Anchor your investments with Principal.

Earn up to 0.7%* rewards when you invest online with us.

7 Key Strategies to Optimise your Portfolio

In today's fluctuating market environment, building a diversified portfolio is crucial to navigate through varying economic situations and mitigate risk effectively. Here are our top 7 key strategies you might find useful to help you manage your portfolio:

Diversification

Spread your investments across various asset classes such as Money Market (for capital preservation), Fixed Income (for income generation) & Equity (for growth opportunities).

We have a positive view on Asian equities due to attractive investment themes and potential for better earnings growth compared to developed markets in 2024. Diversify portfolio and focus on areas with strong earnings growth such as the semiconductor industry, AI beneficiaries and more.

Opportunities in Asia

The excitement over AI is rational, given its tremendous potential to transform industries. Nevertheless, investors holding too much tech exposure should look to diversify, and one way to reduce concentration risk is to position into overlooked Asia, ASEAN, and domestic markets.

Broaden Exposure from Technology

A focus on balance, quality growth & income, and diversification can potentially better help weather short-term volatility.

Income Generating

Create a balanced portfolio to navigate varying economic conditions and mitigate risk effectively.

Risk Management

Pay attention and stay up-to-date with the evolving market trends.

Market Trends

Constantly review and rebalance your portfolio once every 6 months.

Review and Rebalance

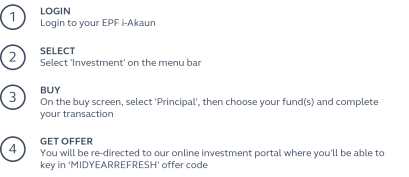

Mid Year Refresh Offer

Get up to 0.7%* one-off reward when you invest with us using your EPF savings or Cash via our online investment portal. Include offer code "MIDYEARREFRESH before you complete your transaction to get rewarded.

DisclaimerThis reward is a one-off reward, applicable on investments made between the campaign period i.e from 29 July till 4 August 2024. Subjected to campaign's Terms and Conditions. Investing involves risk and cost. You should understand the risks involved, compare and consider the fees, charges and costs involved, make your own risk assessment and seek professional advice, where necessary. You should read and understand the contents of the disclosure document or any relevant agreement or contract before investing. Securities Commission Malaysia does not review advertisements produced by Principal. For full disclaimer, please visit here.

Not a Principal investor?

QUICK WAYS TO GET STARTED.

For cash investments

For i-Invest

© 2024 Principal Asset Management Berhad 199401018399 (304078-K)