MARKET COMMENTARY

May 2025

Global Outlook

In April 2025, global equity markets were volatile. Gainers were Indonesia, India and Thailand at 3.9%, 3.7% and 3.4% respectively. H-Shares, Singapore and Taiwan dropped 5.2%, 3.5% and 2.2%, respectively. Bond indices ranged from -0.3 to +2.9%.1

The Fed maintained the Fed Fund rate at 4.50% during the May 2025 FOMC meeting. The Fed guided that the uncertainties from the proposed tariffs do not provide leeway for rate adjustments. The ECB cut interest rate by another 0.25% to 2.250% in April 2025 based on weak economic fundamentals and better-behaved inflation.

Neutral Equity vs Cash. Cut off-benchmark exposure while keeping Gold and Treasury ETF as a hedge against tariff and recession risks. Equities will likely remain under pressure until a clear catalyst for change emerges. Markets are expected to maintain a defensive stance. The US economy faces headwinds as consumers and businesses face rising cost pressures from import tariffs and labour market cracks. Policy support through deregulation and tax cuts may be crucial to offset the tariff impact and help mitigate the risk of an economic downturn.

Global Outlook of the two capital markets: Fixed Income & Equities

Region: Developed economies

Fixed income

- Our view: Positive.

- The Fed maintained the Fed Fund rate at 4.50% during the May 2025 FOMC meeting. The Fed guided that the uncertainties from the proposed tariffs do not provide leeway for rate adjustments.4

- While pullbacks in government bond yields could offer entry points, we remain selective given expectations of sustained fiscal expansion in the US, and we will look to add exposure during periods of market weakness.5

Equity

- Our view: Neutral.

- The Fed maintained the Fed Fund rate at 4.50% during the May 2025 FOMC meeting. The Fed guided that the uncertainties from the proposed tariffs do not provide leeway for rate adjustments.4

- Neutral weighting across US, EU and Japan. Reduce off-benchmark exposure while keeping Gold and Treasury ETF as a hedge against tariff and recession risks.

Region: Regional (Asia-Pacific ex-Japan)

Fixed income

- Our view: Positive.

- Pockets of opportunity in local currency Asian and Chinese credits as yields remained relatively attractive.6

- We expect investment-grade Asian bonds to provide a gross yield of 5.50% to 6.00% in 2025. 6

Equity

- Our view: Neutral.

- We turn cautious on Asian equities as Asia will be in the spotlight due to the US trade surplus.

- We prefer telcos, consumers, materials, real estate and financials. And companies with more visible growth in technology, healthcare, industrials and internet platforms. 3

Region: China

Fixed income

- Our view: Neutral.

- The net credit bond supply in February 2025 was flat at RMB298bn. The flat number resulted from redemptions for non-financial, non-LGFV and SoEs.8

- The default rate for Mar 2025 edged lower to 0.10% from 0.12% as of Feb 2025.

Equity

- Our view: Neutral.

- Prefer domestic-oriented companies with growth and strong cash flow, such as selected names in technology, domestic consumption, cyclical, infrastructure and defence, communications, and financials.

- Manufacturing PMI for Mar 2025 recovered to 50.5 from 50.2 previously. The Services PMI improved to 50.8 from 50.4 over the same period.9

Region: Domestic (Malaysia)

Fixed income

- Our view. Positive.

- BNM maintained the OPR at 3.00% during the May 2025 MPC meeting. They, however, cut the SRR to 1.00% from 2.00% previously. The move released RM19bn liquidity into the system.10

- Take profit on government bonds and redeploy them into credit given the widening credit spreads. We are selective as the overall credit environment appears to be weakening. We prefer a credit segment for better yield pickup. 3

Equity

- Our view: Positive.

- The National Energy Transition Roadmap (NETR) and the Industrial Master Plan 2030 would revitalize domestic investment and buoy consumption. 3

- Prefer quality names in financials, REITs, and consumer companies that will benefit from strengthening MYR. Government policies supporting local businesses and attracting FDI should see construction, properties, and utilities do well. Very selective on technology.

