3 min read I Date: 9 March 2022

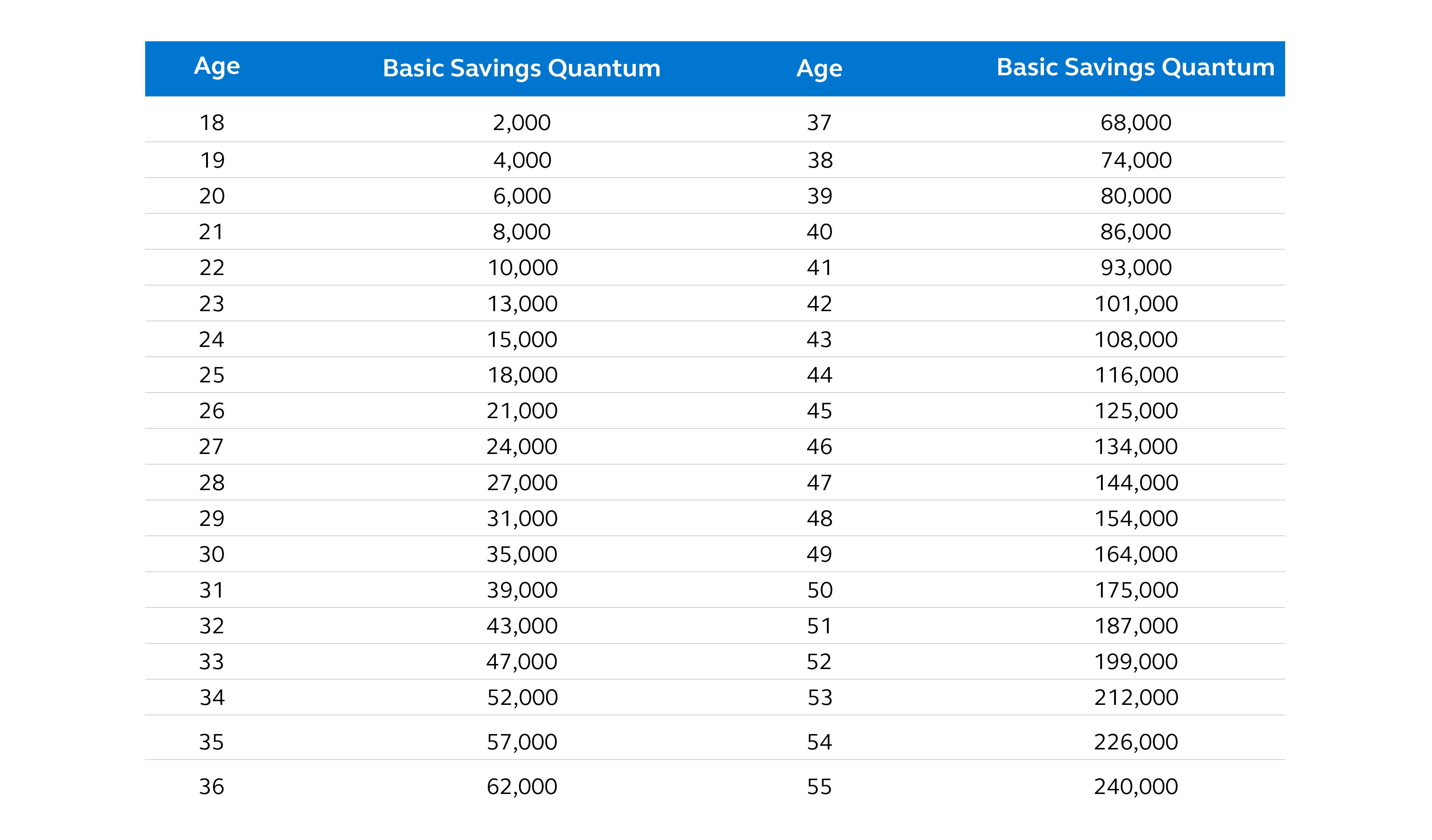

If you need some sort of benchmark on the bare minimum amount in your retirement fund for your age, we recommend going through EPF’s quantum for the Basic Savings as guidance. The quantum is benchmarked against the minimum pension for public sector employees. If you look at the below table, the bare minimum is when a person has a target minimum savings of RM228,000 by the age of 55.

According to the EPF, Basic Savings refers to the amount that is considered sufficient to support their members’ basic retirement needs for 20 years from age 55 to 75, aligned with the Malaysian life expectancy.

Next, figure out your income

Now that you know how much money you’ll need to raise and for how long, the next step is to figure out your sources of income during retirement.

Generally, these could be some of your current sources of income:

-

Monthly salary.

-

Investments.

-

Private Retirement Schemes (PRS).

-

EPF.

-

Side-gig / freelance.

-

Running a business.

By the way, some experts say at least 10% of your income (in addition to EPF’s mandatory contributions that adds up to 23%) should go towards retirement. So, if you’ve started saving later in life, you may need to bump that up. After you get a better sense of your income, the next step is to figure out when you can withdraw your money: according to the EPF, members can make a partial withdrawal at 50 from Account 2, and a full withdrawal at age 55 and 60. In most cases, just EPF alone will not be sufficient to cover for our retirement.If you work in the public sector, you may get a pension for retiring. Those in the private sector don’t share the same luxury but you could opt for the PRS to supplement your EPF. Then, you need to figure out how much you are likely to make from your overall investments, retirement funds and/or savings.

The key is to aim to have multiple sources of income, which will help to grow your retirement funds so that you can have enough retirement funds to retire comfortably. Here are some additional tips:

-

Factor in dollar-cost averaging.

-

Start investing early to fully maximise the compounding effect.

-

Make regular savings.

-

Understand market volatility.

Related: Creating retirement income: 3 steps to getting your ‘new’ paycheck

In addition, it’s important to figure out how much money you need to retire and when you are ready to withdraw that money. A good rule of thumb is to follow the replacement ratio, a concept where the proportion of a person’s income needed in their working life that they need in order to maintain the same level of living standards during retirement. Though we are not advising that you continue to work post-retirement, working for slightly longer than the official retirement age could help close the gap between what you have and what you need to retire. If you are still in the right shape, it doesn’t hurt to look for simple part-time jobs as a way to reduce withdrawing more than you can afford to your retirement savings. The more you have in your retirement savings, the longer it will last you in your golden years.

What to do next?

Talk to a financial consultant about your retirement goals? Need a financial consultant? (We can help you find one.) The consultant can help you discover your goals and advice you based on your risk tolerance.

In the meantime, here’s what you can read on how to:

-

supplement your retirement savings with Private Retirement Scheme (PRS). or

-

diversify your EPF savings via EPF's i-Invest.