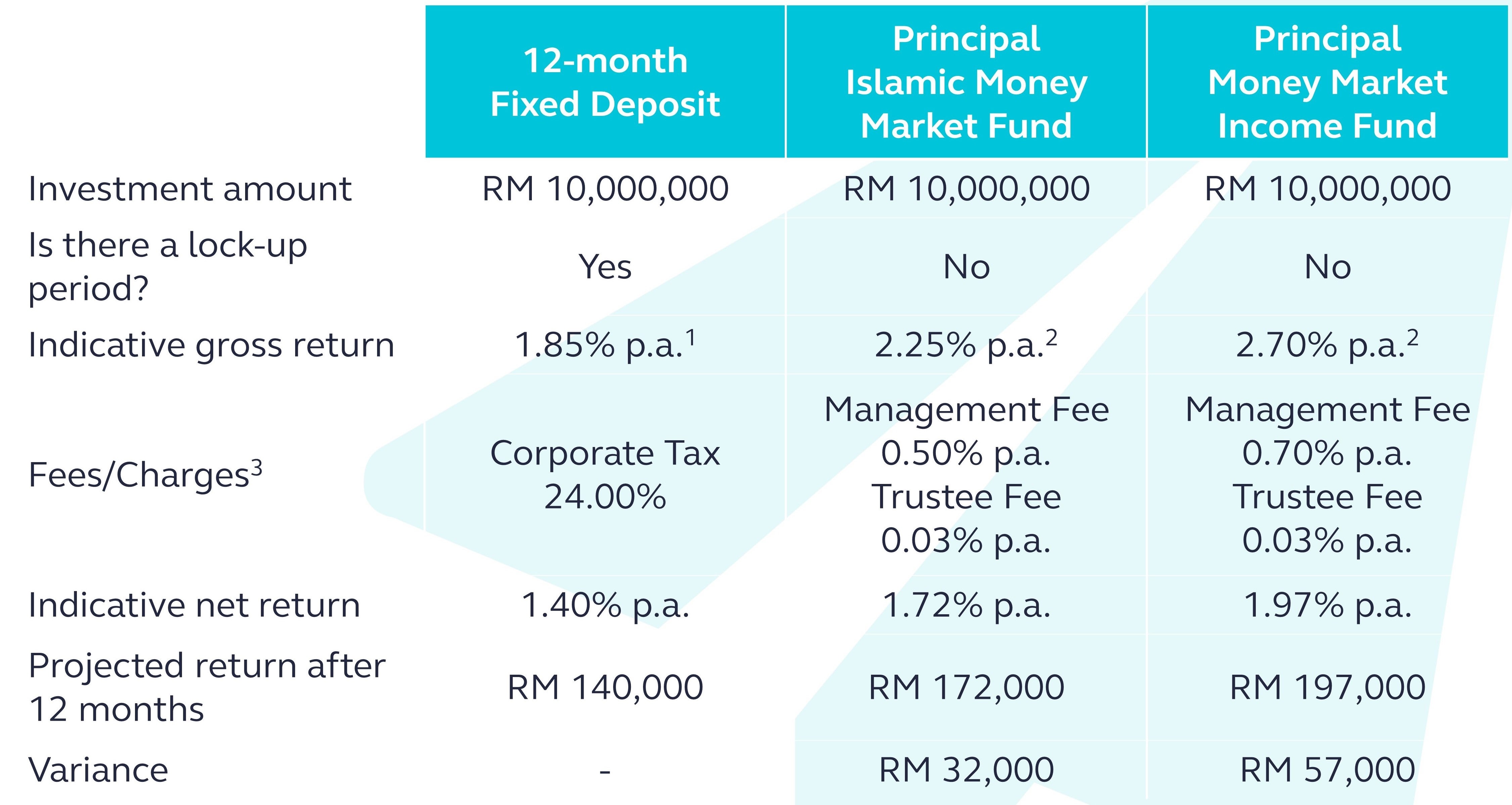

How Principal Cash Management Solutions are different from fixed deposits?

Note: The above table if for illustration purposes only.

1 Based on CIMB Fixed Deposit.

2 Projected 1-year return, not guaranteed.

3 As of October 2020.

Let's get started!

Let's get started!

If you're looking for some perspective and additional understanding of Principal Cash Management Solutions, please call and work with:

Your Principal consultant

Your bank relationship manager

CIMB Bank | CIMB Private Banking | Bank Rakyat | Hong Leong Bank | RHB Bank | Standard Chartered Bank | United Overseas Bank

Disclaimer:

The Securities Commission Malaysia (“SC”) has not reviewed this advertisement and does not take responsibilities for the contents of this materials. You are advised to read and understand the contents of the relevant Prospectus, Information Memorandum and/or Disclosure Document (“mentioned documents”) before investing. Among others, you should consider the fees and charges involved. The relevant mentioned documents including any supplemental thereof and the Product Highlight Sheet (if any) have been registered and/or lodged with SC, who takes no responsibility for the content. The registration of the relevant mentioned documents with the SC does not amount to nor indicate that the SC has recommended or endorsed the products. A copy of the relevant mentioned documents including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant mentioned documents relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant mentioned documents. Please be advised that investment in the relevant unit trust funds, wholesale funds and/ or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant mentioned documents. You are advised to understand the risks involved in the products and make your own risk assessment and seek professional advice, where necessary. The price of units and distributions payable, if any, may go down as well as up. Where past performance is quoted, the past performance of a fund should not be taken as indicative of its future performance. Where unit trust loan financing is available, you are advised to read and understand the contents of the unit trust loan financing risk disclosure statement before deciding to borrow to purchase units. Where a unit split/distribution is declared, you are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit split NAV/ex-distribution NAV. Where a unit split is declared, you are advised that that the value of your investment in Malaysian ringgit will remain unchanged after the distribution of the additional units.