Special Topics:11

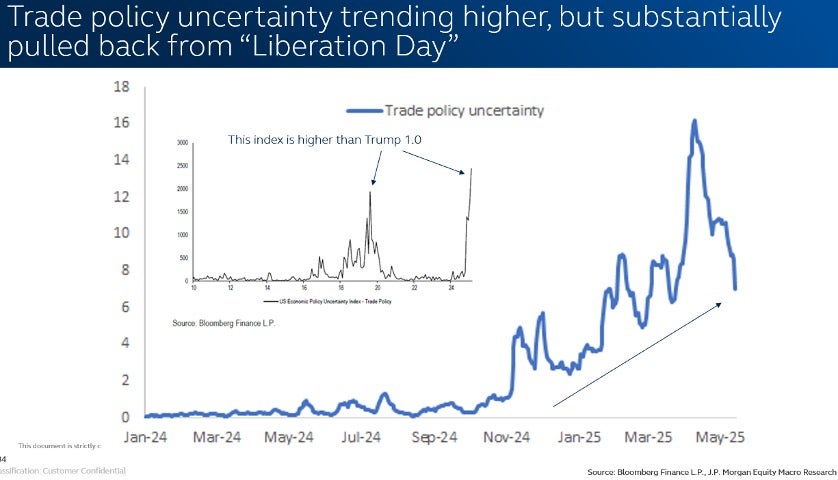

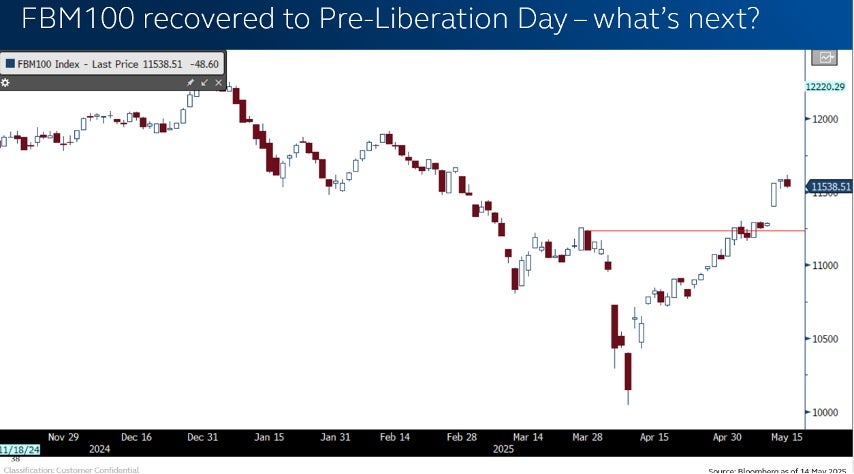

- Global Trade uncertainty pulled back but remains elevated: Trade uncertainty index subsided after peaking on 9th April 2025. Global equities bottomed, USD weakened, bond yield jumped. A lot of unusual movements during this short period of time. Nonetheless, after the pullback the uncertainty index remains elevated and expect these waves to continue aka volatility is here to stay.

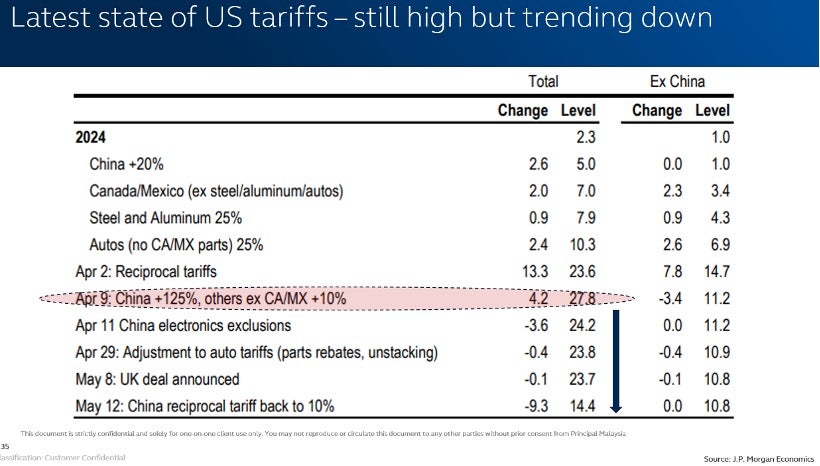

- US tariff remains very high: Trending down from the high of 27.8% to now approximately 14.4% tariff being imposed by US to their trade partners. After the Liberation Day and the subsequent retaliations, US government decided to de-escalate. However, at 14.4% average tariff being imposed, it is still very restrictive vs 2.4% at the end of December 2024.

