Diversification is critical to investment performance—and studies have shown that asset allocation is crucial to a sound portfolio. Do you know what type of investor you are? We can help you design a personalized investment portfolio that helps you meet your long-term investment needs.

But, before we do that it’s important to understand what type of investor you are:

- Are you comfortable with risk?

- How long do you have until you retire?

If you know the answers to these, you’ll be able to make more well-informed choices about where to invest.

This short quiz will help you determine the best type of allocation to meet your long-term investment needs.

This short quiz will help you determine the best type of allocation to meet your long-term investment needs.

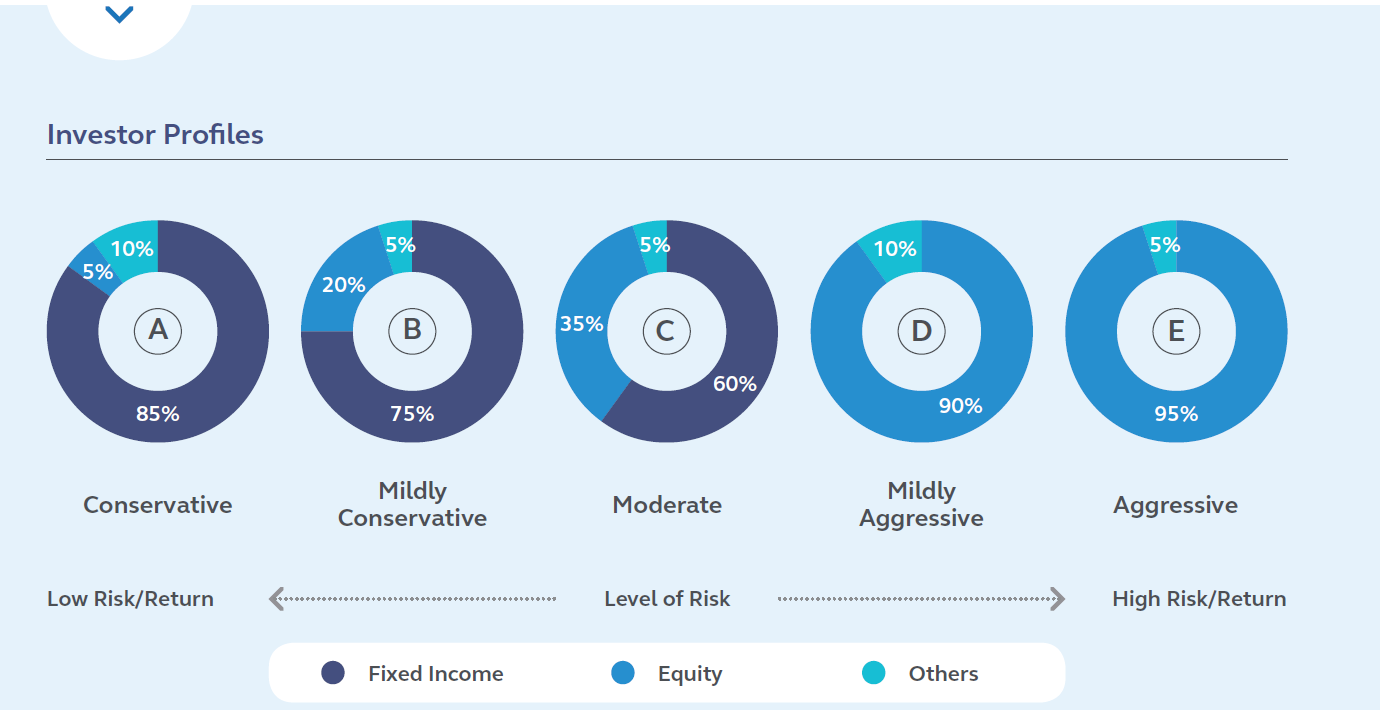

Investor Profiles

More about our investor profiles

My main priority is to safeguard my investments capital. I feel safe to invest provided my capital invested is exposed to very little risk. I am willing to accept a minimal or very low potential returns; as long as my investment capital is retained.

My primary goal is to gain some returns from investments capital. I am willing to accept returns that are potentially higher than banks’ fixed deposit rate as long as my investments capital is expose to minimal level risk.

My focus is to obtain moderate returns by diversifying my investments capital. I am convinced that in order to achieve potentially moderate returns I have to be prepared to take a moderate level of risk. I am willing to keep my capital and returns invested in the short to medium term. I want to see my investments grow and increase over the long-term.

My desire is to achieve high returns and understand the “high risk, high returns” trade off. I am confident that to purse potentially high returns over the long term, I must anticipate higher risk. I am willing to keep my capital and returns invested in the short to medium term. I want to see my investments grow and increase over the long-term.

My aim is to optimize the highest returns possible. I am bold to invest in high capital growth investments to yield potentially high returns over the long-term. I am prepared to be exposed to very high level of risk. I am willing to keep my capital and return invested in the medium to long-term as I want to see my investments grow and increase over the long-term.

Investing involves risk, including possible loss of principal. Equity investment options involve greater risk, including heightened volatility, than fixed-income investment options. Fixed-income investments are subject to interest rate risk; as interest rates rise their value will decline. Lower-rated securities are subject to additional credit and default risks. Small and mid-cap stocks may have additional risks including greater price volatility. International and global investing involves greater risks such as currently fluctuations, political/social instability and deferring accounting standards. Diversification is critical to investment performance—and studies have shown that asset allocation is crucial to a sound portfolio. Do you know what type of investor you are? We can help you design a personalized investment portfolio that helps you meet your long-term investment needs.

Disclaimer:

We have based this document on information obtained from sources we believe to be reliable, but we do not make any representation or warranty nor accept any responsibility liability as to its accuracy , completeness or correctness. Expressions of opinion contained herein are those of Principal Asset Management Berhad only and are subject to change without notice. This document should not be construed as an offer or solicitation of an offer to purchase or subscribe or sell Principal Asset Management Berhad’s investment products.