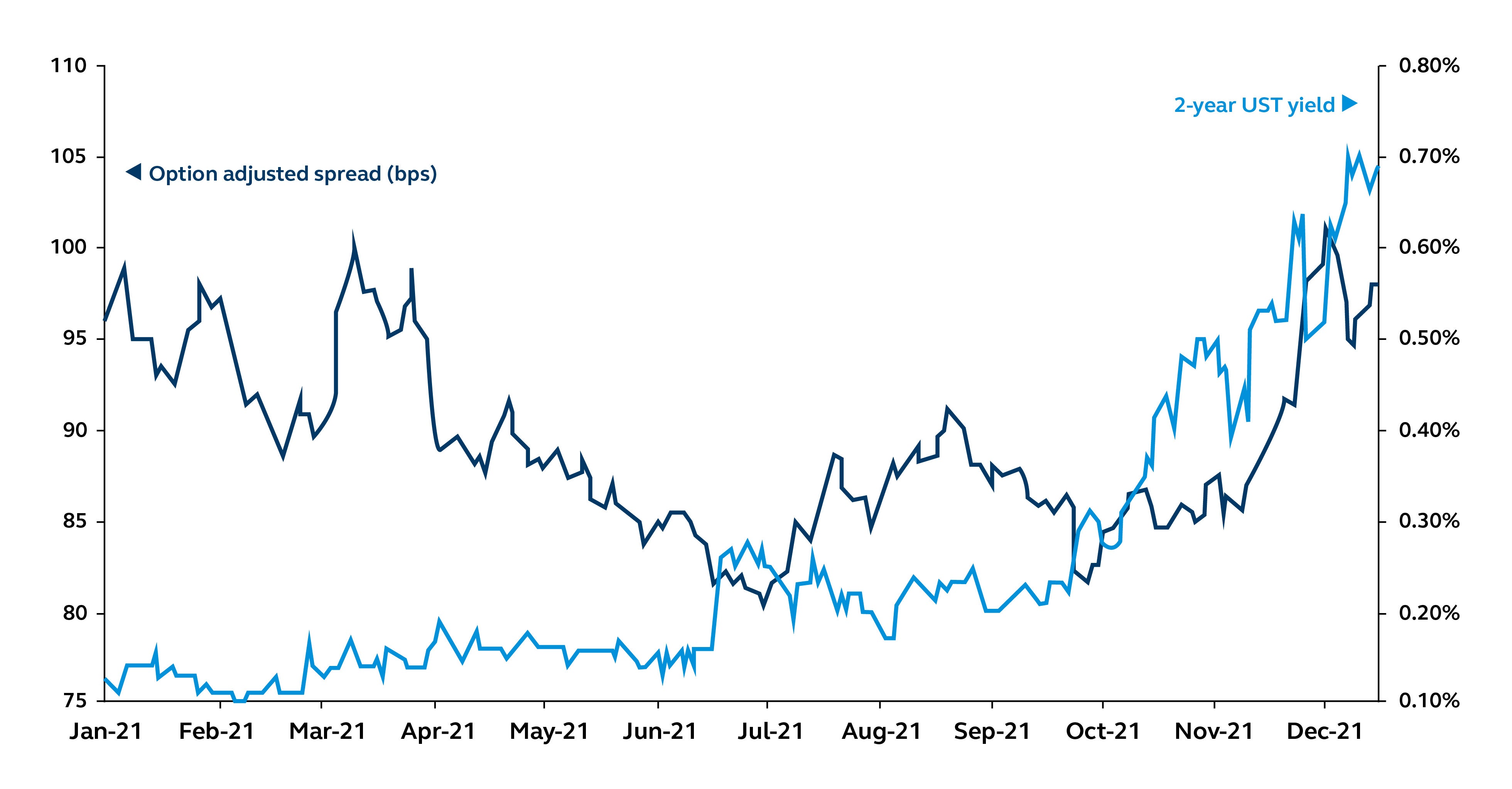

Wider credit spreads and higher 2-year UST yields are signaling that investors should position for the beginning of the rate hiking cycle. Future returns will likely come from alpha, rather than from spread compression, in the year ahead.

Credit spread and 2-year UST yield

Option adjusted spread, market yield on U.S. Treasury securities at 2-year constant maturity

Source: St. Louis Fred, Barclays POINT, Principal Global Investors. Data as of December 15, 2021.

The attention of fixed income investors has quickly shifted in the latter portion of 2021, as stubbornly high inflation prints have forced the U.S. Federal Reserve (Fed) to, at last, publicly acknowledge that inflation may not be transitory. Not only did the Fed announce a doubling in the pace of asset purchase reductions at December's Federal Open Market Committee (FOMC) meeting, but it also signaled that they're likely to raise interest rates multiple times in 2022. Investors have taken notice of the rhetoric, and in recent weeks have pushed 2-year U.S. Treasury (UST) yields and investment grade (IG) spreads up quite quickly.

As markets approach rate lift off in 2022, expect both the flattening of the UST yield curve and increasing credit spread volatility to continue. In aggregate, improving credit fundamentals should also persist, as above-trend GDP growth is broadly supportive for the credit metrics of IG bond issuers.

How can investors prepare for this rate hiking cycle? The rise in 2-year UST yields is signaling tighter liquidity as tapering ends and rates lift off, which will likely keep fixed income volatility elevated and credit spreads wide. In this environment, positioning fixed income portfolios to earn returns from alpha rather than from spread compression or duration will be key.

Disclosure

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Fixed‐income investment options are subject to interest rate risk, and their value will decline as interest rates rise. Lower-rated securities are subject to additional credit and default risks.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor's investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the United States. For Institutional, Professional, Qualified and/or Wholesale Investor Use Only in other Permitted Jurisdictions as defined by local laws and regulations.

Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world.

Principal Global Investors leads global asset management at Principal.®