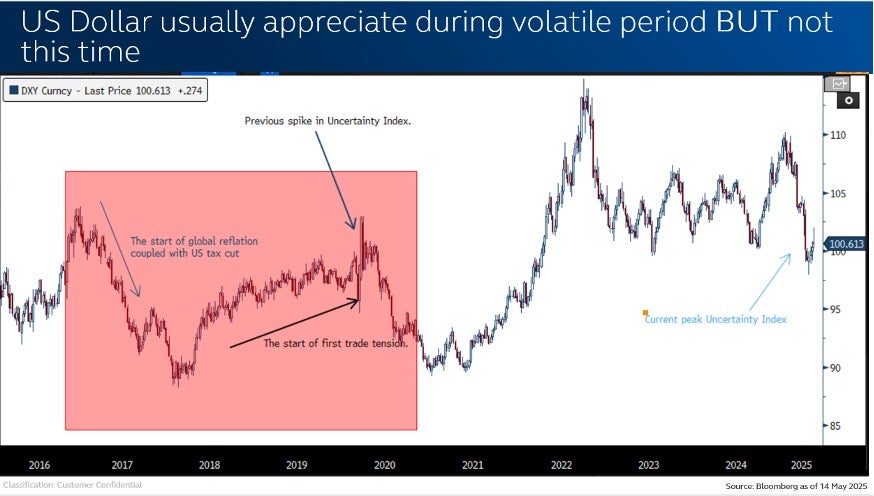

- FX: Under normal circumstances, US dollar usually acts as a safe haven currency during volatile periods but not this time. Previous spike in Trade Uncertainty Index under Trump 1.0, USD appreciated. During Trump 2.0, US dollar depreciated instead of appreciation. However, other safe haven currencies aka Gold, Japanese Yen, Euro appreciated.

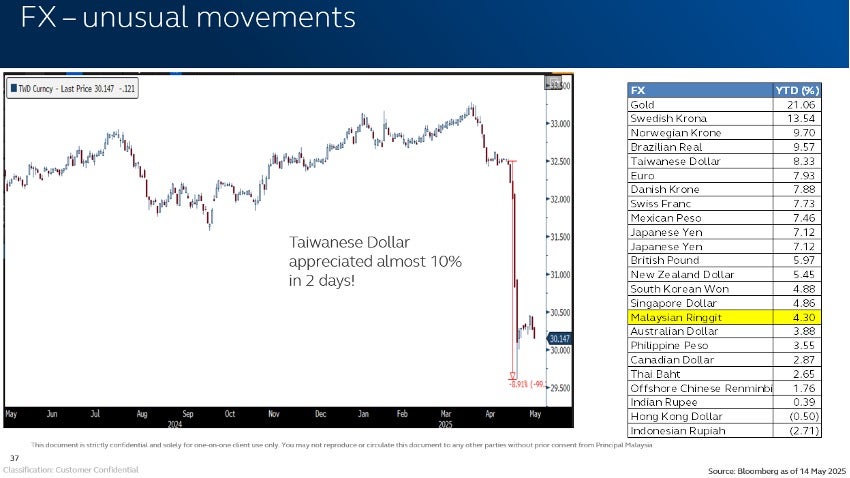

- Exporters FX: Continuing from the above, besides other safe haven currencies that appreciated, some interesting movement in selective currencies. Taiwanese dollar appreciated close to 10% in 2-days since we entered the month of May. Another interesting observation, exporters FX performed better vs net importers. Malaysian Ringgit is relative outperformer within Asian region.

- Summary: Global equities along with Malaysia have recovered above pre-Liberation Day. What can propel the markets higher? Weaker US dollar is good for emerging markets and selective commodities that are facing supply deficit. And with stronger EM currencies, central banks have room to cut rates to boost economic growth. Lastly, trade tensions to further subside will definitely help, however, we reckon it will take some time if not long.

Investment Implication:3

Global: Neutral Equity vs Cash. Neutral across all markets while keeping a slight below benchmark weight for Japan. Reduce off-benchmark exposure while keeping Gold and Treasury ETF as a hedge against tariff and recession risks. Equities will likely remain in a risk-off environment until a catalyst for change emerges. While markets had priced in tariff risks, the announced reciprocal tariffs are more severe than anticipated, and future actions remain uncertain. Until a credible resolution emerges, the market is expected to adopt a defensive stance. The reform of Germany's debt brake and the introduction of an additional infrastructure fund are expected to benefit the defence sector and provide cyclical support to the economy. However, successful implementation will be crucial. Europe must also address other structural challenges, including the regulatory burden and labour market flexibility, to enhance its long-term growth prospects. The market faces the added risk of reciprocal tariffs and a global economic slowdown in the near term.

Asian Equities: We have a cautious view of Asian equities. The Asian region is in the spotlight because of the trade surplus with US. It is likely hard for developing Asia to significantly reduce the trade surplus as the US may not be a producer of their main imports or may be selling items of higher value that the Asian countries cannot afford to buy. Hence, diversification is key, and our preference is to balance between "growth" and "value". We are invested in value and high dividend yielders across telecoms, consumer staples, materials, real| estate and financials. We are also invested in companies with more visible growth in technology, healthcare, industrials and internet platforms.

