The Fed is accelerating its tapering process and could raise rates sooner than expected in 2022. For investors, however, rate hikes driven by a growing economy have historically been nothing to fear.

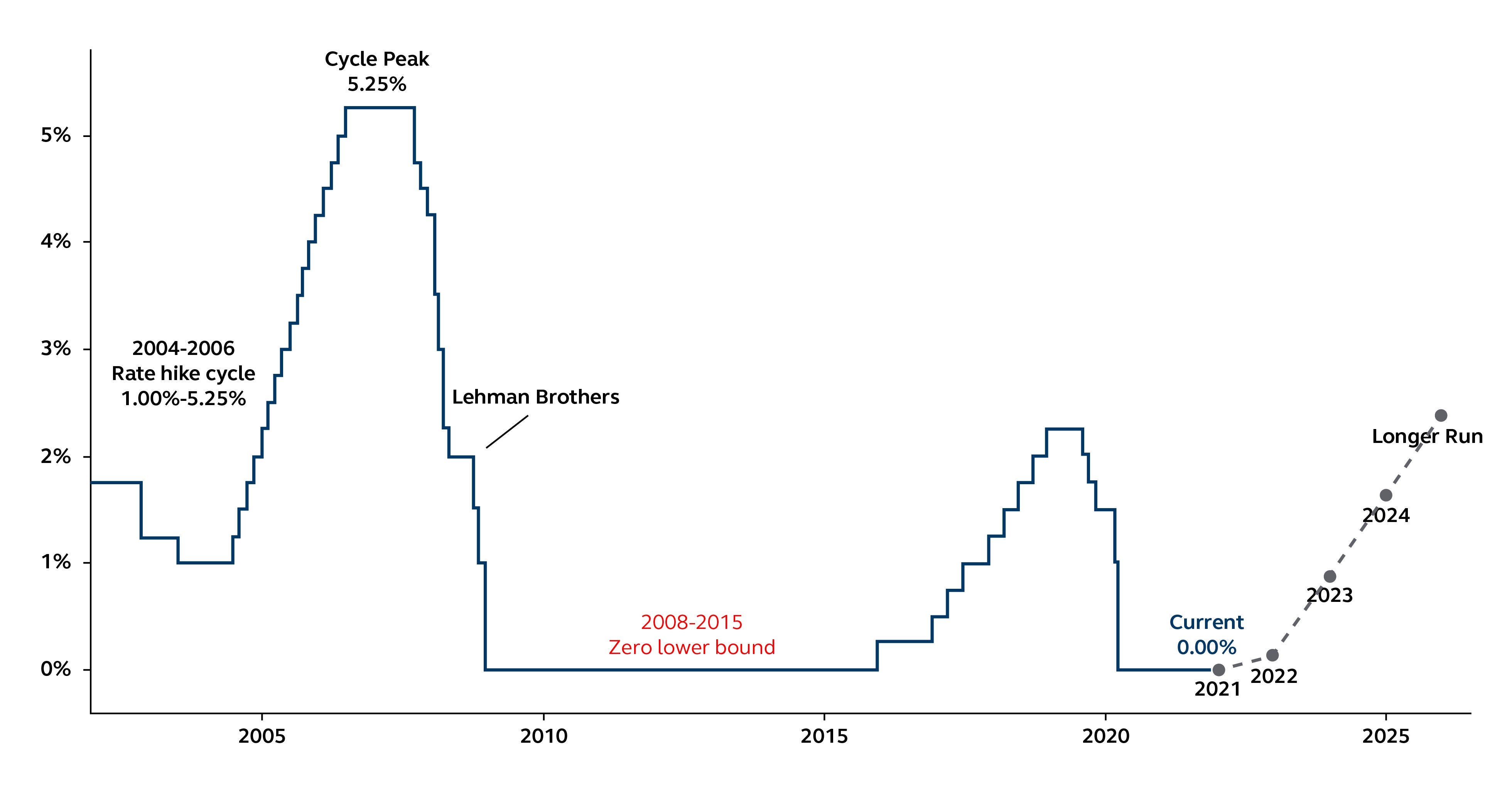

The federal funds rate

Fed funds rate (lower bound) since 2002 and the FOMC's projections

Source: Clearnomics, Federal Reserve, Principal Global Investors. Data as of December 8, 2021.

Investors have shifted their expectations for Federal Reserve (Fed) policy. Less than a month after it began to taper its monthly asset purchases, Fed Chair Jerome Powell hinted that the Fed may accelerate its tapering process. This means that the Fed's balance sheet expansion could end ahead of schedule (by early 2022) and sets the stage for the first Fed rate hike to follow soon after.

Driven largely by inflationary pressures, the change in the pace of purchases naturally raises concerns among investors. If markets have performed well riding the coattails of robust Fed stimulus, doesn't its removal mean that stocks could reverse course?

Tapering and tightening is both a natural part of the economic cycle, and an environment where markets can still perform well. The Fed usually hikes rates only if the economy is growing significantly, and that same growth is what drives corporate earnings and stock market returns.

For example, the S&P 500's average annual total return was 10.5% from 2004 to 2006 when the Fed hiked rates 17 consecutive times—a significantly sharper hiking cycle than the 4-6 hikes we anticipate in 2022-2023. Even during the last rate hike cycle (2016-2018), the S&P 500 averaged 9.8% annually. While the past is no guarantee of the future, history does not suggest that rate hikes are a reason to believe that a market correction is imminent.

Disclosure

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Lower-rated securities are subject to additional credit and default risks.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor's investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®