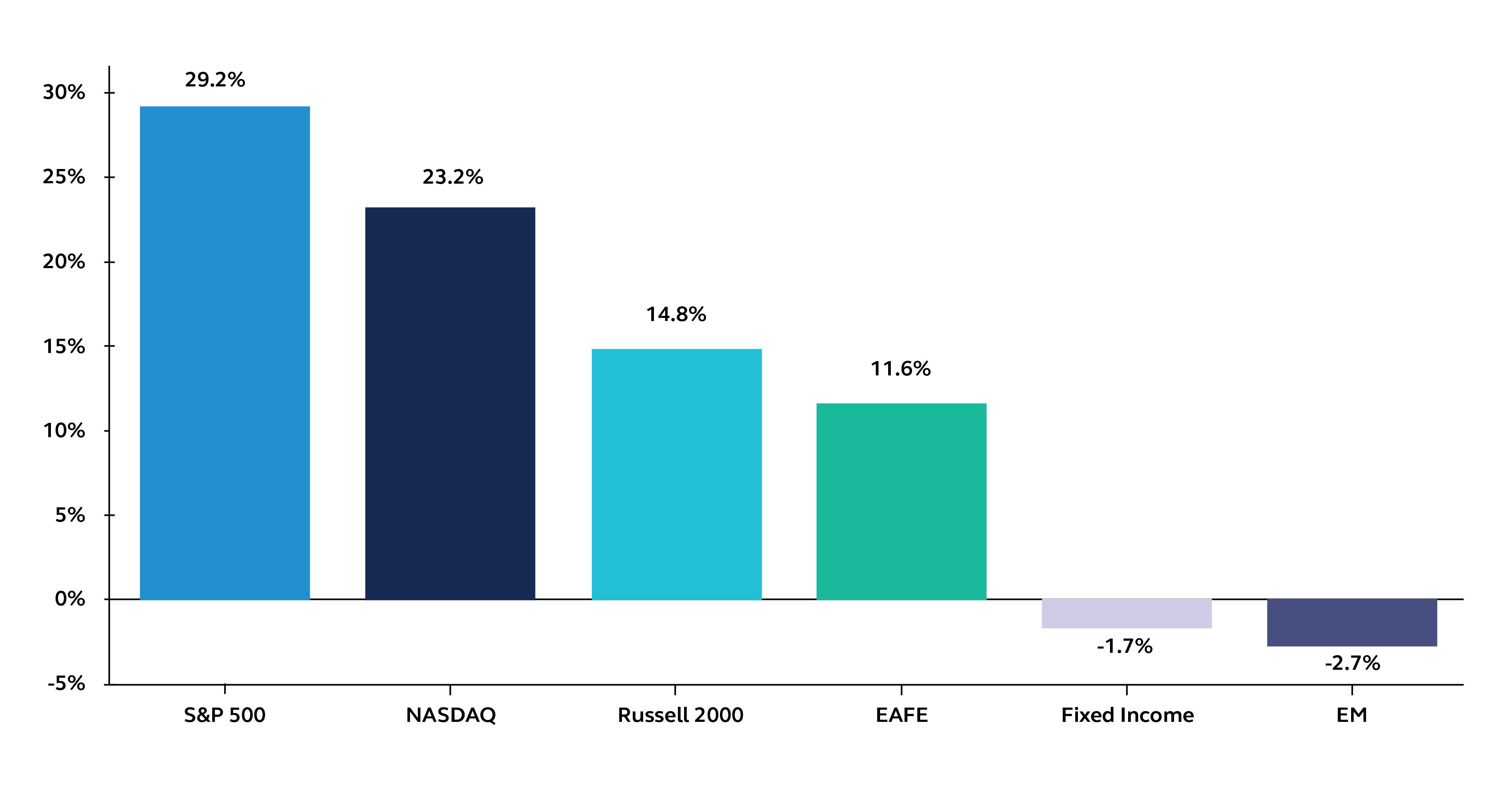

Global asset classes in 2021

Major stock and bond index total returns, year-to-date

Source: Clearnomics, Standard & Poor's, NASDAQ, Russell Investments, MSCI, Bloomberg. EAFE = MSCI EAFE Index. Fixed Income = iShares Core U.S. Bond Aggregate Index. EM = MSCI Emerging Markets Index. Data as of December 28, 2021.

Many major asset classes performed well in 2021, validating our optimistic views entering the year. U.S. stocks gained 29% with dividends, small caps rose 15% and international developed markets gained 12%. These add to 2020's strong returns despite ongoing concerns around inflation, monetary policy and the persistence of COVID-19. In contrast, bonds struggled as interest rates rose, and emerging markets underperformed due to the pandemic and challenges in China.

Many of these issues will linger into 2022, especially as global growth plateaus. Elevated inflation could last through the first half of the year as supply and demand imbalances remain. The U.S. Federal Reserve has already been forced to accelerate the taper process, which could lead to faster rate hikes. And, as the economy slows, earnings could decelerate, forcing valuations even higher.

These concerns underscore the importance of diversification in the year ahead, especially for retirement portfolios. Even with greater headwinds, it is still the case that solid economic fundamentals, strong corporate balance sheets and elevated household savings should support risk assets. However, investors may need to expand traditional portfolios, adjusting the standard 60/40, to include asset classes such as private equity and credit, as well as real assets, which can potentially generate greater income and reduce volatility as we move "past the peak."

Disclosure

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Lower-rated securities are subject to additional credit and default risks.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor's investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®