Malaysian Equities: The Malaysian market drifted further due to global volatility and heavy foreign outflows. External macro concerns have dented investor sentiment and will remain unsettled due to increasing recession risks in the US economy amid Trump's unpredictable tariff and trade policies. Despite external uncertainties, Malaysia still has opportunities backed by strong domestic catalysts, investment upcycle and rolling out of government policies and initiatives. Given the current macro environment, the situation is fluid for the stock market. We would continue to bargain hunt but stick to liquid, quality names. We continue to seek opportunities in companies with defensive profiles and value-beaten-down names, especially in domestic-driven sectors and potential direct beneficiaries of the NETR. Key risks are the derailment of Malaysia's macroeconomic recovery and corporate earnings growth due to slower global economic growth and heightened geopolitical risks.

Malaysian Fixed Income: We are mindful of the external headwinds of US trade policy, tariff actions, and potential geopolitical tensions, thereby leading to a risk-off sentiment. Market volatility will persist in the coming months. When writing, government bonds rallied aggressively following Trump's announcement on Liberation Day, and credit spreads widened. Meanwhile, the markets are pricing in 1 cut within 6 months and two cuts within 12 months in the OPR. Given the widening credit spreads, we are inclined to make some profit from government bonds and redeploy them into credit (both primary and secondary). We must be selective in the credit picks, as the overall credit environment is weakening. We prefer issuers with strong financial metrics and fewer exposures to external trade shocks. Overall, we continue to choose the credit segment for better yield pickup.

Market volatility will likely remain elevated in the weeks ahead as investors assess rapidly shifting tariff developments and consider the potential implications for growth, inflation, central bank policy, and financial markets. Nevertheless, incremental news flow could become more supportive as we approach the year's second half, as clarity emerges with countries beginning negotiation and offering consessions.

Investors should not lose sight of timeless investment principles as markets will likely refocus on fundamentals that should support the equity market rally further. We reiterate the importance of keeping sight of longer-term investing principles that can boost risk-adjusted rates of return through portfolio diversification and emphasising quality growth and income to navigate the volatility ahead. In response to the tariff developments, our strategy has also emphasized focusing on companies that demonstrate the attributes of large-cap defensiveness, with more domestically focused earnings.

We have a slight preference for equities over fixed income. Key themes for 2025 include i) the impact of policy shifts on China's recovery. ii) the US economic outlook, and iii) the influence of tariffs and geopolitical risks on asset prices.

Glossary:

UW: Underweight

OW: Overweight

MoM: Month-over-Month

YoY: Year-over-Year

FOMC: Federal Open Market Committee

ECB: European Central Bank

UST: United States Treasury

PMI: Purchasing Managers Index

SoE: State-Owned Enterprise

SEZ: Special Economic Zone

BNM: Bank Negara Malaysia

MPC: Monetary Policy Committee

Disclaimer

We have based this document on information obtained from sources we believe to be reliable, but we do not make any representation or warranty nor accept any responsibility or liability as to its accuracy, completeness or correctness. Expressions of opinion contained herein are those of Principal Asset Management Berhad only and are subject to change without notice. This document should not be construed as an offer or a solicitation of an offer to purchase or subscribe or sell Principal Asset Management Berhad’s investment products. The data presented is for information purposes only and is not a recommendation to buy or sell any securities or adopt any investment strategy. This material is not intended to be relied upon as a forecast, research, or investment advice regarding a particular investment or the markets in general, nor is it intended to predict or depict performance of any investment. We recommend that investors read and understand the contents of the funds’ prospectus and product highlights sheet available on the Principal website, which have been duly registered with the Securities Commission Malaysia (SC). Registration of these documents does not amount to nor indicate that the SC has recommended or endorsed the product or service. There are risks, fees and charges involved in investing in the funds. You should understand the risks involved, compare, and consider the fees, charges and costs involved, make your own risk assessment and seek professional advice, where necessary. Past performance does not guarantee future results. Performance data represents the combined income and capital return as a result of holding units in the Fund for the specified length of time, based on bid-to-bid prices. Earnings are assumed to be reinvested. This article has not been reviewed by the SC.

Sources :

- Bloomberg, 30 April 2025

- Federal Reserve Board, 30 April 2025

- Principal, 30 April 2025

- European Central Bank, 30 April 2025

- Federal Open Market Committee (FOMC), 30 April 2025

- JP Morgan Research, 30 April 2025

- Bloomberg, 30 April 2025

- BofA Securities, 30 April 2025

- National Bureau of Statistics of China, 30 April 2025

- Bank Negara Malaysia, 30 April 2025

- Bloomberg, Factset, Principal View, 30 April 2025