Build financial security for a more secure future

Set aside a little each month to take you one step closer towards your financial goal.

From now until 31 May 2021, Jom Dapat Lebih Kaw rewards when you invest with Principal through EPF i-Invest using the campaign code “LEBIHKAW”.

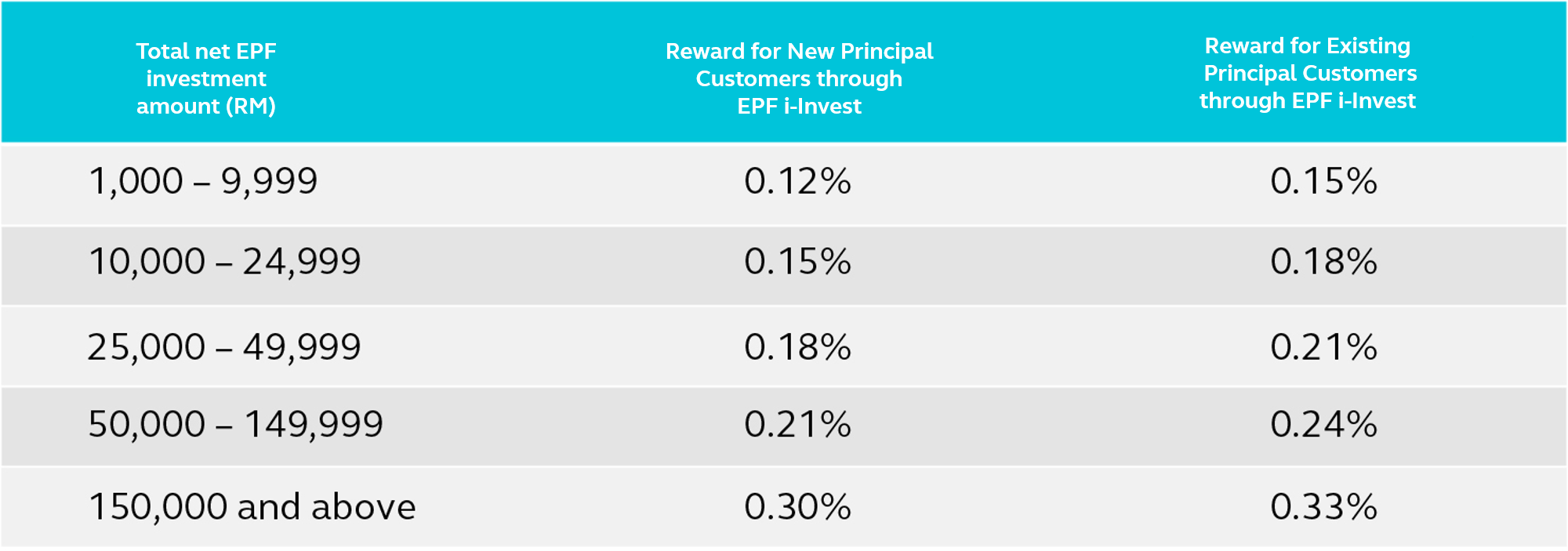

Earn rewards when you invest

Start earning rewards when you invest a minimum of RM1,000

Invest with Principal through EPF i-Invest

Total of RM80k Touch n Go eWallet reload pin up for grabs.

Click here for the full list of Terms & Conditions.

