In recent gubernatorial elections in Virginia and New Jersey, Republicans shaved 10-plus percentage points from Democratic statewide advantage—potentially signaling GOP momentum as attention turns to 2022 midterm elections.

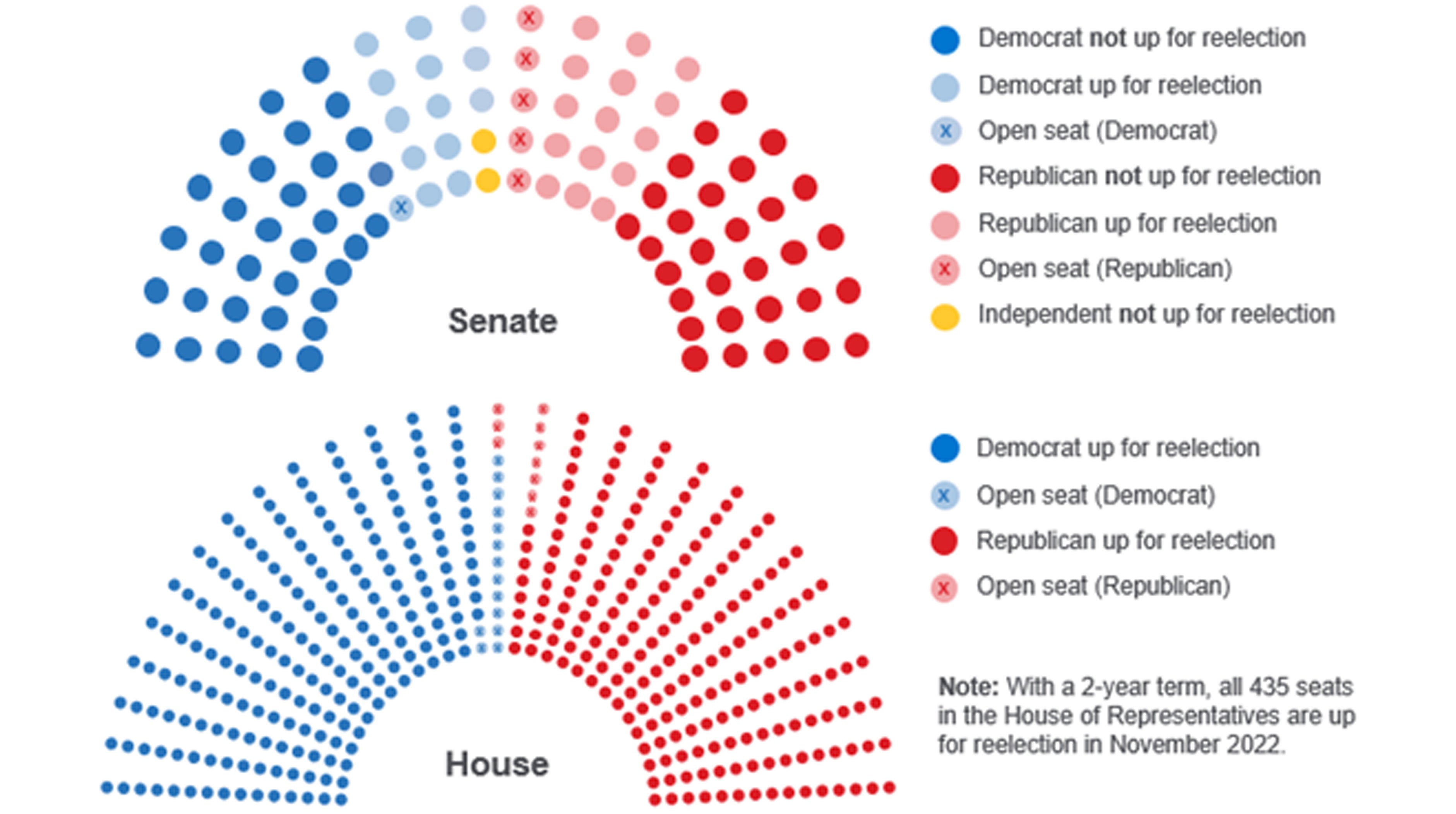

Democrats' command of Congress will be tested in 2022

U.S. Senate and House of Representatives control, by party affiliation

Source: Associated Pres, U.S. House of Representatives, U.S. Senate, Principal Global Investors. Data as of November 15, 2021.

History tells us that a sitting president's party loses, on average, 37 House seats during a mid-term election when the president's job approval is below 50%. With President Joe Biden's approval hovering in the low 40s, it appears the narrow three-seat House majority held by Democrats is very much at risk in 2022.

Further complicating the math? An ongoing congressional redistricting process, controlled by Republicans in a greater number of states than by Democrats. That process alone could produce a net of 3-4 seats for the GOP and dampen further significant legislative action on Capitol Hill.

The Senate remains more complex. Republicans will be forced to defend 20 seats in 2022, including five open seat races. Democrats will be challenged to protect incumbents in 13 states, plus an open seat in Vermont. Campaign resources and candidate electability will play an outsized role in defining Senate control. With an average Senate campaign costing about $15 million, both parties are expected to raise more than the $1.15 billion spent on 2020 races.

Particularly in swing states, intraparty friction will complicate the primary process and create risks that unelectable "extreme" candidates emerge. Successfully avoiding "extreme" candidates may well decide Senate control, a dynamic that may not become fully clear until mid-2022.

Disclosure

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Lower-rated securities are subject to additional credit and default risks.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor's investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®