Ways to get lebih KAW rewards

Supplement your retirement savings with Private Retirement Scheme

Supplement your retirement savings with Private Retirement Scheme

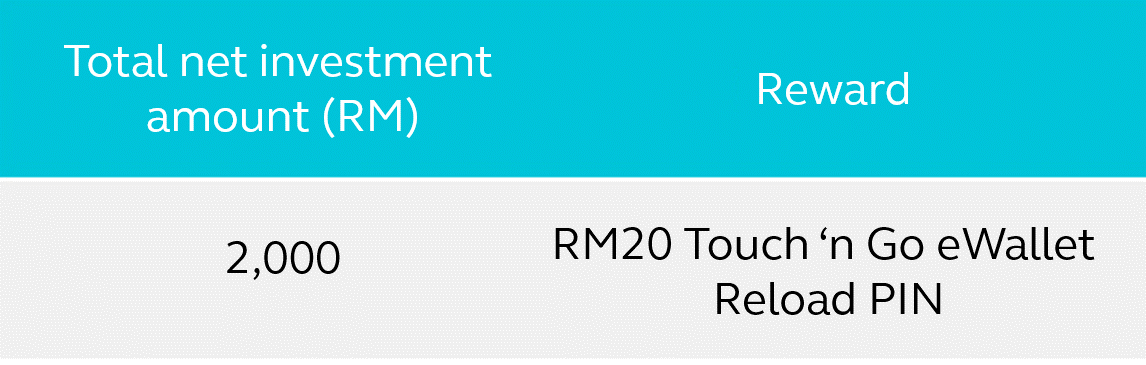

Diversify your portfolio with the Private Retirement Scheme and “ earn Touch ‘n Go eWallet reload PIN.

Principal PRS

Refer your kawan-kawan and get more together

Refer your kawan-kawan and get more together

Join our referral programme to get even more rewards. Find out more here

Why invest with Principal through EPF i-Invest?

![]() 0% sales fee*

0% sales fee*

![]() Diverse fund opportunities

Diverse fund opportunities

![]() Access to exclusive promotions

Access to exclusive promotions

![]() Latest market updates

Latest market updates

![]() Exclusive invites to Principal webinars

Exclusive invites to Principal webinars

*For limited time only

Start investing in a few simple steps

Invest with Principal through EPF i-Invest

Step

- Log in to your EPF i-Akaun.

- Click “Investment” then “Transactions” and “Buy”.

- Select “Principal Asset Management Bhd” as your FMI and choose your preferred fund.

- Checkout with “Principal Asset Management Bhd” and complete your transaction.

- Complete the eForm and use the campaign code “LEBIHKAW” to earn your reward.

New/Existing PRS customers

Step

- Go to PPA online Enrolment portal.

- Log in with your username and password.

(For new user, you’re required to complete the registration via the e-form.) - Top up a lump sum investment amount with any of your preferred Principal PRS plus or PRS Islamic funds and complete the transaction.

(For new user, please select “Principal” as your provider and choose your preferred fund to complete the transaction.)

Still undecided or need more information?

Fill in your details here and we will get in touch with you.

Explore our fund options for you

Principal Asia Pacific Dynamic Income Fund (Class MYR)

Aims to provide regular income by investing primary in the Asia Pacific ex Japan region and at the same time aims to achieve capital appreciation over the medium to long-term.

*Please note that the past performance of each fund does not reflect the future performance. You may read more on our fund fact sheet here.

*All funds are subjected to your risk appetite. To know more about this, you can take a quick test here.

*Please view and understand out full disclaimer, terms of use, and privacy policy.

Disclaimer:

You are advised to read and understand the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) before Investing. Among others, you should consider the fees and charges involved. The registration of the relevant Prospectus, Information Memorandum and/or Disclosure Document including any supplemental thereof and the Product Highlight Sheet (if any) with the Securities Commission Malaysia (SC) does not amount to nor indicate that the SC recommends or endorses the funds. A copy of the relevant mentioned documents including any supplemental thereof and the Product Highlight Sheet (if any) may be obtained at our offices, distributors or our website at www.principal.com.my. The issuance of any units to which the relevant mentioned documents relates will only be made on receipt of an application referred to in and accompanying a copy of the relevant mentioned documents. Please be advised that investment in the relevant unit trust funds, wholesale funds and/or private retirement scheme carry risk. An outline of the various risk involved are described in the relevant Prospectus, Information Memorandum and/or Disclosure Document. As an investor you should make your own risk assessment and seek professional advice, where necessary. The price of units and distributions payable, if any, may go down as well as up. Where past performance is quoted, the past performance of a fund should not be taken as indicative of its future performance. Where unit trust loan financing is available, you are advised to read and understand the contents of the unit trust loan financing risk disclosure statement before deciding to borrow to purchase units. Where a unit split/distribution is declared, you are advised that following the issue of additional units/distribution, the NAV per unit will be reduced from pre-unit split NAV/cum-distribution NAV to post-unit NAV/ex-distribution NAV. Where a unit split is declared, you are advised that the value of your investment in Malaysian Ringgit will remain unchanged after the distribution of the additional units. Securities Commission Malaysia does not review advertisements produced by Principal.